Now is the time to take note of where novel bakeries are popping up. And where the New York Times is recommending we eat. And where Millennials are flocking to buy homes.

I promise, I haven’t lost my mind. Nor have I run out of interesting apartment-investment related content.

This is how real estate soothsayers spot new, profitable investment markets.

Mentions of Millennials and foodie destinations might elicit images of Ballard, but I’m actually referencing a neighborhood that’s not so obvious: Burien!

The masses won’t lead you to such markets, so I’ve put together a roadmap to help you find the returns you desire as we enter a new market cycle:

- Apply the urban apartment investment recipe

- Analyze how other underestimated markets matured

- Adopt an evolved mindset to plan for new market opportunities

Recipe for Success

Early in the current real estate cycle, the recipe for analyzing apartment markets comprised walk and transit scores, the impact of hip retail, and the need for nearby parks to walk designer Labradoodles. Following these trends, apartment investors and developers doubled down on obvious neighborhoods that checked these boxes in and around Downtown Seattle: Capitol Hill, Fremont, Greenwood, Ballard, and West Seattle.

As the cycle matured, investors turned their attention to decidedly luxury suburban markets (e.g., Bellevue, Redmond), which, while new to urbanization, were well established with little room left for accelerated growth. This left other investment-grade markets untouched due to lack of proximity to Downtown Seattle and/or grittiness most investors were unwilling to stomach.

As markets evolve and cycles iterate, so too does the “urban apartment investment” recipe. Yet, no matter the ingredients, applying such an analysis to markets beyond the most obvious will allow investors to identify opportunities for massive appreciation – it just takes work, foresight, and trust in an investment thesis poised for long-term success.

Mitigate the Risk, Not the Reward

Does buying 4% cap rate apartment deals have you feeling blue? “Obvious” investment markets are no more profitable than low-yielding, blue-chip stocks; yet, seeking outsized returns introduces the risk of being wrong. So how do you spot the right “less obvious” investments…and spot them early enough for market-leading returns?

One such methodology is looking to other, more mature markets to analyze the when, how, and where of their growth. Many such examples in other major US cities seem obvious now, but they weren’t always:

Each of these less-obvious submarkets showed promise when analyzed and compared to their well-known counterparts, but ultimately required investors to make a leap across barriers – both mental and physical – to transition from obvious to newly-formed investment-grade markets.

This rings true for Seattle, as well.

Case Study: Burien vs. Ballard

Ballard’s ascension this market cycle is nearly unparalleled. Coming out of the great recession, Ballard’s apartment stock measured less than 1,000 units. Over the last decade, the market grew nearly 300% – now boasting 4,000 apartment units. All the while rent levels rose and vacancy remained tight.

How is Ballard’s past a prologue for Burien?

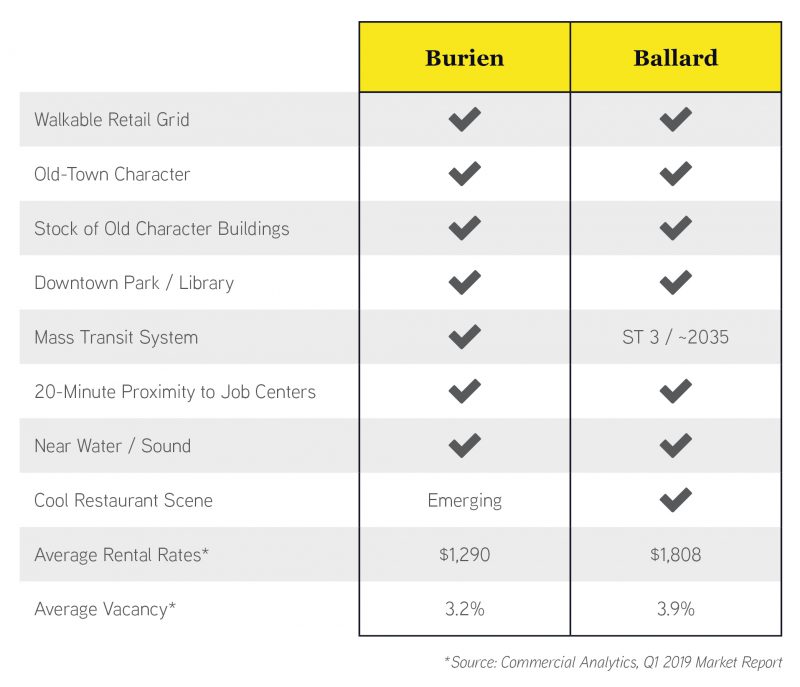

It’s more than just alliteration. Burien possesses most all the constituent elements that make Ballard such a wonderful apartment market – and, in some cases, more.

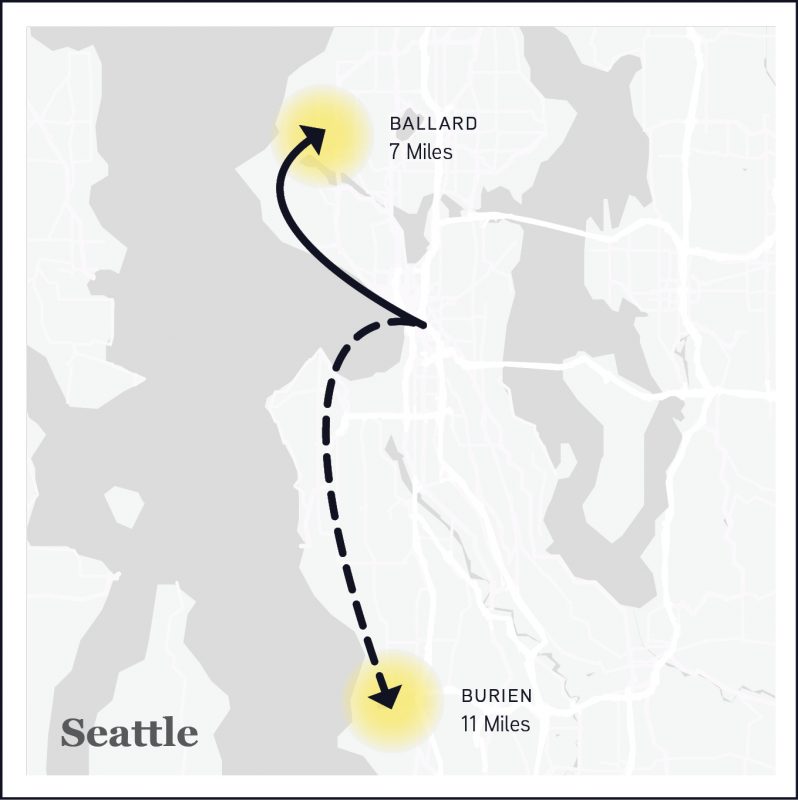

Critics will undoubtedly focus on Burien’s distance from Downtown Seattle. Ballard is a 6.7-mile commute, while Burien is nearly double that distance (11 miles). Yet on most days it’s faster to commute from Burien than through the congested streets leading to Ballard.

Burien’s mass transit bus system is already in place, and commuters have a private freeway dropping them off in Downtown Seattle – future proofing a mass-transit commute that Ballard won’t match any sooner than 2035.

Naysayers may also claim that Burien has a less-than-stellar crime rate, but the statistics are no more comforting in the lauded Capitol Hill neighborhood, with nearly 400 crimes in 2019 thus far. Urban is urban: take the grit with the great!

This analysis is not meant to take anything away from Ballard, only to highlight that its fundamental attributes can be applied to not-yet-proven markets like Burien.

How to Seize Opportunity

Burien has tremendous upside potential; however, seizing this opportunity goes beyond comparing it to Ballard – it requires a change in thinking. As we plan for the emergence of an entirely new market cycle with new market opportunities like Burien, we must consider the following:

- Bias is expensive – consider the opportunity costs of historical perception over reality

- Spend time in new markets – not via Google Earth…go sit down and observe in person

- Don’t follow other investors – follow users (aka shoppers and renters)

- Growth is not radial from the city center – Columbia City leapfrogged many other “closer-in” markets

- Place bets based on market fundamentals – certain trends are here to stay

The Puget Sound region is poised for continued growth, and this growth will require expansion into new markets and neighborhoods that have similar attributes to those already fully priced. Spotting trends that lead apartment investors into less obvious markets will prove immensely profitable.

Wondering what areas beyond Burien are sure to offer outsized returns to those bold enough to look outside the current market? Stay tuned for our next discussion to find out which five markets we love for 2025.

Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Call us for a valuation of your apartment building and to discuss how we can work together.

Allow us to Turn Our Expertise into Your Profit!