Welcome to 2021! Almost everyone tore off the last page of the 2020 calendar with equal parts distain for the previous year and optimism towards the next.

New year, new start – right?

Well, not so fast.

In the apartment world, the ringing-in of 2021 brings with it a host of carry-over challenges from 2020, not the least of which include (selectively by submarket): falling rental rates, rising vacancy rates, slow absorption of newly delivered buildings, and an unrelentingly challenging regulatory regime.

We knew that many of these challenges would chase us into 2021, yet how can we see a future through the fog that clouds our vision from one of the most challenging years on record?

History shows us the way.

From its founding “roots” in the timber industry, to a bustling Klondike Gold Rush leading to innovation in aerospace and software – Seattle has nary rested on it laurels.

Seattle’s DNA of innovation will not only lead to a fast(er) recovery in the local apartment market, its seeds are already sewn around us. We just need to look through the fog of negative news to see already emerging grass shoots.

Three case-studies prove that we don’t need to wait for apartment rents to rebound to know that Seattle is destined for economic vibrancy in the very near term.

- Venture Capital

- Key Employment Sectors

- Retail Resiliency

For individualized market insights and to discuss your apartment investment needs – whether buying, selling, or refinancing an apartment building or apartment development site – I invite you to reach out to one of our Team Members.

Case Study #1 – Venture Capital: Madrona Venture Group

Ideas spark innovation – but capital fuels growth. And the flourishing of ideas into actual companies occurs when venture capital is available.

To the uninitiated, Madrona Venture Group provided the seed capital to Amazon, the $1.5T company sitting smack-dab in the middle of downtown Seattle.

While many investors sat on the sidelines in 2020, Madrona Venture Group Closed $500 Million for New Funds to help fuel Seattle’s next pack of entrepreneurs and innovators.

The following quote says it all:

“Inventors and founders in Seattle and the Pacific Northwest are fueling the economic success of our region and beyond. While it is increasingly possible for companies to be built anywhere, few places have access to talent, understanding of market problems and the ability to build emerging solutions like greater Seattle. The Seattle Mindset, combining curiosity, iteration and agility, has proven to build some of the most innovative and valuable companies in the world.”

— Matt McIlwain, Managing Director at Madrona Venture Group

A more graphical representation of the innovative ecosystem of Seattle is displayed in the 2015 “Seattle Tech Universe” map [which is unfortunately not yet updated].

[click for expanded view to see the connection points between companies]

In Seattle, the connection points that spark innovation – and the capital that fuels its growth – is only second to a few select cities on the globe. We may not see it just yet, but grass shoots are growing all around us that will mature into commercial real estate demand before we see it operationally in our portfolios.

Case Study #2 – Key Employment: Amazon

As announced this week, Amazon’s Puget Sound headcount now exceeds 75,000 employees – surpassing Boeing as Washington State’s largest employer.

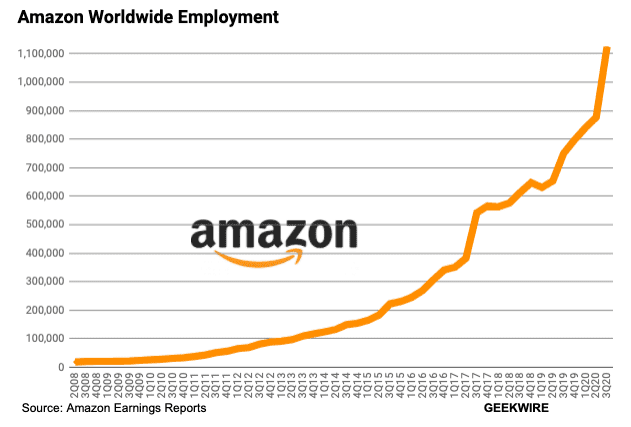

Reported by GeekWire, since planting its Global Headquarters “pole” in South Lake Union just 10 years ago, Amazon has invested over $4.5 billion in Seattle and created 244,000 non-Amazon jobs locally. Globally it hired 400,000 people in 2020 alone!

It’s good leverage against anti-business policies in Seattle to say that Amazon is turning its focus to Bellevue, yet it would be shortsighted to believe that is entirely true.

Amazon’s massive capital investment in Seattle, its adjacencies to local Google, Facebook, and Apple campuses, and the overall attractiveness of Seattle all militate towards a return to business-as-usual in downtown Seattle for Amazon, and its counterpart innovators.

Doubling-down on its commitment to its hometown, Amazon just announced a Housing Equity Fund, a $2 billion-plus commitment to preserving housing affordability.

It’s easy to see the challenges Seattle faces in a near-term recovery, yet quite another challenge to ignore the trillions of dollars of market capitalization horsepower exhibited by the most innovative companies in the world calling Seattle home.

Case Study #3 – Retail Resiliency: Nordstrom

While other retailers – including and especially major department stores – fall to the wayside, victim to both changing consumer habits and the economic maelstrom that was 2020 – Nordstrom continues to thrive.

With its stock taking a beating in 2020 – down as much as 70% – it is now within 17.5% of its pre-COVID-19 value.

With the pandemic raging, social unrest in downtown Seattle, and brick-and-mortar retail’s essential viability in question – Nordstrom could easily have gone the way of its counterpart fashion retailers.

The list of dead at roadside fashion retailers is both massive and staggering – akin to Lehman’s 2008 collapse, these are stalwart brands and household names. Each of the following businesses entered bankruptcy protection in 2020, many will not emerge intact.

- Neiman Marcus (founded 1907)

- Lord & Taylor (founded 1826)

- J.C. Penny (founded 1902)

- J. Crew (founded 1947)

- Brooks Brothers (founded 1818)

- Stein Mart (founded 1908)

Nordstrom’s survival – and arguable flourishing – in the current economic environment is not only a testament to its DNA, but a testament to the very essence of Seattle’s DNA. Don’t just survive challenging times, outperform them!

Looking Ahead

Seattle solves problems. It is in our collective DNA, and no matter how much COVID-19 mixes with that DNA, we will continue to solve not only local problems, but problems globally.

With each innovation, another company will outgrow its current office or spawn a start-up – both requiring more office space and more employees that require housing.

And if you think the majority of people are going to work from home, you might want to consider that with the advent of each new innovation – the plow, the assembly-line, email – people thought that machines would take over, reducing the amount of work humans need to do.

How did that work out?

For better or for worse, work – and workers – will predominantly go back to their old ways.

And mark my words, if you wait for that to happen to rekindle your investment strategies – you will be both wrong and too late to take advantage of opportunities in the Seattle apartment market.

I wouldn’t bet against Seattle!

Whether you own an apartment building or development land and want/need to sell, or you are looking to get into the Seattle/Puget Sound market–there is no time to waste.

We can help with a Free Valuation of Your Apartment Building or answering questions about lending for both new acquisitions and refinances (contact Alex Mundy).

Working with a capable, experienced, and active team of sales and lending experts is always important–and such sage guidance was never more necessary than it is today.

Give us a call to Turn Our Expertise into Your Profit!