What Happened in 2018, and Where are We Headed in 2019?

In Issue 1 of our 2019 Apartment Market Study, released this month, we discuss the state of the multifamily lending market in addition to providing a granular look at 2018 sales activity in the Puget Sound Region.

90% of our conversations with investors regarding multifamily lending revolve around two questions:

- What’s happening with interest rates?

- How much loan proceeds are available?

These questions are easy to answer retrospectively:

What Happened In 2018

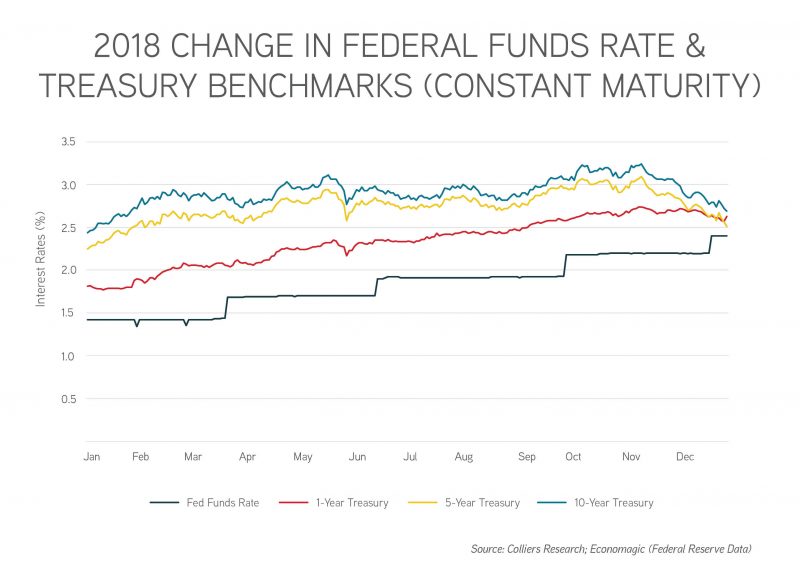

Interest Rates: The Fed increased its target rate by a full percentage point between January and December. The market responded by pushing short-term rates upward in lockstep, and the 10-Year Treasury ended the year at 2.69%, compared to 2.44% on January 1st.

The fact that the 10-Year ended at 2.69% is remarkable considering that it peaked at 3.24% in November.

Interest rates on multifamily debt moved along with treasuries.

Proceeds: As most Puget Sound apartment investors know, loan-to-value limits at 70%-80% have limited relevance in markets with cap rates in the 4% range. Permanent debt proceeds in our market are almost always limited by debt service coverage, and are sensitive to interest rates as a result.

How sensitive?

Taking a simple example: $100,000 of apartment NOI would have supported a 10-year loan of about $1,420,000 in January 2018, $1,290,000 in November, and $1,370,000 in December. This back-of-the-napkin analysis assumes a consistent spread between interest rates and treasuries and 1.20 minimum debt service coverage.

What Will Happen in 2019?

This is much more difficult to gauge—if not impossible—with any reasonable degree of certainty. But like any well-meaning brokerage team, we will enthusiastically share our predictions!

Back to Interest Rates

December 2018 marked a turning point in the interest rate environment. After the Fed increased its target rate a final time at the December meeting, Chairman Jerome Powell and other Fed officials began to indicate that the Fed would take a “wait and see” approach on interest rate increases going forward.

Rates subsequently stayed relatively flat through January and February.

The Fed never officially backed away from the previously-stated plan to raise rates twice in 2019, but the market is not buying further rate increases this year. Fed funds futures currently reflect a 90% chance that the Fed’s interest rate target remains unchanged through December 2019.

In a more recent development, Chairman Powell indicated that the Fed is close to agreeing to end its runoff in treasury holdings, which is significant because reducing its holdings of more than $2 trillion in government debt would put the burden on the rest of the market to make up the gap, putting upward pressure on interest rates.

What does this mean for real estate investors?

Patient monetary policy in 2019 means that we won’t have the specter of consistently-rising rates hanging over the market, which is good for all forms of real estate debt. Construction debt in particular stands to benefit, since short-term interest rates are most acutely affected by changes at the Fed.

Long-term rates are subject to macroeconomic expectations and are more susceptible to factors completely outside our realm of control, like interest rates in Europe.

Given these factors, what can we predict about interest rates in 2019?

- The Fed won’t raise its rate target again this year.

- Long-term interest rates will end the year within 25 basis points of where they stand today. (Disclaimer: though educated, this is still a guess.)

Multifamily Lending Sources

In our market study, we summarize the state of the multifamily lending market as of 2018, which is captured by the chart below:

Fannie Mae and Freddie Mac dominate the market, and 2018 was another solid production year for the agencies at roughly $140 billion (essentially flat from 2017). Official lending caps of $35 billion for each agency carried over from 2018 to 2019, as did exceptions for affordable and green properties. We can expect agency capital to remain plentiful, along with the strong proceeds, interest rates, and interest-only terms they offer.

The Mortgage Bankers Association recently released its fourth quarter originations survey, which showed that 2018 ended on a strong note. Multifamily originations were up 22%, leading the pack in commercial real estate. Of note is changes in market share, with Fannie/Freddie and life insurance companies increasing, and banks and CMBS declining.

In step with national trends, loan volumes in the Puget Sound Region appear to be higher as well with originations on existing apartments in King County increasing from $2.6 billion in 2017 to $2.9 billion in 2018.

Will debt capital remain plentiful in 2019?

We believe so. MBA’s 2019 Outlook Survey indicated that 80% of responding lenders expect commercial real estate loan origination volumes to remain flat or increase in 2019. Of all respondents, only 5% believed that their firm would pull back in 2019.

We tend to believe the respondents. Bridge and construction debt is widely available, and MBS, life companies, and some banks continue to have aggressive appetites for commercial real estate debt. We expect banks to be more conservative at this stage in the market cycle given their relatively higher exposure to construction risk and stricter regulatory oversight compared to other debt sources. Banks also face competitive struggles as other lenders more readily offer nonrecourse and interest-only terms. The latter is particularly important in markets like the Puget Sound where compressed spreads between cap rates and interest rates mean that extended interest-only periods are often the key to meeting cash-on-cash return targets.

Another valuable piece of data to consider is loan maturities, which can have a significant effect on availability of debt and price competitiveness. Fortunately, 2019 maturities look to be in line with 2018 maturities.

Our prediction:

Multifamily origination volumes will end 2019 within 10% of 2018 levels.

Tying It All Together

In a nutshell, we expect multifamily lending in 2019 to look a lot like 2018—and while this outlook is not particularly exciting, I think most investors can agree that boring is good.

The 3% interest rate era is over for now, but permanent debt for multifamily looks to continue to remain in the low to mid 4% range, and construction/bridge debt in the low to mid 5% range.

Most lenders continue to quote debt service coverage limits at 1.20-1.25 for acquisition and refinance, which will be the limiting factor for loan proceeds in our region until cap rates move into the high 5% range (at which point LTV becomes a consideration). There are no major market forces constricting the availability of capital to commercial real estate, and we don’t see lenders significantly tightening credit criteria unless systemic economic risks begin to appear.

Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help. Call us for a valuation and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!