Pattern recognition is an important aspect of discovery. Whether trying to decipher trends in nature, understand human behavior or predict outcomes of a commercial real estate investment, the ability to recognize patterns is a critical element of understanding complex systems. The purpose of pattern recognition within the context of commercial real estate investment is simple: identifying and/or creating durable income streams of predictable growth, ideally with concomitant asset appreciation over time.

Analyzing San Francisco is an interesting and likely important exercise of pattern recognition. Its importance lies in identifying growth/prosperity patterns in San Francisco that likely have direct application to Seattle in order to better predict high-growth opportunities in our market.

In this article we will cover:

- Similarities between San Francisco & Seattle

- What Happens When you Rotate SF Counterclockwise

- Important Connections & Conclusions

- Seattle Neighborhoods with High Growth Potential

Similarities between San Francisco & Seattle

The City (San Francisco) is a very mature urban market with growth patterns that have many corollaries to Seattle. One can dissect a variety of similarities, some more obvious than others.

Similarities:

- West Coast Gateway Cities

- Geographic Barriers to Entry

- Stellar STEM Based Job Growth

- Excellent Post-Secondary Schools

- Highly Educated Populace

- Lifestyle Amenities Proximate to Urban Core

The above (and I am sure readers can identify myriad more) attributes are both easily identifiable and important, yet only justify a comparison of the cities – they are not a conclusion. We need to embark upon an analysis at a greater level of granularity in order to arrive at any actionable investment thesis.

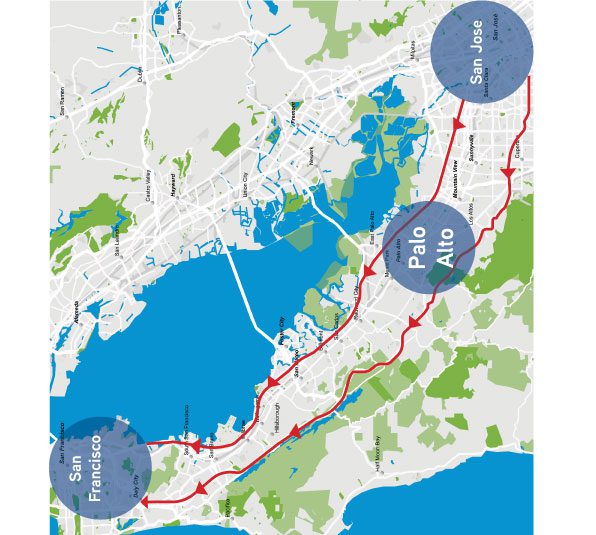

What Happens When you Rotate SF Counterclockwise 90 Degrees

Literally take a map of the San Francisco / Bay Area and rotate it 90 degrees counterclockwise. What do you find? First, you notice there are two relatively parallel freeways (101 and 280), now oriented West-East. Second, these freeways connect a major urban center (SF) to important tech-based job centers on the Peninsula (Palo Alto / San Jose).

San Francisco

San Francisco, Rotated

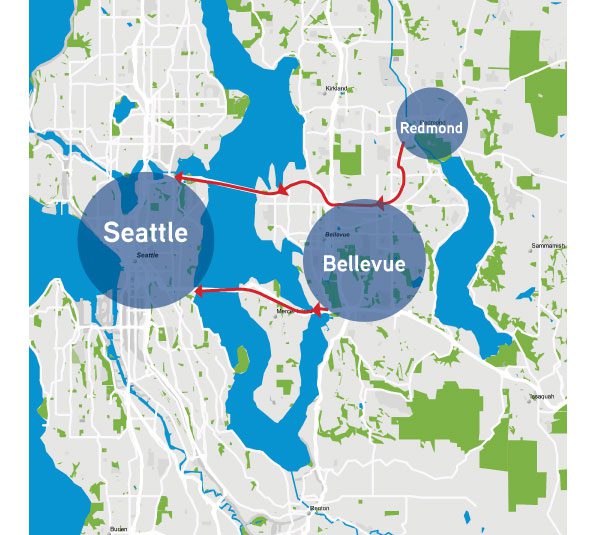

With this viewpoint, Seattle is not too dissimilar from San Francisco with respect of geographic orientation of job centers and transit routes to them. Our further analysis illustrates some interesting similarities.

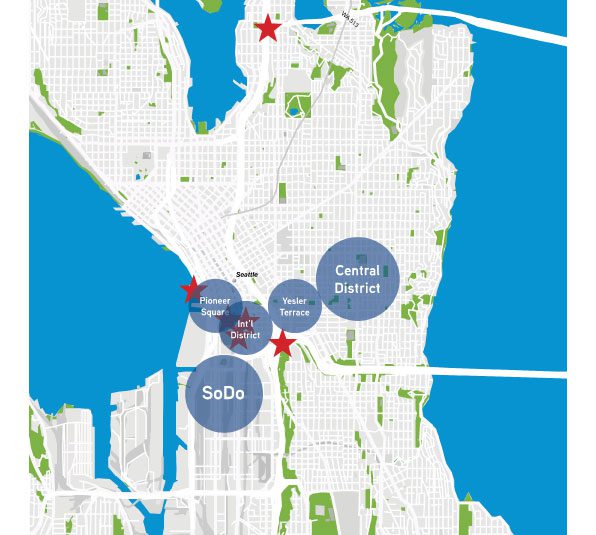

Seattle

Important Connections & Conclusions

One of the first conclusions that one can draw about patterns in both cities is the movement of people. In San Francisco, high levels of growth are occurring in locations with proximity to traditional transit, as well as mass transit options:

- SF Off-ramps from:

- Interstate 80

- Interstate 280

- US Route 101

- Transbay Bart Terminal

- San Francisco Ferry Terminal

- SoMa Caltrain Station

Interestingly, all 6 of these connection points are located within a relatively small radius of another. At or near each of these connection points are thriving neighborhoods – ones not considered highly desirable less than a decade ago.

Turning to Seattle, we find surprisingly similar transit connection points:

- Seattle Off-ramps from:

- State Route 520

- Interstate 90

- Union Station

- King Street Station

- Seattle Ferry Terminal

- East-Link Light Rail (2023)

Seattle Neighborhoods with High Growth Potential

Based on this analysis, it is clear that in San Francisco “gateway” neighborhoods with transit connections to Peninsula-based employment centers continue to reap locational benefits. Interestingly, all of these neighborhoods are South of San Francisco’s CBD.

In Seattle, it is highly likely that we will experience a similar phenomenon. There is plenty of room for growth in Pioneer Square, SoDo, the International District, Yesler Terrace, the Central District and all points in-between. Validation of an investment thesis in these neighborhoods is merely a matter of connecting the dots.

The epicenter of all mass transit is located adjacent to all of the aforementioned neighborhoods. Soon the First Hill Streetcar and Broadway Extension will further connect these neighborhoods to important cultural and lifestyle amenities in more established neighborhoods. A lynchpin for the emergence of growth in these neighborhoods are connections points, and they are in our sights.

Bankable or Just a Theory?

The application of pattern recognition from growth in San Francisco to that in Seattle requires belief that transit connections are important and that tech/STEM job growth will continue to lead our economy. I am willing to hang my hat, and my investment dollars, on both of these postulates. If you would like to learn more about how analogies to mature urban centers can lead to outsized investment returns in ours, please contact me.