The Savvy Investor’s Top 3

Here’s what apartment investors in Eastern Washington need to know this month.

YOU ARE MISSING YOUR HEAD START

In this blog, my partner, Dylan Simon, discusses why now is still a great time to invest in multifamily. Notably, he states “While the vocal majority continues to convince the world (and itself) that its caution is both warranted and prudent, those prescient among us continue to plod away at outperforming the market by analyzing opportunities and buying on a 5 to 7 year horizon.”

WHAT TO EXPECT FROM THE FED’S FEBRUARY MEETING

The U.S. Federal Reserve is all but certain to raise interest rates 0.25 percentage-points when it announces rates on February 1. Following that, the March 22 meeting should be a similar story, where the Fed is likely to once again raise rates 0.25 percentage-points.

2022 YEAR IN REVIEW

Last year, our team had its biggest year yet, closing 54 apartment transactions and over $600,000,000 in total sales volume.

Market Update

SALES INSIGHT

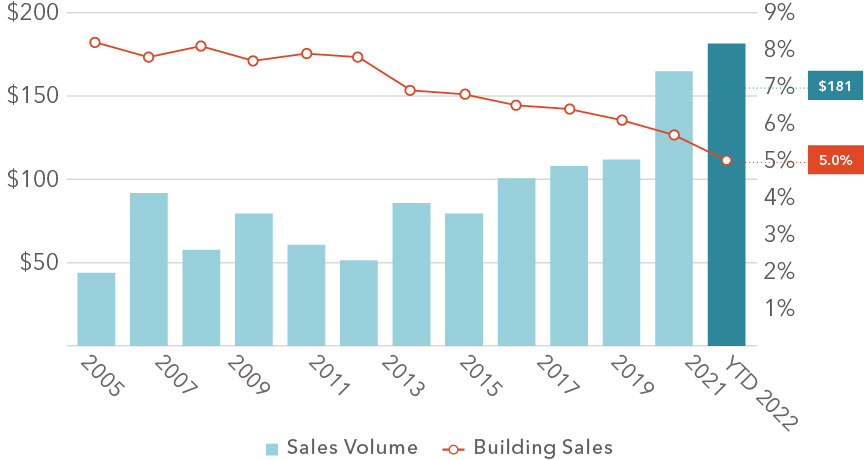

While cap rates continued to dip in 2022, expect an increase in upcoming months due to rising interest rates. And while transactions are still getting done, lending has become a much larger factor than previous years. For motivated sellers, we have seen an increase in seller financed transactions.