Real Estate Excise Tax Overhaul

The 2019 legislative session certainly was a busy one. 481 bills passed the state legislature, many with direct implications for the commercial real estate industry. Most of these have already been covered thoughtfully by local organizations and news sources, so we briefly summarized key bills along with links to source documents at the end of this article.

We see the real estate excise tax overhaul (Senate Bill 5998) as the most urgent and actionable at this time. Signed into law on May 21st, it changes Washington’s excise tax from a flat statewide rate to a progressive structure based on four sales price tiers.

Most owners of residential real estate in Washington will benefit from the change because it lowers excise tax for transactions under $1.56 million, which was a selling point to the public. However, the revised excise tax is expected to bring in significant additional revenue due to its implications on commercial real estate sales. Since most real estate owners in Washington will pay less, the burden is fully borne by a minority that mostly consists of real estate investors and wealthier homeowners.

We are seeing an immediate impact on apartment transactions in two principal fashions:

- Owners of apartments are considering sales in 2019, versus 2020 and beyond

- Buyers are underwriting much higher costs of sale upon their exit – impacting today’s sales prices and apartment values

To discuss how this market reaction may impact your property, give us a call immediately as there are only seven months left to take advantage of the existing “discounted” excise tax structure.

Where We Are and Where We’re Going

Washington’s current excise tax is a flat 1.28% everywhere in the state. With a couple exceptions, cities and counties are allowed by statute to add up to 0.50% on top of the state portion, bringing the maximum possible excise tax to 1.78%. Unsurprisingly, 179 out of the state’s 320 jurisdictions charge the maximum, while only 10 out of the 320 opt out of any additional charge.

Everything changes on January 1, 2020.

On January 1st, state excise tax moves to the following scale:

- 1.10% on the first $500,000 of sales price

- 1.28% between $500,000 and $1,500,000 of sales price

- 2.75% between $1,500,000 and $3,000,000 of sales price

- 3.00% over $3,000,000 of sales price

The new rate stacks with municipal add-ons, which are not changing. Therefore, in most areas (including King and Snohomish Counties), the effective brackets will be 1.60%, 1.78%, 3.25%, and 3.50%.

Tax rates are applied by tier, like income tax. For example, a $1,500,000 sale would be taxed at 1.10% on the first $500,000 and 1.28% on the next $1,000,000. That is why sales up to $1.56 million will pay less than before, even though the last $60,000 of the sale is taxed at 2.75%. (The exact cutoff for those interested is $1,561,224.49.)

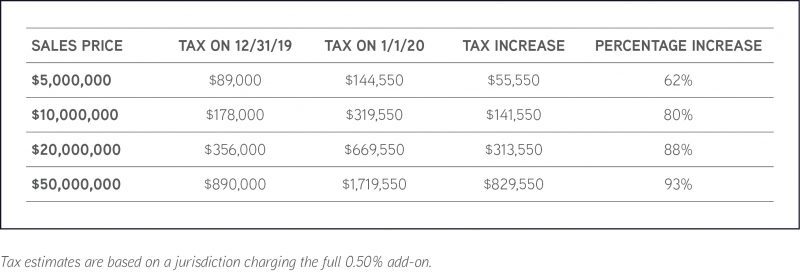

For property sales exceeding the break-even threshold, the percentage increase escalates very quickly.

The table below illustrates my point:

Why It Matters

We see the end of 2019 being a difficult time for large transactions given the relative cost of a day in either direction. Per the example above, a $20 million sale will cost the seller an extra $356,000 if a mid-December closing is pushed to January, making the holiday crunch considerably more stressful.

Sellers should be prepared to market their properties immediately and negotiate financial protections with buyers on any deal that could potentially stretch into December and beyond. By the same token, buyers should be prepared to negotiate these terms and push hard to get deals closed on time.

The Fine Print

Aside from the changes to the tax rates themselves, many provisions of the current excise tax will remain. For example, there are no changes to exclusions for inheritance, government transactions, and other qualified transfers. Agricultural land and timberland will remain at a flat 1.28% tax rate.

However, there are two notable changes in the way that property transfers will be considered “sales” subject to excise tax. One is through beneficial ownership transfers within an LLC or other entity structure — currently, only a transfer of controlling interest within 12 months is subject to excise tax, but the new law will extend the timeframe to 36 months.

The other important addition is language that allows the state to review transactions that appear to have been structured to avoid the tax, and to make determinations as to how the tax should be applied. The most obvious example would be splitting up a multi-parcel property into smaller individual transactions.

Finally, it’s important to note that the sales price tiers are fixed until January 1, 2023, at which point they will be adjusted upward by whole dollar amounts that move with the lowest tier, capped at the lesser of 5% or CPI. They can never go down, even if real estate values decline.

Why are these caveats important?

Because growth in values will vastly outpace rising thresholds in these tiers, meaning property owners seeing no tax increase now will continue to be pushed into the higher brackets over time.

There is certainly room for improvement in these bills, but it’s our hope that the real estate community will continue to be as actively engaged in shaping these issues as it has been in the current session. We owe it to our colleagues in organizations like WMFHA, RHA, and NAIOP for taking the time and spending the money to be thoughtful advocates on behalf of the commercial real estate industry and our stakeholders.

We are also here to serve as your advocates. Call us to review the unique implications for your real estate portfolio, receive a no-cost valuation of your apartment building(s) or land, and discuss the timing for marketing and sale to take advantage of the existing “discounted” excise tax structure.

Allow us to Turn Our Expertise into Your Profit!

Notable Legislation

Condo Liability Reform:

- 5334: Signed into law 4/30, it amends Washington’s condominium liability laws. It passed both the House and Senate unanimously. Notable changes include extension of legal immunities to HOA officers, limits declarant liability, and narrows the scope of what constitutes a valid claim.

Energy Efficiency:

- 1257 establishes a framework for creating energy efficiency standards for commercial buildings with more than 50,000 gross square feet, to be fully implemented by all qualifying buildings by 2028.

- 5116 requires power utilities to eliminate coal-fired power resources by 2025, be carbon-neutral by 2030, and be carbon-free by 2045.

- 1444 establishes energy efficiency standards for appliances sold in Washington after 2021.

Tenant Protections:

- 1440 extends minimum notice of rent increases to 60 days.

- 1462 extends the notice period for substantial rehabilitation or change of use to 120 days.

- 5600 provides various eviction protections.

Mobile Home Communities:

- 1582 increases protections for tenants against eviction due to new rule violations.

- 5183 creates a program for tenant relocation assistance funded by landlords and tenants.

New Taxes:

- 2158 creates a workforce education investment and levies new B&O taxes on “advanced computing industries,” which is very broad (dentists are included, for example). The surcharge is 20% of existing B&O tax, with additional surcharges of $4 million to $7 million for large firms.

- 2167 in addition to the B&O tax increase, imposes an additional 1.2% tax on financial institutions.

- 1406 authorizes cities and counties to impose additional sales taxes of up to between 0.73% and 1.46%, depending on existing sales taxes, to fund affordable and supportive housing.

- 2140 raises property taxes for education.