Investing is a bet on the future. It’s that simple.

Coke versus Pepsi, Ford versus Tesla. Equities versus bonds, apartment investments versus crypto.

We assume, hypothecate, guess, and rationalize the likelihood of future events – aspiring to increase the odds of a “more correct than not” future outcome that will reward our bet with outsized investment returns.

Many refer to seeking outperformance on an investment as alpha.

Yet, in general, our betting strategy is horribly flawed.

We bet the lane of traffic to our left – which was moving faster just a moment ago – will move faster once we merge into it. Research shows this is simply an illusion.

We bet that rent growth that occurred for the past 3 years will occur for the ensuing 3 years with little analytical based research on why the trend should persist versus revert.

The last 36 months demonstrated massive anomalies from the mean (e.g., a 100-year biological event with ensuring supply-chain disruptions, massive equity market gyrations, armed conflict between Russia/Ukraine), yet many in the investment community are behaving/investing on the thesis that these events will define the next several years.

I believe longer-term trends – all of which predated the COVID-19 outbreak in the United States – will better predict the near-term investment landscape.

Assuming that the sustained impact of anomalous, cyclical, yet short-run events will persist is as anomalous as the events themselves.

Investing in a reversion to the following 3 trends are sure to produce outsized investment returns:

- Flight to Tier 1 Cities

- PNW Stealing Migrating Talent Pool

- Seattle-Bellevue-Redmond Superpower Status

Flight to Tier 1 Cities

I have written 100s of articles yet one stands as the most important piece I’ve ever penned, it describes The Importance of Saturday Mornings.

Summarized simply, people – especially young, upwardly mobile renters – live where they want to wake up on Saturday mornings.

It was true that during the pandemic it was both desirable – and possible – to maintain a great job and wake up in Lake Tahoe / Park City / Missoula / in a van in some Mexican surf town.

Yet the ability to ‘live where one wants’ will always be constrained by the realities of life – like needing to pay the rent.

The other side of the coin is the very economy that catapulted computer scientists / programmers / database engineers to the top of the talent pool food chain – a knowledge/innovation economy – thrives on innovation and moves at break-neck speed.

When firing on all cylinders, this type of economy both values and needs collaboration, and collaboration requires proximity.

Accordingly, there are two truths that will ultimately come into focus [again]:

- Employers will need to accommodate ‘some’ of the locational desires of its top talent

- Innovation/technology companies will locate in major cities

The confluence of these truths is geographical – and the conclusion is simple, Tier 1 cities will grow the fastest in this next economic cycle.

West Coast Cities: Tier 1 versus Tier 2

Balance the need to hire very top talent – and the need to hire a volume of talent (e.g., lots of ‘em), innovation and opportunity will happen in major, Tier 1 cities on the West Coast.

Nearly 50 years ago, the very reason Microsoft migrated to Redmond from Albuquerque, New Mexico was to scale its workforce. The same held true for Amazon 30 years ago.

The same is true today.

The future is not secondary cities. Top talent will always choose top cities and top employers will always need a location that will allow it to scale operations.

The next question is logical, which Tier 1 cities will grow the most?

PNW Stealing Migrating Talent Pool

Talent in an innovation economy is mobile. Unlike the industrial revolution, when workers migrated to the materials of production (e.g., lumber, steel), in our new economy employers and employees alike chase one another from city-to-city attempting to achieve a match of needs and desires.

What are these needs and desires?

On the employer side, they need: (1) an existing talent pool in the form of preexisting companies; (2) a major University matriculating talent with an aligned skillset (see Enrico Moretti’s description of this phenomenon in his excellent book written 10 years ago The New Geography of Jobs; and (3) a location with extracurricular amenities matching those of its desired workforce.

On the employee side, they want (1) job opportunities with the most innovative employers; (2) cultural and recreational activities; and (3) a diverse and available dating pool. And as millennials age, they are newly looking for cities where they can plant roots to advance their lives: spouse / home purchase / K-12 schools.

Over the last 10 years, a very strong alignment of employer >><< employee needs/wants occurred in both Northern and Southern California.

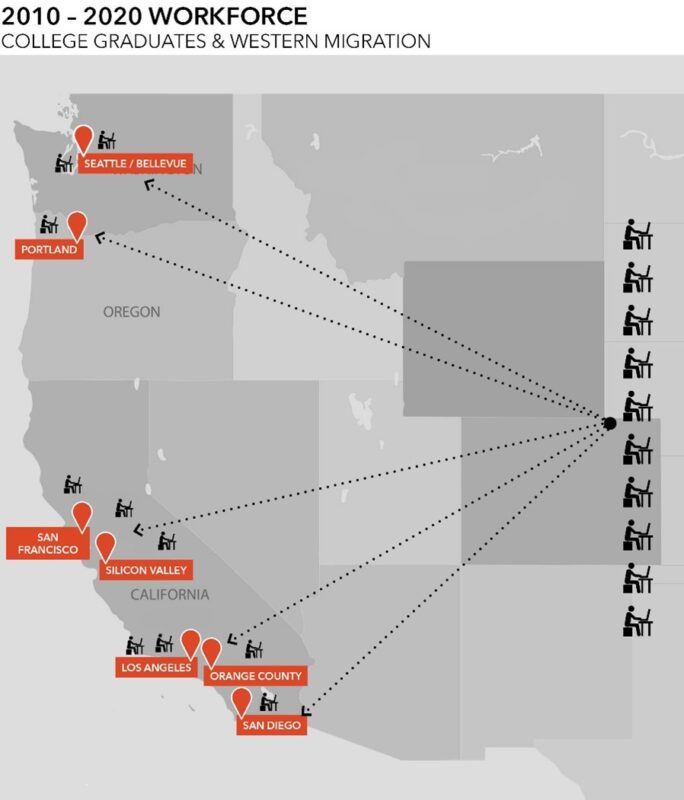

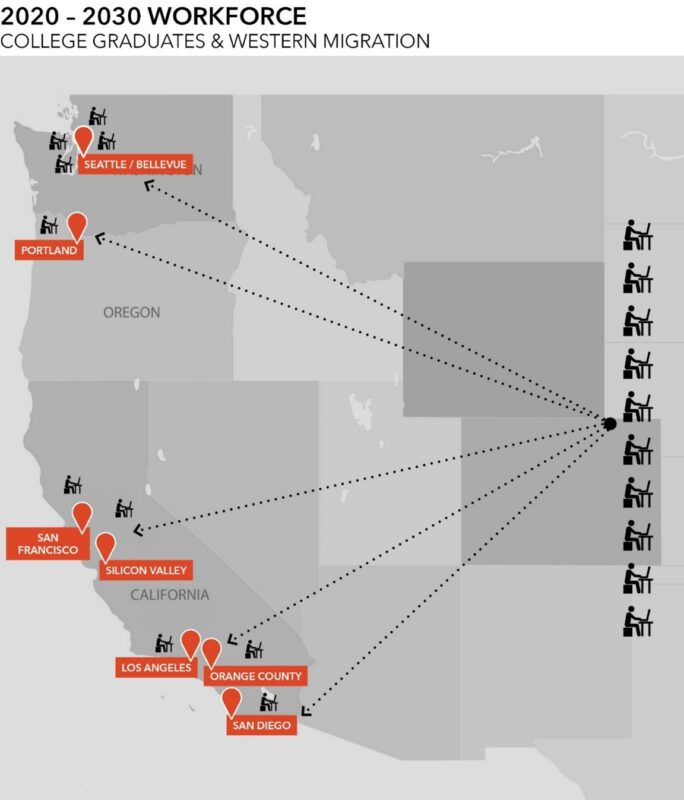

Anecdotally speaking, California was the net benefactor of 70% of college graduates/migrating employees in West Coast Cities. Of the remaining 30%, Seattle received the lion’s share – yet overall, likely only 2 in 10 of top talent landed in Seattle.

As we enter this next economic cycle, Seattle is playing with a stacked deck. A variety of shifting fundamentals make the Seattle-Bellevue / Pacific Northwest lifestyle a more desirable option for top talent.

I expect the share of top talent headed to West Coast urban employment centers will shift remarkably, and predict that at least 4 in 10 – a 50% increase – in top talent will choose the Pacific Northwest.

How can I make such a bold prediction?

Easily!

Here are just a few simple, yet highly poignant factors:

- Housing costs (renting/owning) are 50% less than San Francisco / Bay Area

- No state income tax

- Excellent K-12 school rankings/options

- Eastside rising as a clean and safe urban center

- Superior municipal and state funding and politics

I’ve written significantly over the years about the allure of Seattle and the PNW over San Francisco, to wit: 5 Reasons Seattle Is Still Better than SF and Top 10 Ways Seattle Kicks San Francisco’s Ass. Many of these same factors are equally true in comparing the PNW to Southern California.

The PNW has an amazing amount of runway for growth over its cohort West Coast urban job centers and during the next economic cycle we’ll see these fundamentals play-out in the form of in-migration and income growth – and concomitant apartment rental demand and rising rental rates.

Seattle-Bellevue-Redmond Superpower Status

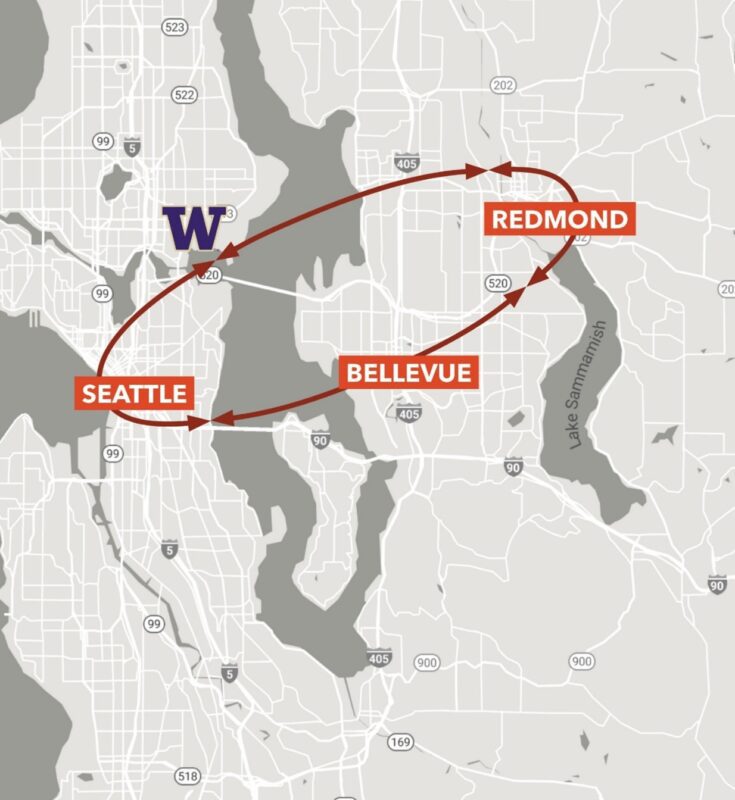

It’s been two years since I queried “Is Bellevue Seattle’s Superpower?”. The thesis is that Bellevue’s growth into a city standing on its own as a top West Coast urban employment hub not only benefits the region, but specifically fortifies Seattle as one of the top cities in the world.

Back in 1959 when Hewlitt-Packard decided to develop its headquarters in the previously sleepy suburbs of San Francisco, no one predicted that Silicon Valley would become the world’s center of innovation – and also fortify San Francisco as one of the world’s most foremost economic centers.

San Francisco / Bay Area Technology—Employment—Education Ecosystem

Before our very eyes a similar phenomenon is playing out along the Bel-Red Corridor. Nearly identical to the Bay Area’s El Camino Real, we are witnessing the Eastside’s rise to national prominence. I’ve related this economic and geographic similarity in a post I wrote 8 years ago: SF versus Seattle — 90 Degrees of Similarity, Counterclockwise.

Seattle/Eastside Technology—Employment—Education Ecosystem

We are in the early innings of the Eastside’s growth, but also its complementary nature to Seattle insomuch as the region’s newfound ability to attract a much broader pool of denizens.

The PNW is no longer a secondary city (and choice) to Los Angeles—Orange County and San Francisco—Silicon Valley; the region is now competing directly (and much more competitively) for the best educated, best compensated, and most employable workforce in the world.

Why Bet Big Now?

We have a few more months of uncertainty and unwinding ahead of us. Many want to sit on the sidelines to watch it play out and see what happens. Those who attempt to time-the-market in this fashion – and by definition that is what they are doing – will seize one or two opportunities, yet what they gain in “pricing perfection”, they will lose on volume of opportunities.

Yes, it would be great to buy a 10 unit or 100 unit, or 500 unit apartment building at a 20% discount. Yet do the math on buying 3 or 4 of those buildings at a 10% discount and you’ll quickly realize the opportunity cost of trying to time the market.

Once the market begins to gain steam – and it invariably will, it will do so too quickly to seize opportunity if you are not already running alongside it.

Now is the time to bet big on the PNW!

About Dylan Simon:

I specialize in the sale of apartment buildings and apartment development land across Washington State. With my co-founder, Jerrid Anderson, we operate a team of 11 apartment sales professionals dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.

CLICK HERE to contact a member of our team and to learn how we can help you Turn Our Expertise into Your Profit ©