This week we are fortunate to have guest content from Colliers Chief Economist Andrew Nelson. This is the first in a series of guest content from preeminent market experts. This post was originally published on Colliers Insights.

Lately, when I speak at industry events, there’re always two questions I can expect. First and foremost: Where, when and how much are interest rates moving? (Up, soon and not much). Now, property investors are moving on to a more salient question: How much longer can this recovery continue? Good question.

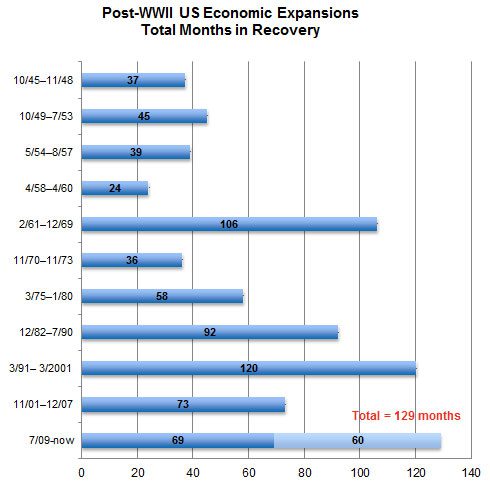

We’re now 69 months into the recovery — almost six years since the recession technically ended in mid-2009 (see below). For perspective, the average length of the previous 10 economic expansions since WWII was 63 months. Plus, as real estate people, we tend to think in five-year time horizons, whether for leasing or acquiring assets. Adding 60 months from today to the 69 recovery months already logged would put the total recovery period at 129 months — the longest since our country’s founding and fully nine months more than the prior record of 10 years (during the 1990s). Hence, a concern.

In all my years in the property sector, I have yet to see an investment pro-forma — or any serious economic model — forecast a recession. At most, investors moderate growth after five years to the assumed inflation rate. But can we get to another five years before a downturn?

Possibly, though it will be a stretch. But there’s certainly strong support for believing we have at least another few years of growth left. Consider that this has been a rather weak expansion, which took a long time to gather steam. We even lost 1.7 million jobs during the first nine months after the technical recovery began. Remember that recessions and recoveries are based on economic output (GDP), not job growth. Under normal conditions, they go more or less hand in hand, but the immediate aftermath of the Great Recession — by far the deepest and prolonged economic downturn since the 1940s — was anything but normal. Arguably, the recovery didn’t really take root until mid-2010, when the country stopped hemorrhaging private jobs. By that count, it’s only been 60 months of recovery.

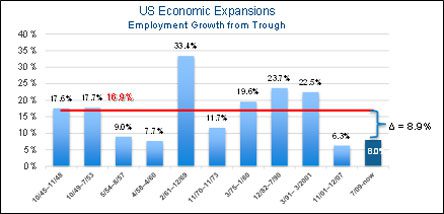

But beyond the duration is the extent of the recovery, which provides more cause for optimism for continued growth. In a typical recovery we register job gains of just under 17 percent. But so far it’s been only 8.0 percent.

And our economic output typically grows by 22.5 percent in real terms during a recovery. But so far, real GDP has risen only 13.1 percent. We’ve added less than half the number of jobs as in a typical recovery, and we’re still less than 60 percent to average total growth on the output measure. So, if prior expansions are any indication, there’s plenty more road to run — and based on recent growth rates, another three to four years.

Then there’s the reality that our economy is only now starting to hit its stride. Meanwhile, our major trading partners are still stuck in neutral (Japan and much of the EU) or growing more slowly than in the recent past (China and the U.K.). So, we can expect greater economic support here in the U.S. once global economic growth picks up. Finally, other economic indicators are uniformly positive. The Conference Board’s Leading Economic Index is at its highest point since before the recession, while the Institute of Supply Management’s (ISM) Purchasing Managers Index (PMI), though slowing recently, is still growing on the heels of 26 months of expansion. Together, these data points and indicators demonstrate that there’s plenty more expansion left before we have to worry seriously about a downturn.

Of course, it’s also worth pointing out how and why expansions end. It’s almost never because of spent fuel like a satellite falling back to earth. While the seeds are usually sown well before the actual downturn, recessions typically are triggered by “black swan” events, often in the context of restrictive monetary policy aimed at cooling overheating economies and/or inflation, such as:

- The recessions of the mid-1970s and the early 1980s, precipitated by the oil crises in 1973 and 1979, each with roots in distant geopolitical events;

- The early-2000s recession brought on by the dot-com bubble, accentuated by fallout from the September 11 terrorist attacks;

- The Great Recession starting in late 2007, rooted in the mortgage crisis and housing bubble, and then sparked by the collapse of Lehman Brothers, among other events.

Rare is the expansion that just loses momentum and peters out, though the brief recession of the early 1990s comes close. Rather, look for an economy growing at an unsustainable rate as an indication that the expansion’s end could well be near. With real annualized GDP growth still yet to hit its long-term average of about 3 percent and with the Fed still propping up the economy, we’re obviously not nearly there yet.

So when? Some analysts have noted that recessions tend to start near the turn of a decade, suggesting we might be due by 2020 — conveniently five years from now. But it’s fair also to note that, of the last 14 recessions including the Great Depression, only five have actually commenced within a year of a decade’s end. Regardless, this expansion, should it continue to the decade’s end, will be the longest on record and will have generated at least an average amount of job and GDP gains at current growth rates. By then, the expansion just might be on borrowed time. Let’s check back in a couple of years and see where we are. But for now, let’s enjoy the growth and the strong drivers for property markets.

Andrew J. Nelson is Chief Economist for Colliers International in the United States. Based in San Francisco, he covers a mix of general economic topics as well as related issues that bear on the performance of property markets.