When will the real estate cycle end? What inning are we in? Has the Grim Reaper entered the foyer?

In the echo chamber that is commercial real estate forecasting and pontificating, there is no greater question of the moment than when the good times will come to an end.

As no one knows the answer, maybe it’s high time to ask a better question…

What does a market softening look like?

And an even better question for those invested in Seattle’s apartment market: how is Seattle affected in a recession?

In this three-part series we continue to explore Seattle’s Resilience.

The Trilogy of Seattle’s Resilience:

- Part 1: Seattle’s Resilience – Demand (posted 1/24/2020)

- Part 2: Seattle’s Resilience – Unique Tech

- Part 3: Seattle’s Resilience – Market Cycles

In our last installment, we demonstrated a validation case for demand in the commercial real estate sector by way of 10 million square feet of office space delivering to the market (with nearly 75% pre-leased) and over 200,000 jobs that will likely follow.

The next step of our analysis takes a detailed look at Seattle’s Unique Tech and how the composition of technology companies – and how they are funded – further solidifies Seattle’s Resilience.

Efficiency Companies vs. Innovation Companies

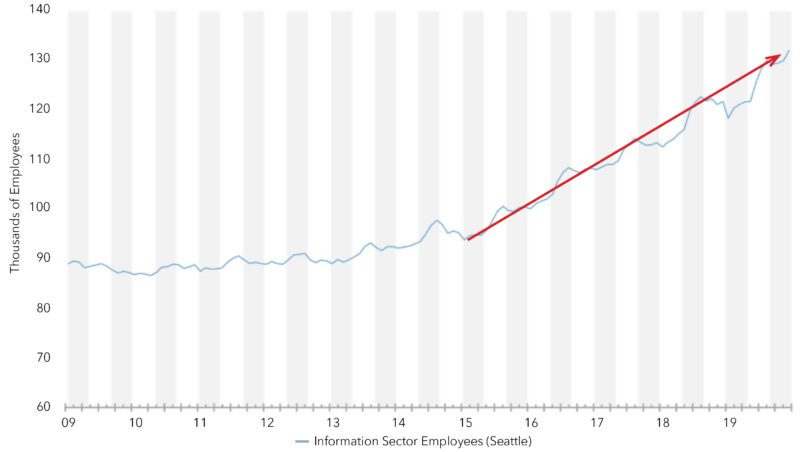

There is no debate that job growth within Seattle’s technology sector has been meteoric over the most recent market cycle. A tech ecosystem that began with Microsoft’s move to Bellevue in the late 1970s steadily gained steam over the following three decades to a fever pitch of tech companies both organically hatching in Seattle and migrating here as they defected from other tech- and non-tech-based cities.

Seattle Tech Employment Sector Growth – 10 Year Period

Source: CoStar

Yet, not all tech is created equal – nor are all technology companies equal. As one takes a more refined approach to analyzing the technology employment sector, differences emerge and one key difference is the durability of the type of technology.

Three years ago, I wrote How Durable is Seattle’s Tech Sector? This article emphasized that the majority of Seattle’s technology-based companies focus on creating efficiencies in marketplaces.

Why is this important? Quite simply, market-cycle durability.

Recessions have a chicken-or-the-egg phenomenon. They are born of people “pulling back” with their spending, and as a result people have less confidence (and money). Then others “pull back” in their spending and the recession deepens.

Yet, if a tool, service, or technology can help you save money by creating efficiencies – whether you are a consumer or a commercial enterprise – you are likely to continue using that tool, service, or technology.

In many cases, you use it more and may even be willing to pay more for it when money is tight.

If Amazon can get you goods for cheaper than the grocery store, that is where you’ll shop – especially in a recession. Same for data/analytics, plane tickets, et cetera.

There is no question that in a recession there is less commerce, yet any city that retains a greater share of the existing commerce will endure the recession more successfully and emerge from it sooner. That was certainly the case of San Francisco (and Seattle) coming out of the Great Recession.

Which firms are these “efficiency companies” and why should we have confidence in their durability in a recession?

When the economy goes south, companies must figure out ways to stay in the black, and one of the best ways to cut expenses is to become more efficient.

These are all homegrown Seattle companies that will not only survive a recession, but thrive as they offer their customers a way to save money through efficiencies.

Mature, not Old

The lament (or correction) I often make to all the twenty-somethings running around the office is that I am “mature,” not old. The same goes for Seattle’s technology sector.

When we think of “technology” companies, we think of startups with bleeding-edge technology on the cusp of becoming Unicorns (the moniker for $1B valuations). Minting new startups is all well and good, but having a stable of mature technology companies with demonstrated business models, strong war-chests, and market-cycle durability is key.

And Seattle has such companies in spades.

A Hot, but not Overheated, Venture Capital Market

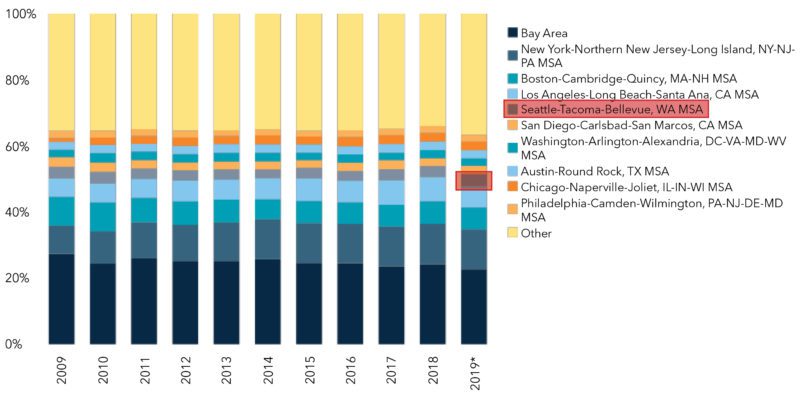

In 2019, the capital that was infused in venture-backed, Seattle-based companies shot up 20% year-over-year, hitting a record high of $3.6B. Impressive as such growth in venture-capital-backed companies may be, this record-setting year was a drop in the bucket compared to the rest of the nation – just 7% of Silicon Valley’s and 13% of New York’s totals, and less than 3% of national totals (San Francisco/Silicon Valley/NYC claim nearly 60% of all venture capital nationwide).

Venture Capital Funding

Percent of National Total

Source: PitchBook

Why is this good for Seattle?

When markets turn and recessions hit, everyone tightens their purse strings – even venture capitalists. Because the region’s ability to thrive is relatively independent of venture capital deals – and the office space absorption, apartments rented, and employee spending these deals create – Seattle is in a far more stable position to endure economic choppiness.

When markets turn, maturity matters.

Cloud Computing, Big Data, Predictive Analytics, a Few Key Professors … and One Massive Flywheel Effect

Lastly, but certainly not least, Seattle’s technology sector is a foundation for emerging technologies that are defining the next decade of business.

The hottest segments of the technology sector are evolving around data and the study, use, manipulation, and storage of it. Whether referencing Amazon/Google/Microsoft’s turf war over cloud computing or predictive analytics driving research at the Allen Institute for Artificial Intelligence, Seattle “owns” the market on these emergent, vastly important, and durable technologies.

A great article co-written by former University of Washington Computer Science Department Head Oren Etzioni takes a deeper look at Seattle’s catbird seat on the future of these technologies: Analysis: Seattle startup ecosystem poised for unprecedented acceleration of company creation

This article provides an in-depth, five-step analysis of why Seattle is poised for further growth and greatness in key technological fields.

Final Installment

In our final installment of this three-part series, we’ll explore how our unique technology ecosystem will have a great impact on the Seattle’s reaction to any recession through a study of market cycles in tech-driven markets.

If you are looking for guidance on any aspect of apartment investing – valuing your building or development land, preparing to sell, acquiring a building or placing financing – give us a call. We are excited to partner with you in 2020 to help you achieve your investment goals – during this economic cycle, and the following one!

Want to keep up with our listings of buildings/land for sale, research, and industry updates throughout 2020? Subscribe to our investor newsletter and follow our team page on LinkedIn!