Are apartment deals still getting done?

It’s a fair question. On the heels of 2019, a record-setting year with over 350 apartment sales and $7.4B in sales volume, we all had high hopes for 2020. Although no one expected to best the previous year, stellar job growth and nation-leading economic fundamentals set the stage for another banner sales year in the Puget Sound.

Given the emergence–and recent resurgence–of the global COVID-19 pandemic, nearly all focus turned to apartment building operations, with little concentration on sales transactions. Yet, in the last 8 weeks, our team alone has placed 8 transactions under contract.

Next week, we’ll release our data on sales for the first half of 2020 (January – June), analyzing apartment sales transactions and market fundamentals.

With such research, we find the answer to our question: deals are still getting done.

In the following update, we will cover how these deals are getting done, with a focus on:

- Pricing: How is it impacted?

- Tours & Inspections: Are they possible?

- Lending: Is debt available?

1. Has COVID-19 impacted pricing?

With any shift in the market, the appropriate first question is that of fundamentals.

And capitalization rates in particular are on everyone’s minds. Capitalization rates are, of course, a measure of risk. The greater the risk, the greater one’s expectation of cap rate expansion.

Comparing sales from our 2019 Sales Market Research (first graph below) to the first half of 2020 (second graph), it is apparent that, although sales volume is down ~60%, capitalization rates did not expand in the first half of 2020.

2019 Sales: Four County Region

(King, Snohomish, Pierce, Kitsap)

Jan-June 2020 Sales: Four County Region

(King, Snohomish, Pierce, Kitsap)

While buyers did not adjust cap rates across the board, they did adjust how they view operations, and that has markedly impacted predictions of future net operating income.

The primary areas buyers adjusted their underwriting are as follows:

- Rental Rates: 1-2 years of zero-to-negative rent growth

- Vacancy: 1 year of +7% vacancy

- Collection Loss: 1 year of 3-10% collection loss (highly market dependent)

Given underwriting of lower NOI, buyers are resolving to offer lower pricing on properties; however, given the scarcity of available opportunities and extremely low interest rates, sales pricing remains much higher than one might expect.

In the transactions we’ve analyzed, we are seeing pricing adjusted downward in the range of 3% to 8%. There are, of course, some assets and markets with localized issues causing distress, resulting in much greater discounts.

We predict a difference in opinion on pricing between sellers and buyers for the remainder of 2020, resulting in lower-than-normal transaction volume, but pricing will remain within this tight bandwidth for sales that are consummated.

2. Can you conduct tours and inspections?

Beyond pricing, the next question on would-be sellers’ minds is whether the traditional sales process can still occur.

I’m the first to admit that March through May was a tough road to hoe when it came to touring properties–whether for buyer tours or due diligence inspections. Since that time, we’ve changed both expectations and methodologies, resulting in a process that is working for all involved.

Here are the largest changes we found:

- Fewer tours and more desk underwriting from buyers

- Fewer units toured by buyers

- Relaxed standards from third parties

All in all, we’ve experienced everyone coming together to make the process work. In the last 2 months, we completed buyer tours and due diligence for properties as small as 6 units and as large as 215 units. In each case we’ve successfully identified buyers, assisted them through tours safely and in compliance with government orders, and toured third party inspectors for buyers and their lenders.

The amount of coordination and consideration expressed among sellers, buyers, residents, lenders, and inspectors is laudable. For us, it has been a very bright spot in otherwise tenuous and uncertain times on how to interact with others.

Kudos to our industry!

3. What about lending?

The final component of stitching apartment sales together is lending. In early July 2020, our partner Alex Mundy published his annual Puget Sound Multifamily Lending Market Update (accessible via this LINK).

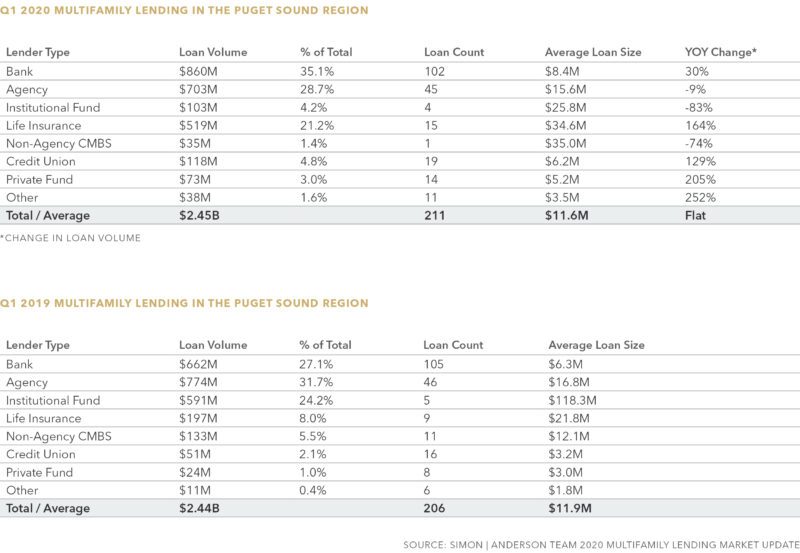

As of Q1 2020, apartment loan originations tracked with Q1 2019.

Multifamily Loan Originations: Q1 2020 vs. Q1 2019

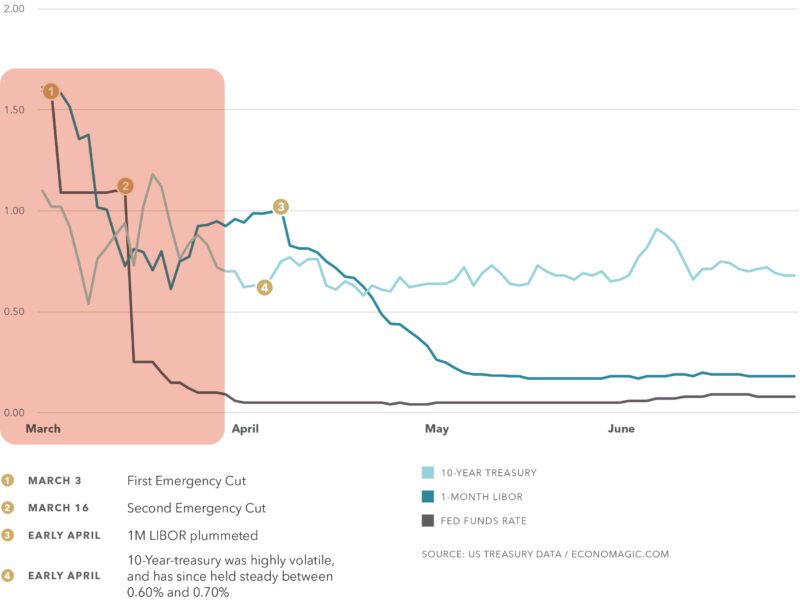

However, as we all know, the end of Q1 marked both COVID-19 impacting the United States and staggering cuts to the Federal Funds Rates.

Change in Federal Fund Rates,

10-Year Treasury, 1M Libor

April through May was marked by wild swings in lending rates, dropping as low as sub-2.5% and surging well past 5%, all in a matter of a few weeks.

The roller-coaster lending market has since recovered, and lenders have narrowed spreads over treasuries and reduced severely draconian and penalizing principal and interest reserves, previously topping 18 months in some cases.

Multifamily loans are available between 2.5% and 3.5%, and interest-only periods for lower leverage loans are available full term (up to 10 years for 50-55% LTV loans).

Just a few months ago, the scarcity of multifamily lending hampered transactions, but today stellar lending is buoying sales and making remarkably low-cap-rate deals palatable to buyers focused on long-term fundamentals and yield.

Sellers & Buyers: You Can Get Deals Done

Deal are still getting done!

There is an old saying that bad deals are done in good times and good deals are done in bad times.

Granted, I’m not one to characterize times as good or bad, just different. And times are certainly different!

Whether you own an apartment building or development land and want/need to sell, or you are looking to get into the Seattle/Puget Sound market–deals are still getting done.

We can help with a Free Valuation of Your Apartment Building or answering questions about lending for both new acquisitions and refinances (contact Alex Mundy).

Working with a capable, experienced, and active team of sales and lending experts is always important–and such sage guidance was never more necessary than it is today.

Give us a call to Turn Our Expertise into Your Profit!