It’s safe to say that the Seattle apartment market is not yet off to a roaring start for the year. A tumultuous 2018 Q4 in capital markets led to a slow-to-return-to-work January 2019. And for those who were ready to hit the ground running in February – it was more of a call to arms for snow shovels than anything else.

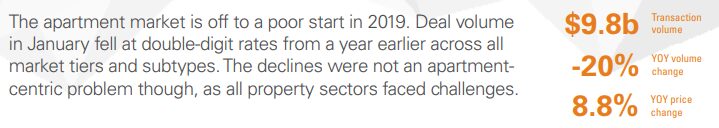

It’s good to know that Seattle/Puget Sound is not the only apartment market facing a bit of post-2018 lull.

Source: Real Capital Analytics, January 2019 National Report

The good news – reported by both Real Capital Analytics and our own 2019 Apartment Market Study: Sales Analysis – although sales volume is down, average apartment values are holding strong, if not growing year over year.

Despite any market-wide sales deceleration, the Seattle Multifamily Team remains busy. Today we hit the 75th day of the year and just closed our 7th transaction of 2019 – averaging a closing every 10 days this year.

With another 7 – 10 transactions planned to close in the next 90 days, our pace of selling apartment buildings and development land continues.

By remaining extremely active on the sales side through recent market shifts we’ve learned several very important lessons for getting apartment deals closed. How deals are getting done in 2019 (and likely beyond) is no mystery to us.

Here are some insights:

- Pricing “Right” is Paramount

- Maximized Current Revenue = Maximized Price (put your proforma away, for now)

- Choose Your Buyer Quickly, but Carefully

March – as well as Q1 – is almost in the rear-view mirror. Corporate/LLC tax filings are due today, and a real Spring in Seattle is still months away, so it’s time to dig deep into 2019 and ensure any plans you have for a sale are successful.

Pricing “Right” is Paramount

A key aspect of marketing a property for sale is choosing a price. Whether the offering is unpriced and broker guidance (or a whisper price) is offered or there is an actual list price, choosing the pricing to guide buyers has never been more crucial.

During the market ascension spanning 2013 – 2017, nearly every price advertised (or whispered) was hit, if not exceeded. Good times, no doubt.

Yet a change in market condition requires changes in strategy.

Empirically derived from our 2018 marketing activities, we had 11 transactions that were priced beyond the market, we had to “re-price” them, and all 11 are still not closed. For each of those sales, we have an example of another listing that was priced to the market and sold already – and not necessarily at any discount to market.

How do listing get priced incorrectly? Many ways.

Market conditions change, operations change, poor broker research/knowledge, owners push brokers to higher pricing based on opinions of value received from competing brokers.

Regardless of causation, pricing right is critical.

When opportunities are priced too high interest wanes, deals get re-traded, and ultimately (not always) the deal needs to get re-priced. Then the vultures come.

Often described as the colloquialism “no one wants to catch a falling knife”, re-pricing often sends the wrong signal to the buying community.

Pricing too high is not fatal to a sale, yet it can create unnecessary friction. We have several examples of listings caught in the middle of a market shift that required re-pricing and will still achieve an excellent result for our clients.

On balance, however, choosing the “right” pricing is of paramount importance. It starts with selecting a highly experienced and active broker. And most important, choosing to work with a broker you trust so you can collaborate and not compete with one another to price your sale correctly.

Maximized Current Revenue = Maximized Price

It seems completely logical that having the highest amount of revenue would lead to the highest sales price. However, that was not always the case.

Many value-add deals were sold on “future upside”. New, non-stabilized buildings were routinely sold on proforma/forecast rental rates and income.

Buyers today are buying based on in-place income. And their lenders are following suit.

Some caveats do apply. In markets where investors still forecast healthy rental-rate growth, buyers continue valuing buildings based on the ability to grow rental rates.

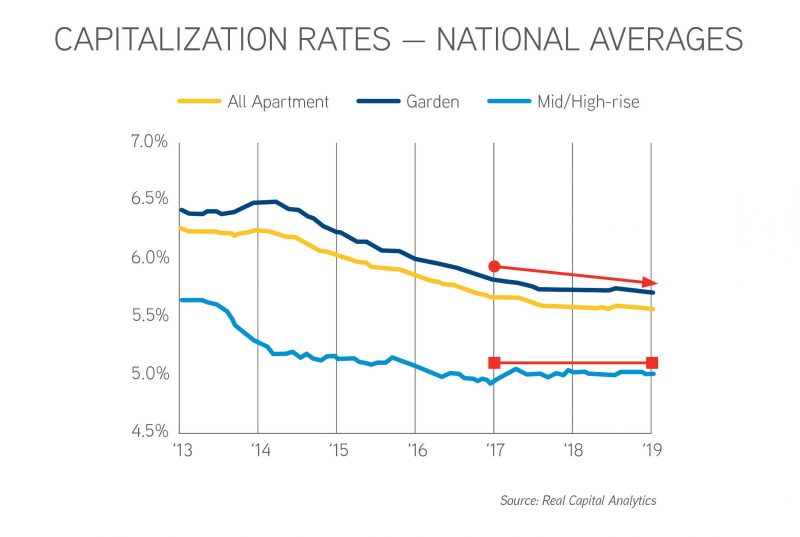

An analysis of trailing capitalization rates is a good measure. In core-located buildings – mostly defined as mid-/high-rise – rental rates are forecast to have plateaued. This is evidenced by compressed and “plateaued” capitalization rates. Whereas in garden-court buildings (often located in suburban markets), rent growth is still forecast – leading to continual compression of capitalization rates.

Want to know in which type of market your building is located? Review our 2019 Apartment Market Study: Sales Analysis.

If rental rates in your apartment building are already “at market” – and especially if your building is in a market with a healthy addition of new supply – expect that buyers will only pay for in-place income. Therefore, maximize it before coming to market!

This analysis leads back to pricing. If you price your property for rental-rate appreciation and the market does not, you risk running afoul of an effective pricing strategy.

Choose Your Buyer Quickly, but Carefully

It wasn’t too long ago that an apartment building hit the market and buyers lined up outside the door to buy it – and did so at highly, highly competitive pricing.

Buyers are still lining up to buy apartment buildings in Seattle/Puget Sound (we’re in a GREAT market), its just that their pricing – on average – is not quite as strong as it once was.

There was a time when a listing had 3 – 5 top buyers, each one as aggressive as the next. In the current market we are finding there are a few (sometimes only 1) “ideal” buyers for an asset.

What makes for today’s ideal buyer?

They are in a §1031 Tax Deferred Exchange. They are in love with the asset. They want to own in that market.

Reasons vary, but the importance of finding that buyer – and committing to them – is our key takeaway.

We’ve seen clients not choose the buyer that is 3% off from their target price, only to be left with a buyer pool down the road that is 5%, or even 10%, off their previous target.

Our advice is not to act capriciously. Don’t hastily choose a buyer, especially one that is unlikely to perform. But don’t try not to leave dollars on the table that were never there.

Again, working with an experienced, active broker is essential to understanding the market and the pool of buyers – what makes some buyers ideal and others risky.

We expect 2019 to produce some truly marquee sales and to provide many owners with a very strong pool of buyers that remain excited to invest in our market.

The rules of apartment sales have not changed – though they have adjusted slightly, and its important for owners to remain cognizant of such changes.

Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation of your apartment building and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!