Seattle remains basking in the glow of its recent announcement as ULI’s #1 Investment Market for 2018. Given the breadth and depth of ULI’s analysis, this is quite an accolade. Of course, rankings are relative, so an understanding of the greater context of both the broad US economy and competitive cohort of comparable investment markets better frames Seattle’s top seed.

In the following analysis we take a look at:

- Workers – Where do unemployment numbers sit nationally

- Wages – Who’s wages are rising the fastest

- Rental Rates– Who’s on top and how do the Top 10 markets look year-over-year

Workers

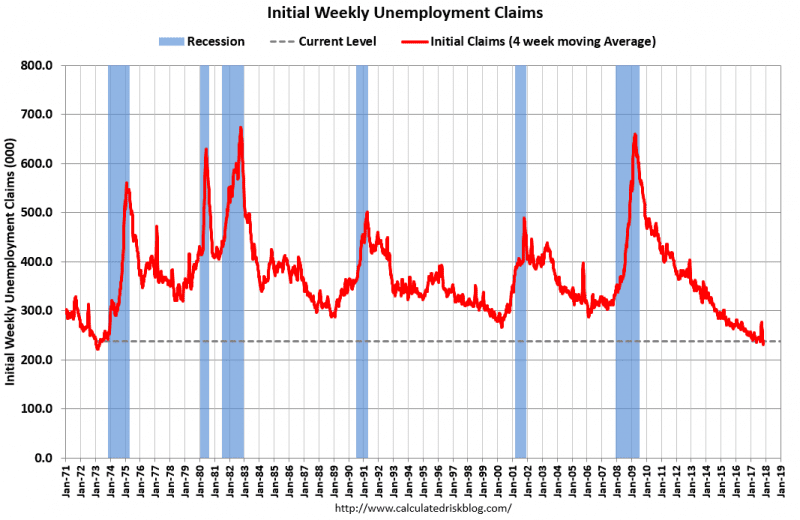

The national recovery since the Great Recession was both slow and uneven. While Seattle recovered all jobs lost in the Great Recession by mid-2012, it wasn’t until 2015 that the national unemployment rate fell to a more historic mean. As we take a broad look at national unemployment, it is clear, that as a nation we are at full employment – reaching the lowest level of unemployment claims in the last 45 years.

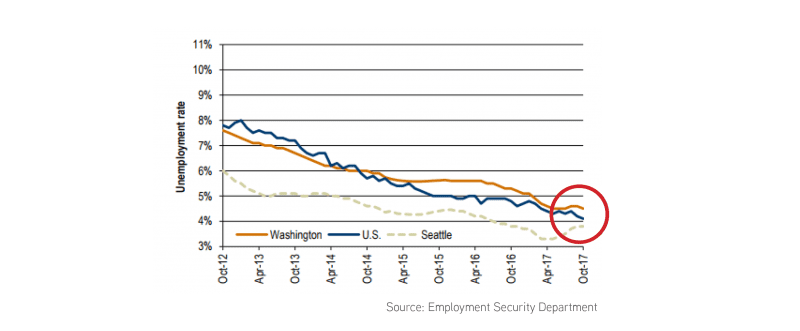

It is clear that Seattle has one of the lowest unemployment rates in the nation. The national average fell below that of Washington State in 2014 and has trended closer to Seattle ever since. Yet, Seattle’s unemployment remains at historic lows, trending up a bit from the low 3% range in Spring 2017.

If we are at full employment, why might it not feel so? The answer – wages. Or better said, lack of their growth. As I’ve written before, the nation’s recovery from the Great Recession is a case of “The Haves – and the Have Nots”. Those markets with true wage growth have truly outperformed in the category of “opportunity”.

Wages

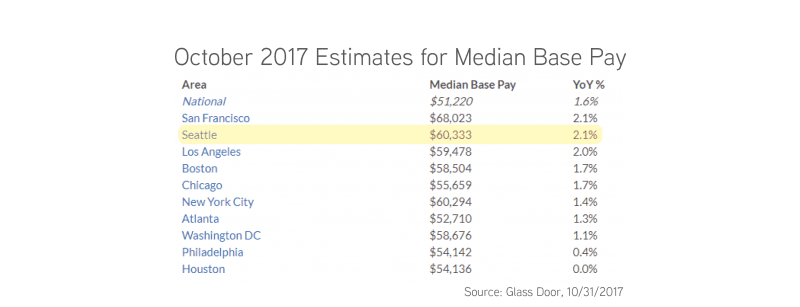

Seattle has truly defined itself as a Tier 1 city in the nation during this current economic expansion. In the past, Tier 1 markets such as New York and Los Angeles received much more investment attention. Yet, with wage growth outpacing the nation on an order of magnitude of +30%, there is no dispute that Seattle squarely fits in the nation’s top tier.

Looking at the job sectors with the fastest growth in wages demonstrates a change in trend from the beginning of the current economic cycle when the fastest wage growth was in top-paying jobs.

Interestingly, of the top 10 jobs with the greatest growth in wages, 9 of 10 make under $50,000/year. At HUD guidelines of housing costs, these renters “should” only allocate less than $1,250/month to rent. With average rental rates in Seattle creeping past $2,000/month, it’s not surprise Seattle is in an affordability crisis.

Rental Rates

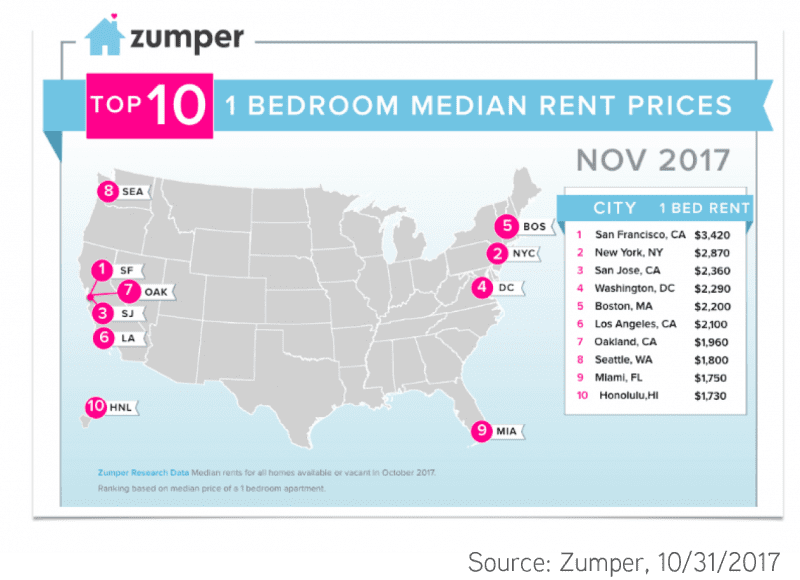

All of the above metrics provide a backdrop for increases in demand for housings (employment) – and on the other side of the coin, ability to pay higher rental rates (wages). When it comes to rental rates, Seattle once again finds itself in a cohort of globally recognized cities.

Seattle remains in a Top 10 nationally (#8 is not bad), yet rental rates in San Francisco for a 1-Bedroom unit are still nearly double that of Seattle!

Year-over-Year Rental Rate Changes

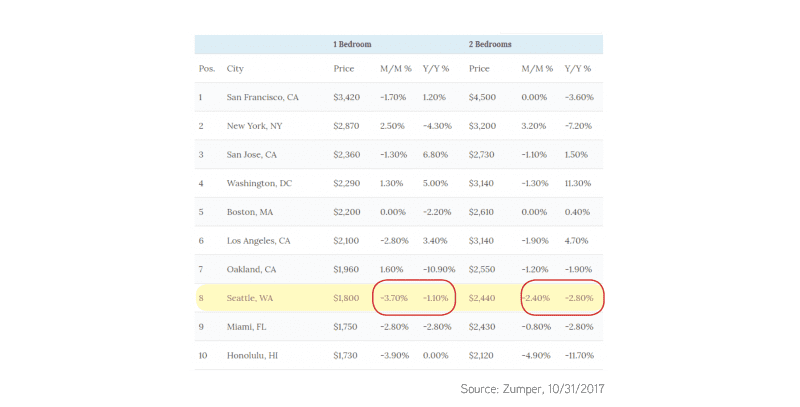

Finally, taking stock of rental rates on both a month-over-month and more telling, year-over-year basis provides additional insight into the strength of the market. We are seeing many top markets slide in rental rate growth.

In Seattle seasonality is very apparent once we hit October/November, yet year-over-year metrics demonstrate that the most expensive units (2-bedrooms) are having trouble maintaining high growth rates.

The Year Ahead

As we make plans for 2018 we find a sense of excitement about our office. The good times continue to roll in Seattle and we all very much believe that the strong economic fundamental tide rising in Seattle since 2011/12 will continue to rise.

Yet, our tide is a bit choppy – so not all boats will continue to lift equally. The days of easy returns are past. Navigating the seas ahead requires more thought, greater analysis – and frankly being right more than wrong (looking back, it was hard to be wrong in just about any investment the past several years). Give us a call to value your apartment building or discuss your overall plans in 2018.

Allow us to Turn Our Expertise into Your Profit!