The commercial real estate market entered Spring 2020 with white knuckles, clutching the safety bar as a roller coaster “ticked” ever so close to the precipice of a major drop.

In March we questioned, “What will happen in April?”

Yet again in April we lamented, “May must be far worse, right?”

Did rents similarly, and scarily, plummet like a roller coaster? Not so much.

Did a crash in occupancy follow? No such meaningful change occurred.

What, then, is all the fuss about?

Entering a global pandemic, closure of nearly all businesses, and orders to stay home resulting in peak unemployment of over 40 million Americans justifies bracing oneself.

Accordingly, in March 2020, we began collecting operations data on roughly 44,000 apartment units – covering nearly 300 buildings located in King County (roughly 20% of all inventory) – bracing ourselves with data.

In previous blog posts (March – May Trends), we looked at month-over-month trends since the COVID-19 lock down began. Such analysis shone a light on fluctuations in the market – most of them positive (e.g., stabilized rent/occupancy, growing renewal rates), while others concerning (e.g., mounting collection loss).

Now armed with 6 months of data, we can turn to an analysis of longer-term trends.

6 Month Trends in King County

*Note, collection loss measured pre-COVID-19 in January at 2.9% – as of June, it is actually down month-over-month to 5.7% from a peak in May 2020 of 6.8%.

What does the data mean at the half-year mark in 2020?

- Rental Rates grew nominally

- Occupancy Rates remain steady

- Collection Loss peaked in May, now declining

- Renewal Rates are back to historic averages

Real rent growth, albeit nominal, coupled with some red ink for the first half of 2020 demonstrates that the Puget Sound market remains resilient and is outperforming the nation as a whole – especially in cohort coastal markets on both the West Coast (San Francisco, West Los Angeles) and East Coast (New York, Washington DC).

Job Loss, Wage Gain

Before we take a deeper dive into each apartment metric we’ve carefully measured over the past 6 months, a quick health check of Washington’s job market is crucial.

A key measure of the health of any economy is employment – inclusive of both total employment and wages.

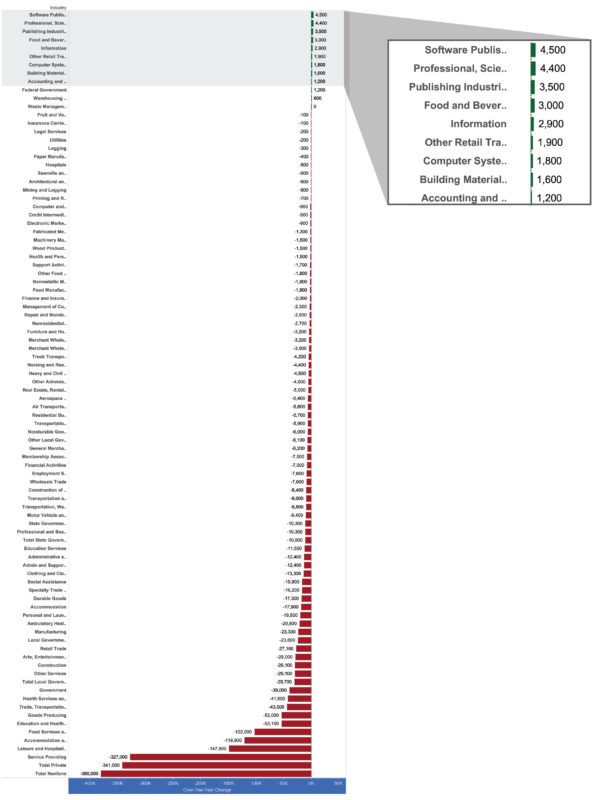

Regional job loss in the Puget Sound is on par with the rest of the nation. We have lost many jobs (to the tune of minus-380,000 year-over-year), yet the lesser-told story is of industry sectors demonstrating year-over-year growth, and these sectors directly equate to high wages.

The following graphic is provided for relative comparison purposes, understanding that the data is far from legible (legible version here: Employment Security Department — May 2020 Jobs Report).

One important story is the subset data in green – sectors of actual year-over-year job growth. Despite COVID-19 circumstances resulting in a 4-fold increase in unemployment, the region grew jobs in the highest-wage-earning sectors.

Washington State – Year-Over-Year Employment Change

The highest-wage-earning sectors – Software Publishing/STEM/Information/Computer Systems – experienced year-over-year growth despite the massive havoc COVID-19 wreaked on the national labor markets. This bodes well for our region’s near-term and long-term recovery.

Rental Rates

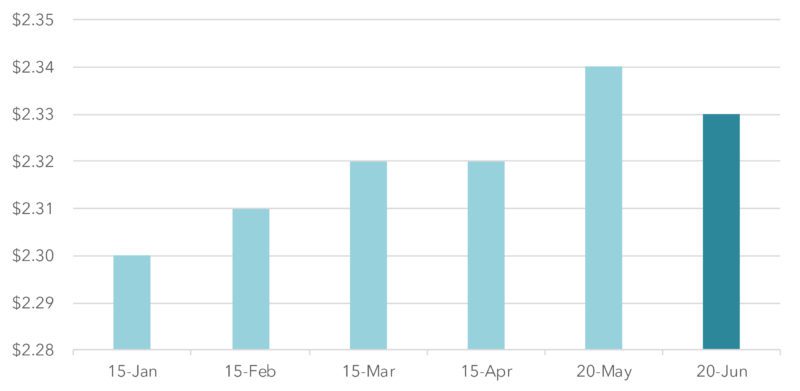

Headline: Rental rates hold strong, posting growth equating to an annualized increase of 2.4%.

My headline remarks are based on data we collected from 44,000 units in King County. The data demonstrates that across our sample cohort the market experienced mild rental rate growth.

King County Apartment Rental Rates

Average Price per Square Foot

Keeping ourselves honest, we also looked at CoStar data surveying the full market of approximately 220,000 apartment units in King County. Its data concludes 3.8% growth in Q1 2020 and a 0.1% decline in Q2 2020 – equating to net 3.7% growth YTD, annualized at 7.4%. I don’t believe that is a fair analysis, as annualization does not consider the current downward trend, yet it does validate market rent growth for the first half of 2020.

CoStar predicts strong declines (+10%) by early 2021, followed by an even stronger rebound (+11%) in late 2021. I don’t believe our market is set for such gyrations. Looking at the jobs picture, we estimate a mild dip in rents, followed by more steady rental rate growth – rebounding to net growth by 2022.

Occupancy Rates

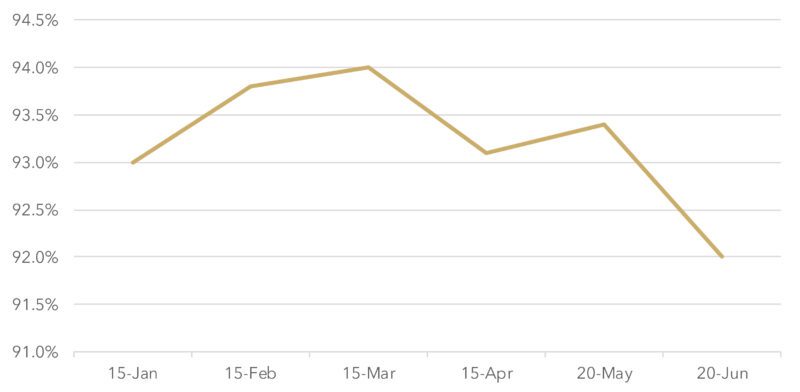

Headline: Occupancy experiences mild decline yet proves overall market resilience.

Our sample set of data was 93% occupied as of January 15, 2020, and as of June 20, 2020, occupancy dipped down 1.0%, settling at 92% occupancy.

King County Apartment Occupancy Trends

While a market vacancy rate of 8.0% does not necessarily prove a strong market, it is skewed by looking at a subset of the market. Again, turning to CoStar’s broader market coverage, its data set shows King County vacancy at 6.1% – a number much more demonstrative of the overall market in balance (nearly 95% occupied, which is broadly considered market equilibrium).

We predict occupancy to remain within the current bandwidth of 92% to 94% – with short term occupancy dips in marks facing delivery of a large number of new deliveries in the near-term. Expect occupancy to then head towards highs experienced during this past market cycle as we approach 2022 – 2023.

Collection Loss

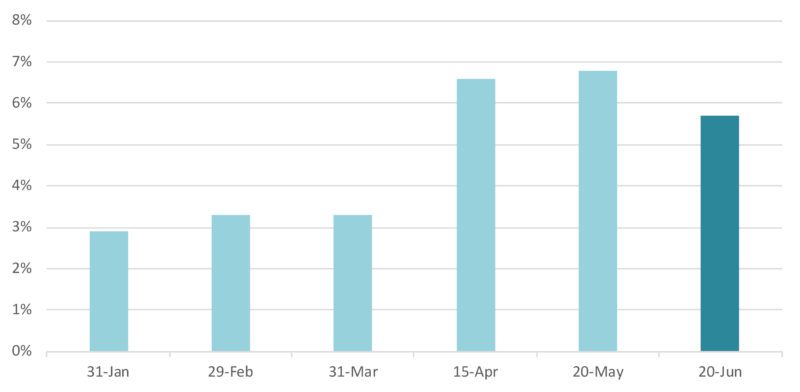

Headline: Collection losses stemmed at 5.7%, off from the peak in May of 6.8%.

The threat and fear of collection loss easily topped the list of nearly every commercial real estate investor since COVID-19 hit US shores – especially Seattle. Panic-stricken reports of 30% of renters not paying rent were the harbinger of times to come.

Well, those times never came – and what did come was both mild and fleeting. All in all, King County generally remained at an average collection loss well below 10% – and, by our data, never crested 7%.

We are now trending towards sub-5% collection loss.

King County Apartment Collection Loss

Although Puget Sound apartment investors are used to low collection loss, the rest of the nation is not. Data from NMHC’s Rent Payment Tracker validates that near 8% collection loss is normal – or at least it was in 2019.

Kudos to the Puget Sound for performing well beyond normal in our most dire hour! We expect collection loss to trend back down to historical averages of 0.5% to 3.0%. You can safely pull your hand away from the panic button!

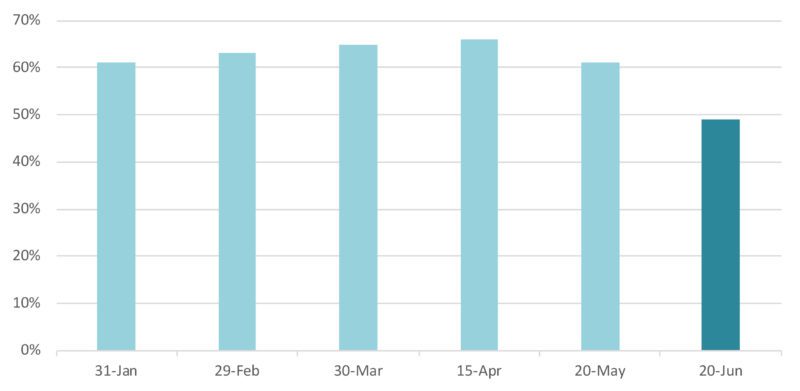

Renewal Rates

Headline: After hitting a fever-pitch of renewals, we trended back to our historic mean.

It was an exciting ride to watch the Puget Sound market lead the nation in apartment renewal rates, with a near-60% renewal rate according to RealPage, and 66% according to our data. Now the balloon of renewals is again safely tethered to historic norms of around 50%.

King County Apartment Lease Renewal Rates

It was a fun and wild ride while it lasted. With the Stay Home, Stay Healthy order abating in Washington State, and renters eager to find the right long-term rental location/price point, expect renewal rates to continue along a more traditional trend line of 50% to 55%.

Back to Work

Nearly all of us are back at our office desks now. It may not be business as usual in the traditional sense – we are still Zooming our meetings and masking our faces – yet our deal pipeline brims with opportunities and we continue to help both sellers and buyers execute on their business objectives.

In fact, “business as usual” was never our style. Market turbulence creates unique opportunities and we are here to help you find and capitalize on those opportunities.

Not only are we back to work – we never really left. We’re more prepared than ever, so give us a call to Turn Our Expertise into Your Profit!