Rent, Occupancy, Collections & Renewals

As the summer progresses, we continue to collect data on just over 44,000 apartment units, serving as a representative sample of the approximately 230,000 apartment units located in King County.

We’ve noticed the following trends over the course of the last several months:

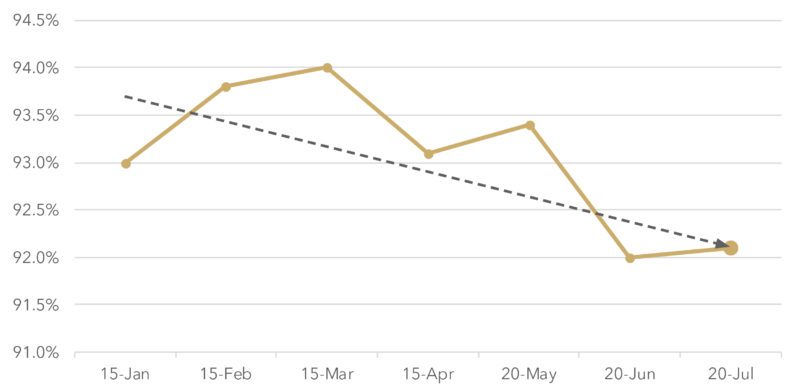

- Rental rates remain mostly steady

- Occupancy trended downward from 94% to 92%

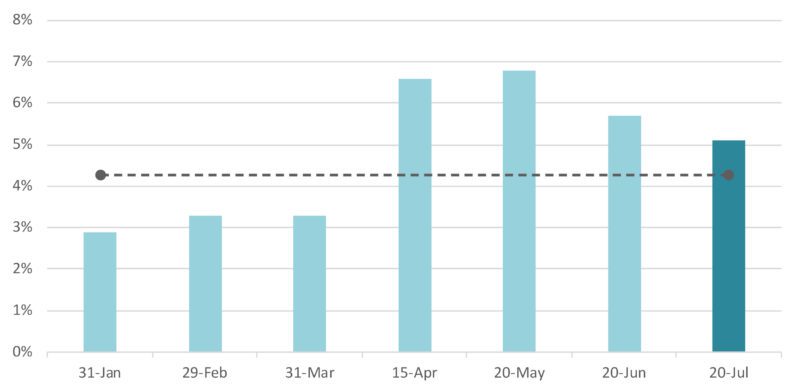

- Collection losses peaked in May at nearly 7% and have now fallen to around 5%

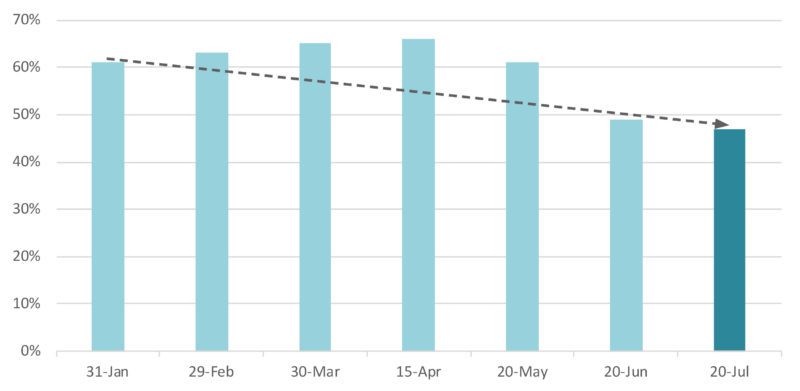

- Renewal rates peaked at 66% in April, now significantly lower at 47%

Last month, we reported our Six Month Check-Up, and noted in our analysis that Seattle’s apartment market demonstrated remarkable resilience during unheralded times. One more month into the year, the data demonstrates that the market remains strong.

June to July 2020: King County Apartment Dynamics

It has been no easy road to keep apartment building operations steady during these uncertain times, and owners and management companies are working double time collecting rent and keeping buildings full. To the outside observer, we seem to have weathered the storm; however, concerns loom as we struggle to reopen the economy.

As we look towards the end of summer and the near-term future, this is what we are watching:

- Labor Market Recovery

- Extension of the CARES Act and PUA ($600/week benefit)

- Projections for Future Rent Growth

Labor Market Recovery

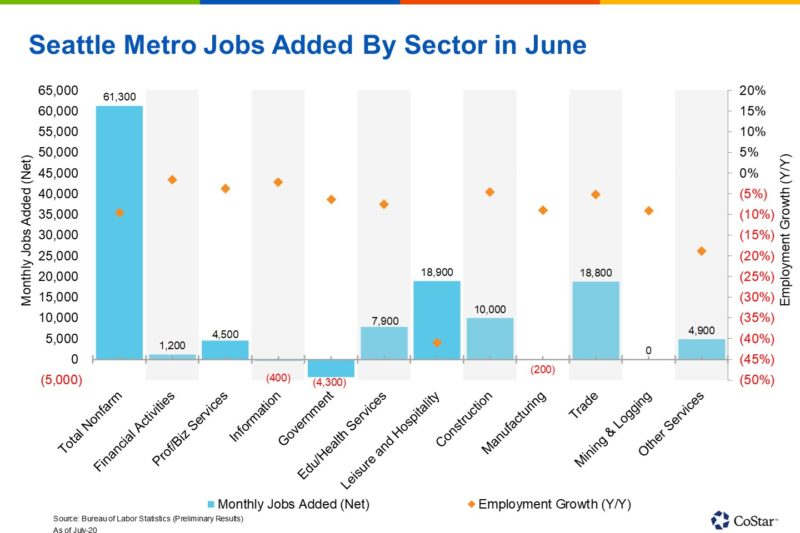

Over the course of the last 12 months, Washington State lost approximately 312,000 jobs – a staggering number considering most were lost in less than 60 days. Yet, in June 2020 alone, over 71,000 jobs were recovered across the state – the majority of which are in Seattle.

May 2020 specifically saw the addition of nearly 64,000 Seattle-based jobs, with another 61,000+ added in June. These totals bring Seattle to within 9% of peak employment in February 2020.

We’ve become accustomed to predicting long-range outcomes by analyzing extremely short-term events and reactivity. For example, after the horrific events of September 11, 2001, it was nothing short of guaranteed that business travel would never return – we were destined to a future of video conferencing.

The virtual certainty of virtual meetings never happened (at least not until COVID-19).

We are in the same boat now. Even as jobs return, the prevailing discussion is whether people will return to the office – in essence, signaling concern for Seattle’s commercial real estate markets.

In the words of my dear friend and favorite local economist Windermere Chief Economist Matthew Gardner, “I say Poppycock!”

Whether we are talking about cavemen gathering around a fire or traders at the river-shore in Mesopotamia, innovation is borne of collaboration. And collaboration’s literal Latin root meaning is “to labor together”.

We are coming back to labor together, and mark my words: Seattle remains a modern-day Mesopotamia for all the reasons we’ve discussed:

- Seattle’s Resilience, Part 1: Demand

- Seattle’s Resilience, Part 2: Unique Tech

- Seattle’s Resilience, Part 3: Market Cycles

Extension of the CARES Act

Turning to very near-term concerns, a large and prevailing discussion surrounds the extension of the CARES Act Pandemic Unemployment Assistance (PUA).

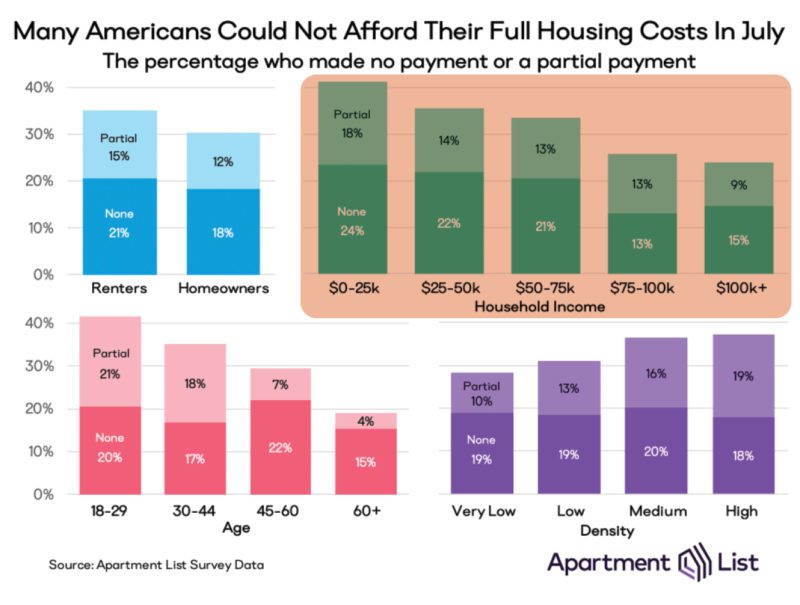

Data we’ve collected and analyzed demonstrates that not extending this program will adversely and disproportionally impact households – and renter pools – with lower incomes.

We’ve kept a steady eye on collection losses and observed the peak of ~7% in April 2020 subside to still meaningful but not massively concerning levels of ~5% in July 2020.

If some form of the PUA is not extended through at least the end of 2020, we predict that collection losses in Class B and especially Class C apartment buildings will exceed 10% and will have large implications on building operations and values – and, accordingly, sales and refinances.

We will know sooner than later the fate of these programs and are watching them closely. Yet, as I discuss below, these are near-term trends, and a broader view of the Seattle/Puget Sound/PNW market remains predictive of a full recovery very early in the current decade.

Projections for Future Rent Growth

One of my favorite quotes regarding pontification on future events is from the Danish politician Karl Kristian Steincke. His proverbial cautioning translates to: “It is difficult to make predictions, especially about the future.”

Yet, here we are in 2020 guessing about the future, so we must start somewhere!

To set the record straight, I don’t care for apartment rental rate data from nearly any source (short of a rent roll), and when it comes to extrapolation of that data in forecasting/predictions, my lack of care diminishes to disdain. However, since nearly all sources of such data are currently coming to similar conclusions, we might as well pick one as a sample for the sake of analysis.

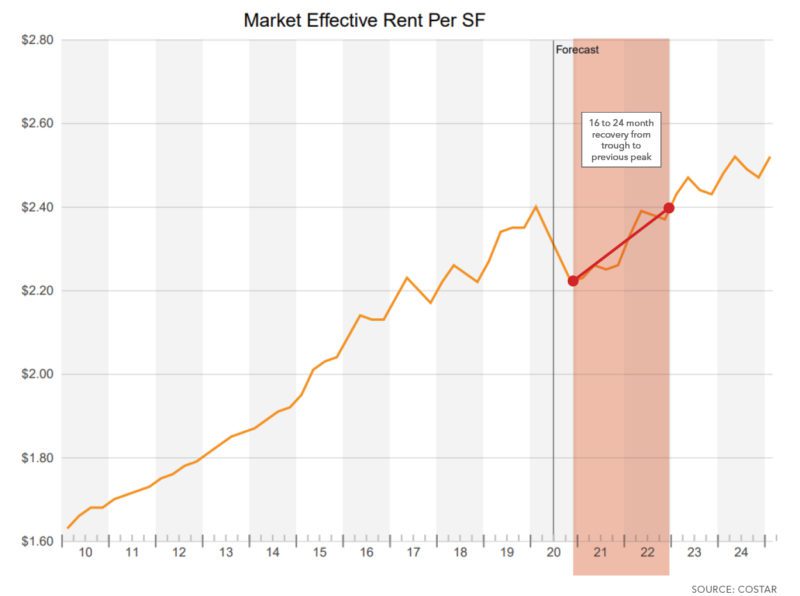

Rental rate data from CoStar demonstrates that rates are headed downward to a predicted low by Q4 2020 – then taking between 16 to 24 months to reach the previous peak in rents achieved in Q1 2020.

Whether the amount of decline and timing of correction are pinpoint-accurate or not, their analysis of the market does demonstrate that we are in for some challenges. Choppy waters ahead are nearly inevitable.

Yet, looking beyond 2022 – the year of recovery to the previous peak – forecasting catches back up to the pre-COVID rental rate growth trendline.

It is anyone’s guess if this is accurate; however, decades of data from other urbanized markets (e.g., New York, San Francisco, London) demonstrate a sine wave of peaks to troughs, and in all cases that sine wave has an upward trajectory with each peak greater than the last

Case in point: markets recover.

Accordingly, if you are looking to invest into the market and you plan to hold an asset for more than 3-5 years, it may matter less when you get into the market than getting into the market at all.

It’s hard to take any advice in July 2020 (other than doing nothing) when it feels like the future is both uncertain and unpredictable.

My simple answer: 70+ years of post-WWII history dictates that the market is headed back up – and certainly well beyond previous market peaks.

We remain excited about the economic vibrancy and viability of the Puget Sound region. Please give us a call to Turn Our Expertise into Your Profit!

Want to keep up with our apartment and land listings, research, and industry updates throughout 2020? Subscribe to our investor newsletter and follow our team page on LinkedIn.

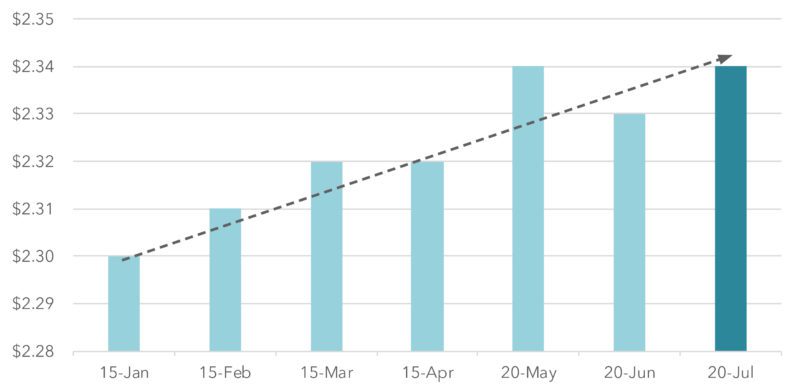

Rental Rate Trends (YTD)

Price / Square Foot