Investing is truly about predicting the future better than anyone else. And predictions are difficult. They are so difficult that they are wrong more often than they are right. So, when it comes to predicting the future – at least in the near term – taking a good hard look at data is often the best start.

The following data points offer a good start into understanding near-term economic fundamentals.

Likelihood of a Recession

Heading into November, we just crested the 100th month of the current expansion cycle. For some historical context, the longest recorded market “up-turns” are 106 months and 120 months, respectively. That means by Q2 of 2018 we will be amidst the 2nd longest expansion cycle in the economically-measured history of the United States.

That may lead some to conclude that the good times are almost over. Yet, I disagree.

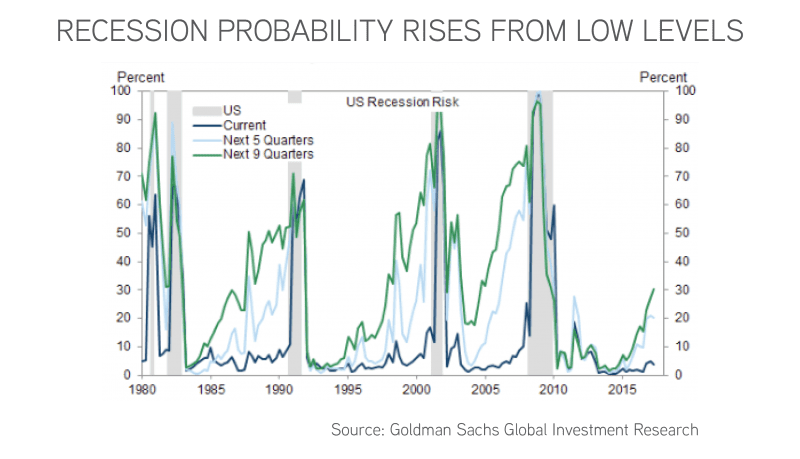

Recessions find their basis in more than just measurements of time. Lots of data is compiled to understand how economies work. The following graph is a summary of the last 5 recessions in the United States, spanning close to 40 years.

Based on historical triggers of recessions in the United States, the data suggests that we are currently in an environment with a low probability of a recession occurring – a 30% chance in the next two years and 20% chance in the next year.

An even better measure – jobs.

Job Growth Seldom Leads to Recessions

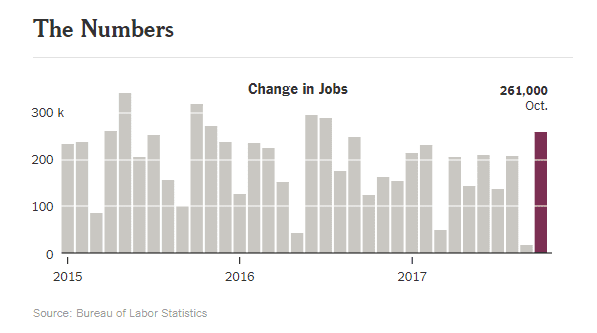

October job creation data was announced today, and the numbers are strong – 261,000 last month strong. Adding 200,000 to 300,000 jobs in a month is great. Yet is it sustainable?

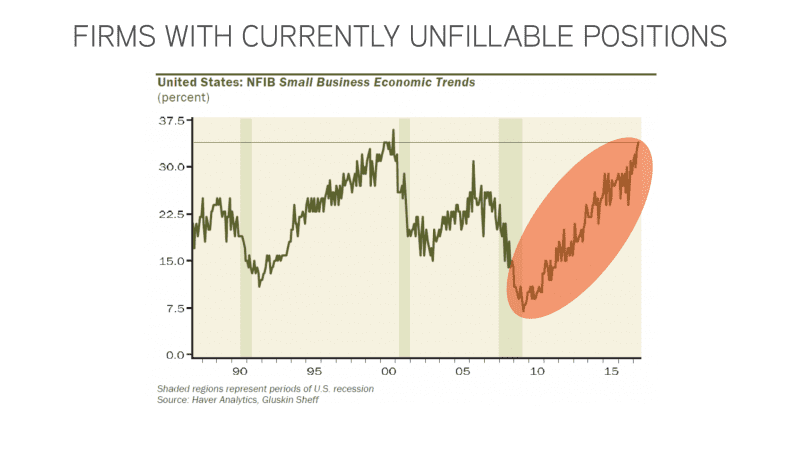

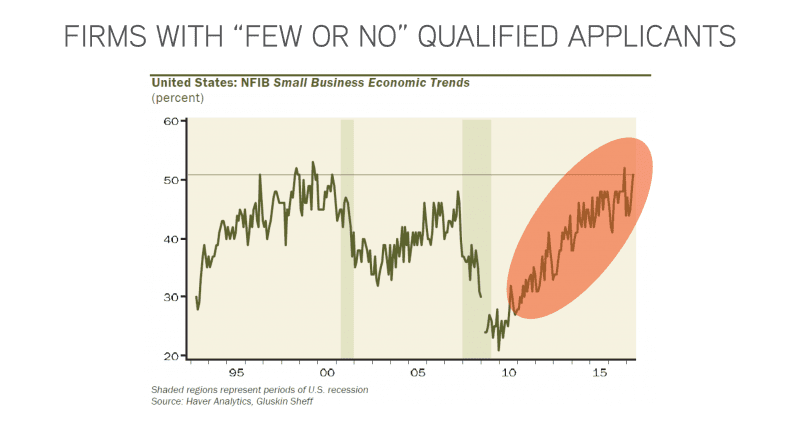

If there is any leading-edge predictor of job growth, it’s demand for new employees – and those numbers are currently astronomical.

As we enter the last two months of 2017 and make plans for 2018, a large part of our planning is making a prediction of what will happen in the economy over the next year or two. A great place to start is the data. After reviewing the data – it’s time for analysis.

Give us a call to discuss your plans in 2018. Whether you are considering selling your apartment building, buying more apartment buildings – or simply trying to optimize the portfolio of apartments you currently own – we can help.

Allow us to Turn Our Expertise into Your Profit!