In July 1897, the steamship Portland docked in Seattle with a cargo-hold full of gold, marking the beginning of the Klondike Gold Rush. Now, nearly a century and a quarter later, Seattle is in the midst of a different, modernized digital gold rush.

This great rush into Seattle found its beginnings several years ago, yet unlike the flash-in-the-pan Klondike Gold Rush, Seattle’s current renaissance of job growth, urbanization, and economic expansion is just hitting its stride.

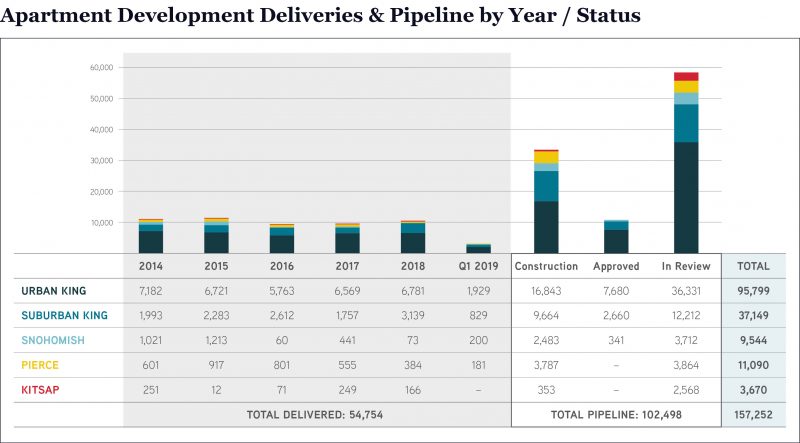

Such economic ignition continues to create extremely strong demand for housing. Since the beginning of the decade, over 70,000 new apartment units were constructed in the Tri-County region. Yet, demand for more housing is evidenced by strong rental rates and stabilized vacancy.

Currently, over 100,000 more apartment units are in some phase of construction, approval or planning.

To access this data, go to page 7 of our Market Study.

For apartment industry professionals, beyond simply the number of new apartment units, several questions are key to understanding the impact of an impressive amount of new apartment supply:

- What: Luxury high-rises or small, efficient SEDU units?

- Where: Do urban neighborhoods remain the focus of developers? What about the suburbs?

- When: Timing is key, when are these units slated for delivery?

The Seattle Multifamily Team is here to help! We prepared a 64-page, detailed market study, broken down on a granular, geo-spatial level detailing the what, where, and when of the current apartment development pipeline.

A Historical Viewpoint

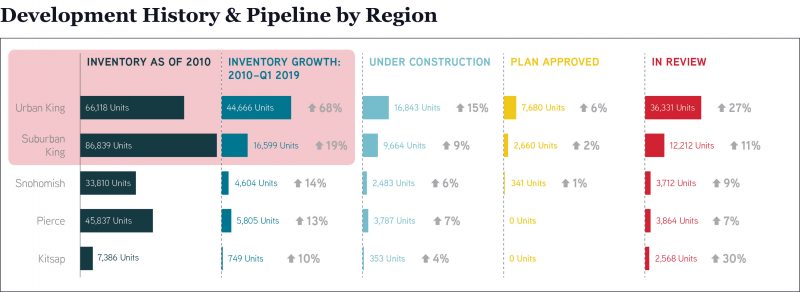

Without question, prior to the current market expansion, the region’s suburban markets overwhelmingly comprised the area’s stock of apartment units. During the last major apartment development boom (circa 1985 – 1995), of the 80,000 apartment units built, over 75% were developed in suburban markets.

This development cycle is certainly different. Looking at apartment deliveries from 2010 through 2018, inventories of apartments in King County’s urban markets grew by 68%, versus 19% growth in its suburban markets. In the last 18 months, the historical tide of suburban-located apartment inventory finally turned – a greater stock of apartments now exists in King County’s urban markets than all its suburbs combined.

To access this data, go to page 8.

Trends toward urbanization that began to take shape in the last decade look as though they will continue for some time. Developers plan to add more than 60,000 apartment units in urban neighborhoods in the next several years.

Yet the story doesn’t end there, as another +40,000 apartments units are planned for otherwise suburban markets. Some of these markets have already begun a trend toward urbanization (e.g., Redmond), while others will eventually urbanize based on the reinvention of retail grids (e.g., Bothell, Burien) and transit orientation (e.g., Shoreline, Kent).

Understanding the potential impact of this new development before it happens is essential to predicting the trajectory of the region’s apartment investment markets, but first you must learn the what, where, and when of new apartment deliveries.

Urbanization Continues

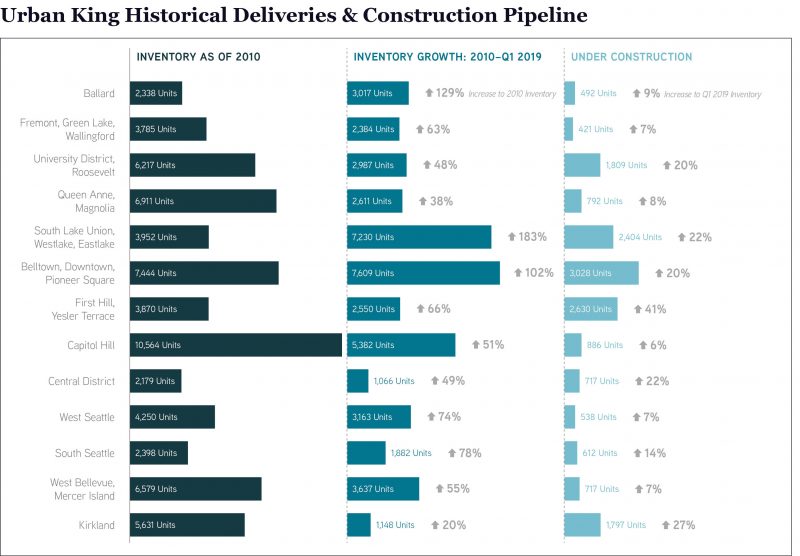

In analyzing each of Seattle’s urban neighborhoods, we’ve arrived at a few key conclusions:

What: The development community has really begun to embrace Small Efficiency Dwelling Units (SEDUs) – efficiency units comprise 5% of the current pipeline.

Of course, it’s essential to understand the character and nuances of each neighborhood, but even markets like Bellevue have “mixed” developments planned that are combining standard apartment sizes with efficiency units.

Where: While tried-and-true Seattle neighborhoods remain both resilient and desirable for renters and developers, newly forming nodes just beyond traditional neighborhoods are becoming popular.

Take a look at this map of Ballard’s future developments – notice a trend moving north along 15th Avenue? It’s not much of a surprise since most apartment deliveries in the last decade were crowded within blocks of NW Market Street.

When: Construction starts are slowing as developers work to make new developments pencil, yet a focus on the long-term is keeping most developers active, even if only developing raw sites.

To access this data, go to page 17.

While units currently under construction will only increase current inventory by 15%, developments under review or with approved plans represent an additional 34% increase.

Suburbs on the Rise

To analyze the suburban markets, we essentially looked at “everything else” in King, Snohomish, Pierce, and Kitsap Counties. Those regions comprise a large area, much exciting activity, and about 40% of the regional apartment development pipeline.

What: Suburban King County is not your average blue-collar suburbs.

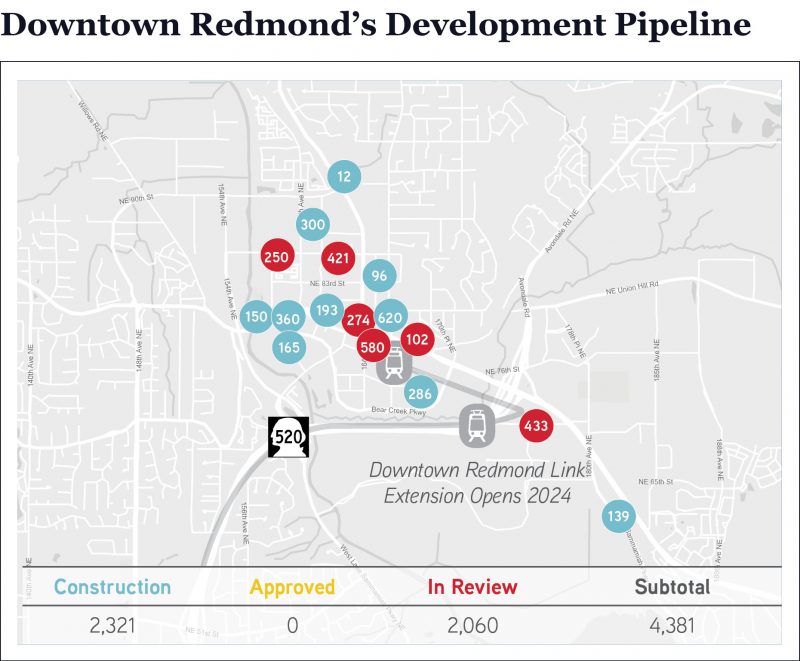

Many of these previously suburban-type markets are quickly urbanizing with modern apartment units and exceptionally high rental rates. And it’s clear that apartment developers are finding both development sites and housing demand that support vastly increasing the supply of apartment development, especially in tech hubs like Redmond. With the Link light rail arriving in 2024, urbanization is inevitable.

To access this data, go to page 35.

Where: Apartment developers were slow to venture outside of King County, but units actively under construction in Snohomish, Pierce, and Kitsap represent a 60% increase to inventory delivered in these markets during the current market cycle.

One of the first markets apartment developers tested outside of King County was Lynnwood. Freeway adjacent and equidistant to job centers both North (Everett) and South (Seattle/Kirkland/Bellevue), Lynnwood provided a great story to the development community.

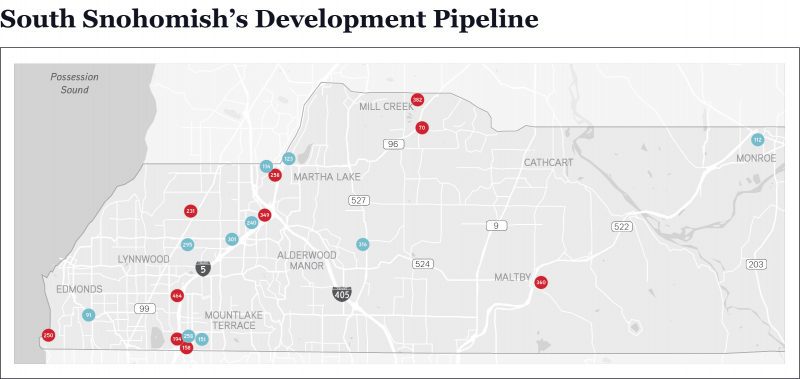

Developers plan to add another 25% to the existing apartment stock in South Snohomish, with prescient investors finally expanding beyond just Lynnwood and developing apartments in a variety of new submarkets.

To access this data, go to page 45.

When: In the last 10 years, less than 1,000 units were built in Kitsap, but developers are betting on this coastal county for the long term.

Kitsap’s pipeline of apartment units in review represents a 30% increase to current inventory – a greater percentage increase than any other region we studied (Urban King included).

What’s so exciting about Kitsap’s future? Aside from renters seeking new markets for lower rents, developers are considering the effects that changes like the Fast Ferry and Opportunity Zone designations will have on the area.

Conclusions

Getting one’s hand around apartment development in our region is no easy feat. The amount of new apartment deliveries so far this expansion cycle occurred at a dizzying pace; however, this is just the beginning.

If you plan to take part in the region’s historic economic expansion – yes, we are on a global stage of economic boom cities – then you need to dig in; learn as much as you can; and make wise, informed, and future-focused investment decisions.

Can we sustain this growth?

That is a great question – and one that we address with our research. In our latest Market Study, we take a close look at job growth: what the region experienced so far and how we expect it to continue. Yet, just reading our market research is not enough to stay apprised of all that is occurring in our apartment market.

Please give us a call to discuss your goals – whether buying, selling, developing, or investing.

Allow us to Turn Our Expertise into Your Profit!