Way, way back in December 2014, I wrote the blog post 2015 Planning: Key Concepts for Apartment Investments in 2015, discussing market conditions and predictions for the future. Well, the future is now – how did we do?

Back in that post we covered four key concepts:

- Where we were in the real estate cycle

- Low interest rates are an immediate phenomenon

- Suburban apartment fundamentals are fantastic

- Apartment development is at an all-time high

Now here we are again planning for today’s future. What can we expect?

Where We Are in the Real Estate Cycle

Analysis of just about every aspect of our industry is referential. For rental rates, we reference rent comparables. For sales, we reference sales comparables. And for market cycles, we reference previous cycles.

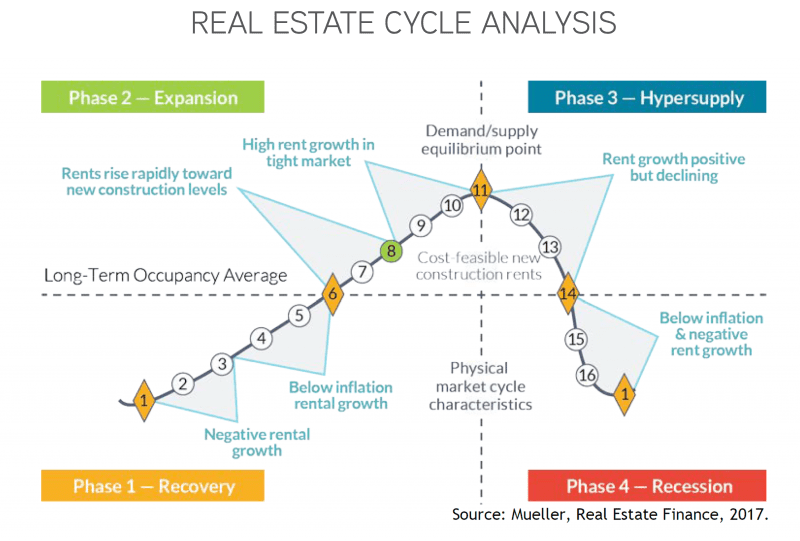

Given the duration of the current market cycle, that metric is nearly out the window; however, it is often useful to measure our progression through a real estate cycle. A well-known analysis for real estate cyclical analysis is that of Dr. Glenn Mueller of the University of Denver’s Daniels College of Businesses.

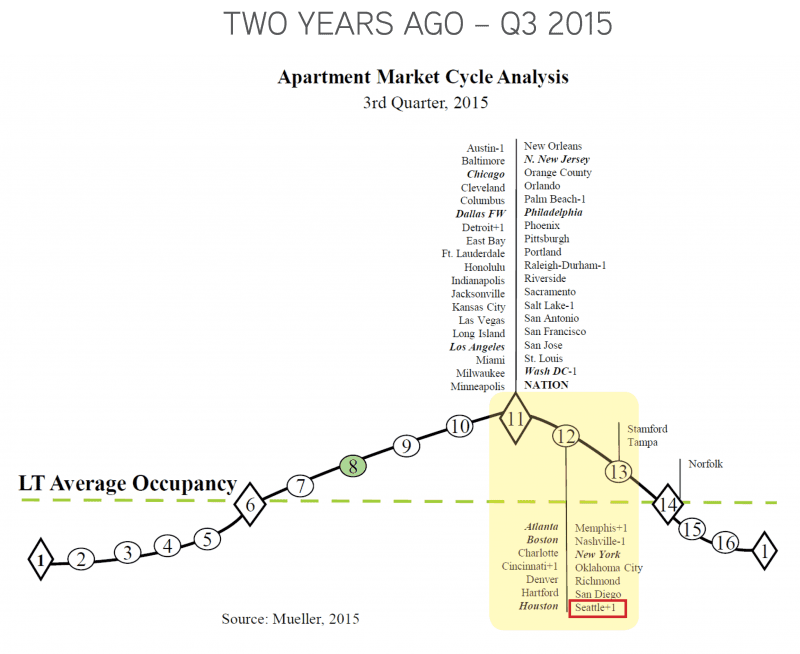

There is no question that since 2011 most major markets fall on the right side of the demand / supply Equilibrium divide. Yet, the question remains when the scales will tip into oversupply or, as Dr. Mueller coins, “Hypersupply.” As of two years ago, the Seattle market crested the point of equilibrium.

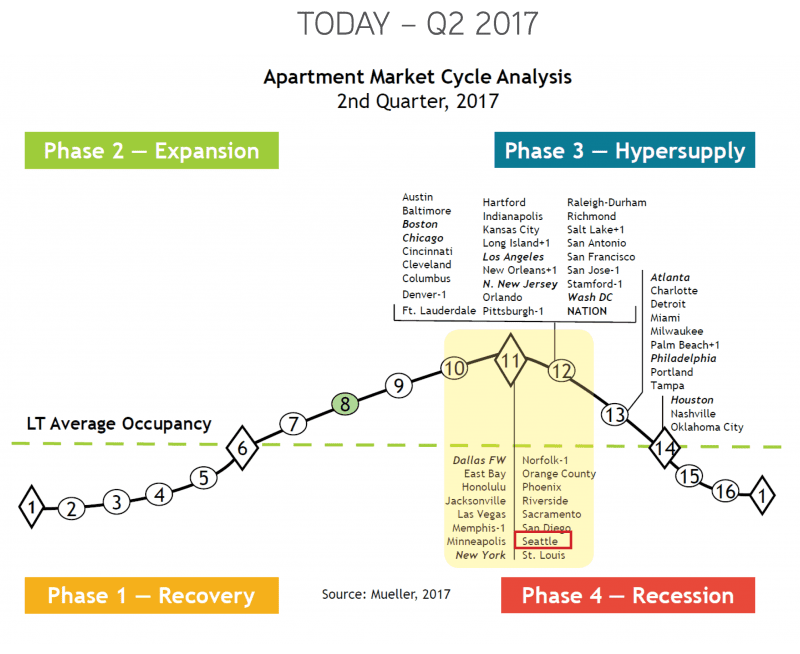

Taking stock of the last two years, one might believe that the market in Seattle would progress further into Hypersupply, based both on market dynamics and the fact that cycles generally progress forward. A quick look at Dr. Mueller’s analysis for 2017 proves otherwise.

According to the above analysis, the Seattle market actually “improved” in the last two years in so much as it moved closer towards equilibrium rather than away from equilibrium into Hypersupply.

Of course, there are myriad metrics one could use to analyze the state of a market – rental rate growth, vacancy rates and absorption of development. I believe the Urban Land Institute (ULI) said it best in its 2018 Emerging Trends report: “We no longer think of markets in terms of absolutes, but rather how different themes interact within the market.”

ULI is saying what we have always said: real estate analysis requires a granular study, and generalizations are simply that – generalizations. According to Dr. Mueller’s graph, Seattle is in fantastic shape. We believe the same is true – yet to understand any particular investment or micro market, granular analysis is necessary.

Low Interest Rates are an Immediate Phenomenon

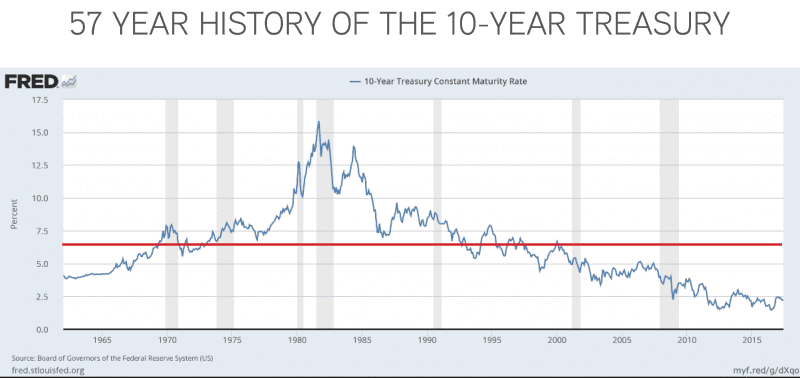

Collectively, if we had all guessed the direction of interest rates over the last three years (2014 – 2017), I think that we can all agree that we would have been wrong. We all thought rates would trend upwards more than marginally.

On December 14, yesterday as of this posting, the Federal Reserve increased the benchmark federal-funds rate by 0.25% – equating to a range of 1.25% to 1.5%. This is the 5th rate increase in the last two years, yet the 10 Year Treasury remains sub-2.5% and well below a +50-year average of 6%.

Yellen’s time in office is coming to a close, and nearly everyone had bet on “good times to come,” meaning inflation and higher interest rates. Good times have come in selective markets (ahem, Seattle), yet across the nation, growth is tepid.

Three years ago we expected slow growth in interest rates, and that is exactly what happened. Collectively, most believe we are in for more of the same: a slightly upward trend in rates. I expect that we are right again – at least for the foreseeable future.

Suburban Apartment Fundamentals are Fantastic

Earlier this year, we wrote Where to Invest Outside the Core based on our faith in urban-suburban markets, outside of core markets. This is a trend we’ve followed since late 2014, and still believe in today.

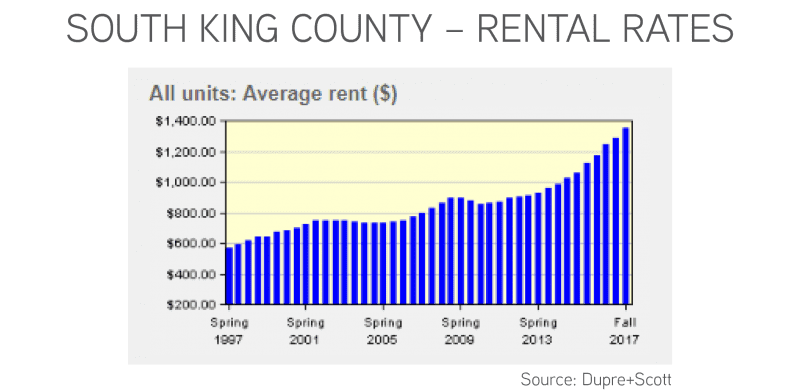

As a proxy for suburban market fundamentals, a quick look at South King County markets (Des Moines, Renton, Kent and Federal Way), in the last three years shows that average rental rates increased cumulatively nearly 32% – equating to an average rental rate growth of 10.6%. That is impressive growth!

For the sake of comparison, measuring this same period in urban markets showed a cumulative rental rate growth of 21.4% – equating to annual growth at a pace of 7.1%. Both markets exhibited impressive growth, yet the suburbs continue to prove their strength.

Current market dynamics point to continued strength in our region’s suburban markets. What was true three years ago remarkably remains true today.

Apartment Development is at an All-Time High

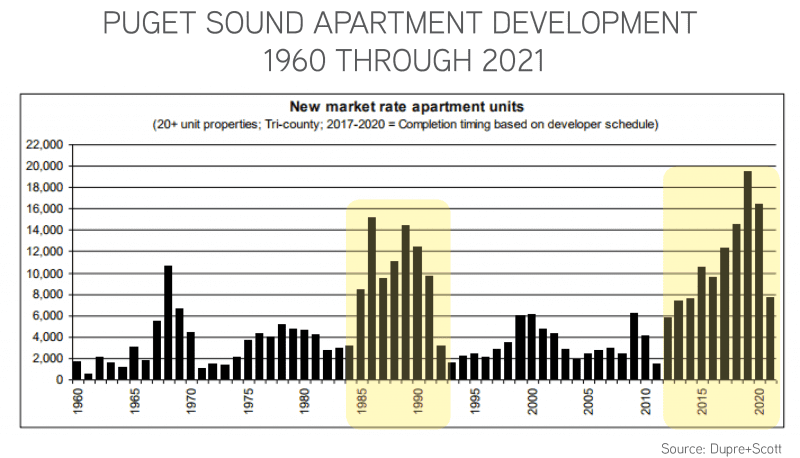

Back in 2014, we watched developers plan for new apartment developments almost as fast as they were opening new apartment buildings. Many were certain that in 2015 we’d see a peak that would then crest. Not so!

The current development boom sees nearly no abatement in sight. Yet, comparing today to previous cycles puts this cycle in a bit of perspective: large development cycles are not unusual.

While we were confident in late-2014 that the market was healthy, and supply and demand were in balance, there were concerns that we would maintain such equilibrium. As noted above, sustained year-over-year +7% rental rate growth in urban markets amidst a building boom certainly validates market vibrancy.

As we look ahead to the delivery of 14,000 units year-over-year, it is important to once again visit the concept of granular market analysis and themes in a market. Not all submarkets will maintain such healthy forward momentum as we progress through 2020 and beyond, although some will.

Development will moderate based on headwinds of construction costs, construction lending, availability of reasonably priced land and regulatory hurdles. Such moderation will prove healthy. Yet, tens of thousands of units will deliver in the next 3 years.

It has never been more important to “be right” about your investments!

Planning for 2018

As we enter the final weeks of 2017 and make plans for 2018, a large part of our planning is making a prediction of what will happen in the economy over the next year or two. Now is a crucially important time to make plans for the future.

Give us a call to discuss your plans in 2018. Whether you are considering selling your apartment building, buying more apartment buildings, or simply trying to optimize the portfolio of apartments you currently own, we can help.

Allow us to Turn Our Expertise into Your Profit!