Guest Post by Austin A. Bowlin, CPA

Austin is a Partner at Real Estate Transition Solutions. His work focuses on tax analysis and strategy for investment property owners seeking to transition their real estate in a tax efficient manner.

Real estate investors are constantly on the lookout for ways to maximize their property’s cash flow and return on equity.

One way to maximize cash flow is to increase the leverage on a property through a refinance and utilize the refinance proceeds to acquire another property. This method works so long as your “cost of capital” is less than the acquired property’s capitalization rate. Another method is to “buy up” to a larger property to increase both your cash flow and available tax-sheltering depreciation. The key to this strategy is to employ a tax-deferred 1031 Exchange. Instead of paying tax on the gain and depreciation recapture resulting from your property sale, an exchange defers the tax and keeps all your dollars working for you – essentially creating an interest-free loan from the government, so long as investment real estate continues to be held.

The popularity of 1031 exchanges rests primarily in their ability to reposition investors’ equity into different property without diluting the sales proceeds by paying tax. 1031 Exchanges allow investors to defer the following taxes:

- Long-Term Capital Gains at 15% or 20%

- State Income Tax (if applicable) up to 13.3%

- Depreciation Recapture at 25%

- Net Investment Income Tax at 3.8%.

The tax rate applied to a sale can be as high as 28.8% in Washington State and over 42% in one of the 43 states with State Income Tax (OR, CA, HI, etc.). For illustrative purposes, to surpass the cash flow associated with a 5% return on a property acquired through an exchange, an investor would need to find a property with a return of 7%+ when re-investing post-tax dollars. Not an easy feat, without assuming significant risk in today’s market.

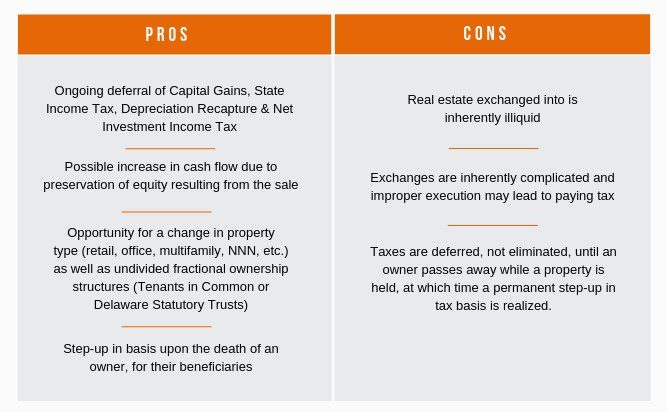

However, it should be noted there are both pros and cons to utilizing a tax-deferred exchange, a sampling of which are detailed in the table below:

You may be asking yourself – why would the federal government allow such an investor-friendly opportunity to be included in the Internal Revenue Code? The history of IRC 1031 began nearly 100 years ago, when tax-deferred exchanges were first mentioned in the Revenue Act of 1921. At that time, it was not uncommon for property to be traded directly for other property. Since no economic benefit was realized when property was swapped for property, the exchange was not considered to be a taxable event. Soon thereafter, in 1924, the code was amended to allow only “like-kind exchanges”, disallowing exchanges between different asset classes such as personal property for real estate.

The next 60 years were quiet on the 1031 front until 1984 when Delayed Exchanges (traditional exchanges with a 45-day identification period and 180-day close period) were approved. In the years following 1984, the code has been clarified and modified to allow for Reverse Exchanges and exchanges to and from both Tenant-In-Common (TIC) and Delaware Statutory Trust (DST) ownership structures. As a result of the Tax Cuts and Jobs Act of 2017, the code was further amended to disallow all property other than real estate to be exchanged. This served to solidify real estate as truly a unique asset class with significant tax advantages.

To give you an indication of the popularity of 1031 Exchanges among investors, in the 10-year period between 2004 and 2013, just over $1.3 trillion of property was exchanged (approximately 2.9 million

transactions), of which $432 billion was exchanged by individuals (approximately 1.9 million transactions)1. Naturally, the popularity of exchanges coincides with the tax liabilities that would result from property sales. During a strong economy, exchanges are more common than during a recession as owners capitalize on an appreciated real estate market.

Tax-deferred exchanges can be applied in several situations depending on the property owner’s investment objectives. Exchanges are a very effective tool to allow owners to reposition their properties so that their real estate investments match their current objectives. For more further history and information on 1031 Exchanges, CLICK HERE.

About Real Estate Transition Solutions

Real Estate Transition Solutions is a real estate advisory firm specializing in tax-deferred 1031 Exchange options and strategies. For over 20 years, Real Estate Transition Solutions has helped investment property owners understand, select and acquire suitable 1031 Exchange properties that meet both their financial and lifestyle objectives.

This is for informational purposes only and does not constitute an offer to buy or sell an investment. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. DST 1031 properties are only available to accredited investors (typically have a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last two years, and reasonably expects the same for the current year) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Securities through Concorde Investment services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. R.W. Bowlin Investment Solutions, Inc. is independent of CIS and CAM.