In March 2020, impacts of the COVID-19 pandemic truly impacted the Seattle commercial real estate market. Touring listed properties stopped on a dime, soon thereafter broad marketing of properties screeched to a halt.

Our Team doubled-down, focused on improving our database, advancing our use of technology, codifying best practices, and building client relationships. Our systematic marketing of apartment buildings soon turned to hand-to-hand combat. Instead of relying on a 12,000+ investor database, we focused on rifle-shots.

Matchmaking via off-market transactions filled our sales pipeline of transactions beyond pre-COVID levels, and 2020 was our strongest year in growing our reach to the market and the size of our brokerage team.

Seasons mark changes and the biggest change we’ve experienced in Spring 2021 is coming back to market with broadly marketed transactions.

We have 9 marketed listings (and another 16 under contract) – giving us tremendous insight into the apartment investment sales market.

In the past week we’ve received 40 offers on marketed properties.

With that much transaction volume in the marketplace, what are we learning?

5 Themes from Investors:

- Bellevue remains the Belle of the Ball

- Interest in Seattle is Alive and Well

- Distress = Excitement = Returns?

- Developers Eagerly Entitling more Sites

- Not Buying Seattle Entitled Land is a Missed Opportunity

How are you looking at opportunities in the market? Will you act presciently enough to seize opportunities others don’t see?

Bellevue remains the Belle of the Ball

Just last month I wrote Is Bellevue Seattle’s Superpower and I remain confident that a growing Bellevue fortifies – not erodes – Seattle’s allure as a primary market for knowledge workers and a growing economy. Be that viewpoint as it may, investors continue to love-love-love Bellevue.

We are seeing pricing for nearly every apartment asset type – core, urban buildings, value-add opportunities, and development sites – at arguably higher than pre-COVID levels.

Bellevue is Blue Chip.

I can’t argue with the investment thesis, believe in it myself, and expect that Bellevue will continue its ascendency as a twin-to-Seattle superpower in the Puget Sound.

If you are chasing opportunities in Bellevue, don’t expect to see much in the way of discounts – even for properties operating less optimally. Yesterday’s 4.25% – 4.5% cap rate in Bellevue is today’s 3.7% cap rate.

Interest in Seattle is alive and well

Don’t count Seattle out just yet!

Are there horrible headlines in the news on politics and social challenges?

Yes.

Does the cityscape look comparably challenging in downtown and urban neighborhoods alike?

Unfortunately so.

Earlier this year I wrote I Wouldn’t Bet Against Seattle, and I am not the only one with confidence in our fair city.

For every apartment listing we’ve taken to market in Seattle we’ve received multiple offers – and the offers are getting increasingly competitive. Investors are beginning to underwrite future rent growth and place bets.

Soon enough, we will see more competition in the market and the deals you were waiting to see will be a distant “value-buy” thesis that evaporated as quickly as they appeared in mid-2020.

Distress = Excitement = Returns?

Not since the Savings and Loan Crisis in 1987 and the ensuing formation of the Resolution Trust Corporation (RTC) did the commercial real estate market experience broad distress in asset pricing.

Yet, in each successive market retraction since (e.g., Dot Com Bust, Great Recession, COVID-19) capital formed en masse around the thesis of buying distressed assets.

There is strong evidence of sectoral distress, e.g., big box retail and hospitality, producing investment opportunities. However, in the Puget Sound region distressed-buy opportunities are few and far between.

We’ve had the opportunity to come to market with a selection of “distressed” assets and boy have the offers arrived. Competition among buyers begets pricing strength, bidding returns out of the “opportunity” to buy distress.

Interestingly, a mildly distressed asset – NOI falling 10-15% – does not receive the buyer excitement compared to one with major distress (NOI off by 30-40%). Yet, the competition for distresses assets – and capital formed around the thesis of distress, has begun to erode the risk premium.

Only time will tell if distressed buys prove worth the work, versus chasing the not-so-sexy deal that few others pursue.

Developers Eagerly Entitling Development Sites

We are nearly at the eve of launching our 2021 Apartment Pipeline Research Report (view all our research: HERE) demonstrating an apartment development pipeline of over 110,000 units. This large pipeline may come as a surprise after apartment developers entitled, developed, and delivered nearly 90,000 units this past decade.

However, the region remains in a housing shortage and with a locational shift in the last 5 years of development from 80% urban to closer to 60% urban – development opportunities and demand abound.

Our Team’s footprint of development listings traverses King, Snohomish, Kitsap, and Pierce County and currently involves close to 20 development sites we are marketing and have under contract – ranging from 20 units to over 700 units.

Simply put, apartment developers are finding opportunities, capital, and demand – enabling them to pursue entitling development sites.

Not Buying Seattle Entitled Land is a Missed Opportunity

If raw, un-entitled development sites are this coming Saturday morning’s fresh-hot cinnamon buns; then Seattle-located, fully entitled, vested, ready-to-build development sites are yesterday’s day-old bread.

Why?

Fear of renters not returning. High construction costs. Muted demand. Fearful capital.

You name it, we’ve heard it!

Do you think rental rates are not returning?

I can show you any number of rental rate growth graphs for Seattle’s urban markets that show 20-year growth rates experienced since 2000 that would cause even an economist to blush.

Are construction costs high?

Absolutely, yet the laws of supply-and-demand and mean reversion are almost as immutable as gravity itself.

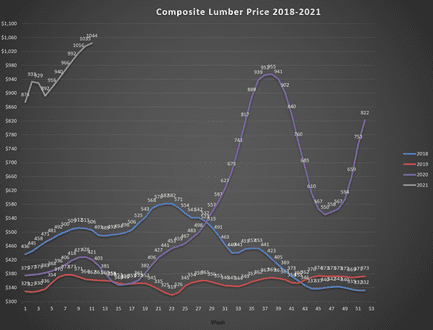

When looking at the following graph demonstrating lumber pricing – guess which lines represent (1) Canadian border restrictions, (2) politically based trade wars, and (3) a pandemic induced global supply-chain meltdown?

Source: Lumber Composite Index

How are buyers/developers missing opportunities in not buying entitled development sites?

The reasons are demonstrable and time-tested:

- Cycles correct quicker than entitling-building raw sites

- New code requirements (structural/MEP/energy) will add $15k – $25k in hard costs to non-vested permits

- Entitlement time + cost equals embedded value (even if yield-on-cost doesn’t make sense today)

- Land values are not going down

- Find value in buying what others are ignoring – someone will if you don’t

Vested permits may not make economic sense under current rental rates/construction costs – yet once you factor the above considerations, they just might represent the best deals in the market that nobody sees.

Get in the market; not too long from now you’ll be glad that you did!

We can help with a free valuation of your apartment building or development site, or answer questions about what/where to buy.

Working with a capable, experienced, and active team of apartment sales experts is always important– and such sage guidance was never more necessary than it is today.

Give us a call to Turn Our Expertise into Your Profit!