Trying to keep up with the market is a constant battle. And our best weapon is knowledge. Yet, in a sea of headlines to watch and reports to read, what truly is occurring across our regional apartment markets?

Rents are either surging or plummeting and the investment market is either red-hot or the proverbial house is burning to the ground.

On balance (and balance is good in the face of heresy), several universal truths are emerging across most all Puget Sound submarkets and they are worthy of study.

The following trends are ones to watch:

- Secondary Markets are Surging

- Seattle Remains Strong

- Operational Shifts are Important

In the following post we’ll cover all three, with an emphasis on the most important factors for apartment owners and investors to watch, study and respond.

Secondary Markets are Surging

For quite some time the nation’s coastal apartment markets garnered a widely disproportionate share of headlines. From San Francisco to New York, large urban metros pumped-out stellar employment growth – leading to runaway rental rate growth.

In 2017 a shift emerged and by 2018 secondary markets were off to the races with nation-leading rent growth. In 2018, only one major metro – San Francisco/Peninsula – made RealPage’s Top 10 list for year-over-year rental rate growth.

The remaining 9 markets are all secondary markets – with some considered even tertiary.

With powerhouse apartment markets such as Seattle and Bellevue, Puget Sound must be immune from such trends, right?

Not quite.

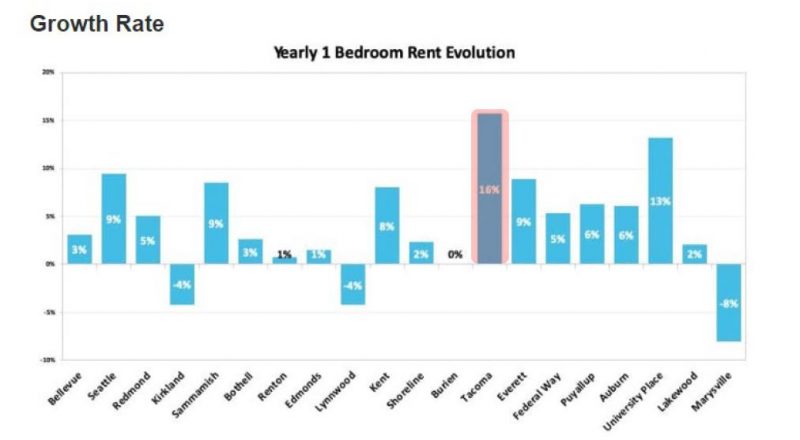

According to Zumper, an online apartment rental marketplace, Puget Sound’s reigning champ for one-bedroom rental rate growth from March 2018 to March 2019 is Tacoma!

A surge in rental rate growth in our region’s secondary/suburban markets must surely mean that urban markets are taking it on the nose. Not so fast. As it turns out, the story of rental rate growth is not that simple.

Seattle Remains Strong

Yes, I will admit that I was inconsolably peeved last week when Bisnow misquoted me and misinterpreted our recently released 2019 Apartment Market Study: Sales Analysis.

I understand that 68 pages of analysis may be hard to follow, so I can simplify it for the sake of a quick recap – in 2018 transaction volume slowed from a 10-year peak in 2016. Yet, for the 8th year in a row, sales price increased across the entire region.

For a granular understanding and analysis of all 265 Puget Sound apartment sales in 2018 – and 15-year sales trends – please download and review our study (or give us a call to send you a hard copy).

But what about rental rates, you ask?

In Seattle’s urban markets, rental rate growth slowed from nation-leading peaks from 2014 – 2017, and the reason is simple – a glut of supply delivered. And more is coming.

In the last 7 years, over 60,000 new apartment units delivered regionally, with greater than 75% of those deliveries occurring in Seattle’s urban neighborhoods.

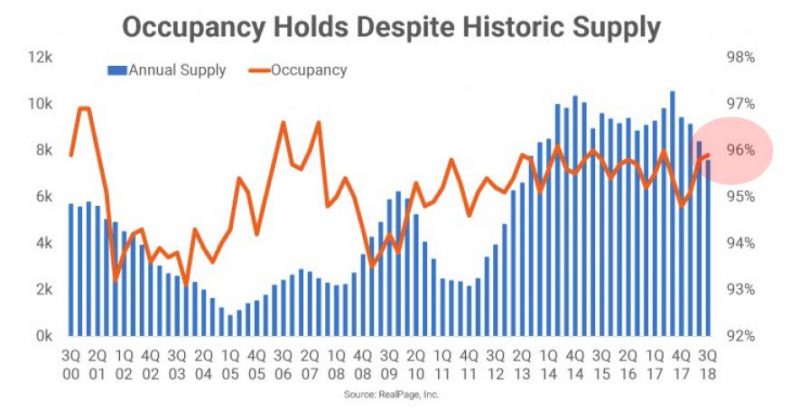

The silver lining is that despite the largest delivery of apartment units in Seattle’s history, vacancy rates remain around 4%.

According to Realpage, the Seattle region is holding fast at 4% vacancy.

Local (and new) data provider Commercial Analytics concurs:

It’s terrific news that apartment markets across our region remain both strong and resilient to an outsized delivery of new apartment units. However, our region is far from insulated from a slowdown.

We know two nearly irrefutable truths: (1) many, many more apartment units are under development and delivering in urban markets during 2019 – 2021; and (2) nationally/globally we are due for some economic softening.

How should apartment owners prepare for the future?

Keep ‘em full!

Operational Shifts are Important

The current market cycle generated monumental rent growth, and with such rent growth many owners focused on capturing the highest rental rates. While there is nothing wrong with pushing rental rates, as the market cycle matures it is important to keep in mind that keeping your building full may require strategic and operational shifts.

Focus on Renewals: Renewals make up at least 50% of any building’s rent roll. It’s a war out there for residents, maintain a focus on keeping the residents you already have – it’s a terrific strategic move.

Utilize Operational Technology: The entire apartment market recently witnessed prospective (and current) residents become all the wiser via technology. Whether using Apartments.com, Zillow, Zumper, HotPads, PadMapper, RadPad, or RentLingo – residents are armed with the latest and greatest technology.

Here are a couple of trick services for apartment owners:

- Appfolio: Marketing and management

- Knock: Lead generate and operations

- Remarkably: Marketing analytics and asset performance

- RHA’s RMAP: Digital Lease Signing & Rent Payments (geared towards smaller buildings)

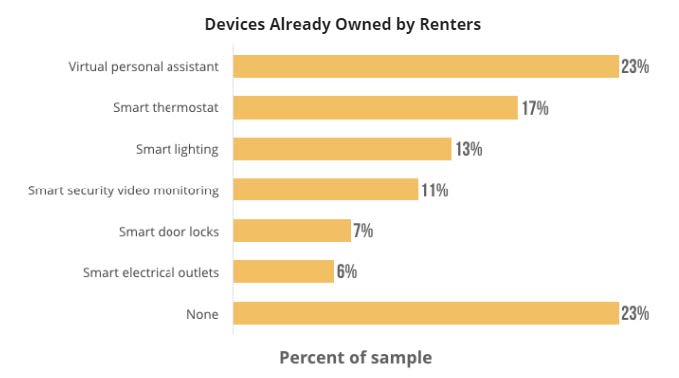

Install / Offer Technology Solutions: Technology is getting quite cheap – and clever. Convenience and ease are huge resident “amenities”. Savvy owners find that offering prospective devices such as a free Amazon Echo, Google Home or Sonos One is a big draw to their leasing.

As it turns out, many renters are ahead of the game when it comes to smart devices:

Finding personalized ways to keep your existing residents, and economical and creative ways to draw prospects to your building will serve as keys to unlocking continued success with your apartment investment.

Remember, now is the time to Keep ‘em Full!

Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation of your apartment building and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!