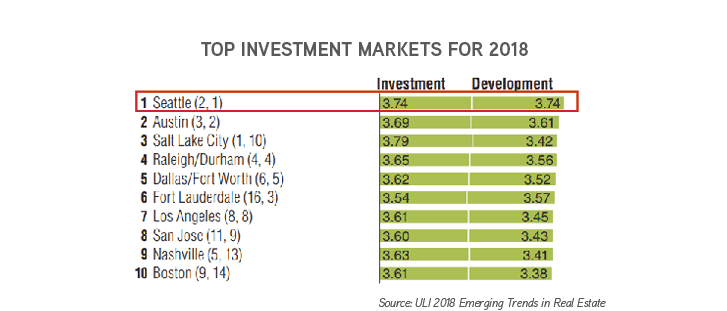

The world of commercial real estate is incredibly self-referencing. So, when 1,600 real estate professionals come together and decide upon the best investment market in the nation, that is meaningful. And this week it was announced in ULI’s 2018 Emerging Trends in Real Estate that Seattle is the #1 investment market in the nation for 2018!

Seattle’s diverse mix of industries, highly skilled workforce, incredible lifestyle – among myriad other factors – led to a well-deserved win across the board. ULI’s report provides an expansive look at markets across the nation, as well as a granular analysis of 78 key markets.

The Urban Land Institute (ULI) conducts a comprehensive survey each year to collect the cumulative knowledge of thousands of real estate professions across industry segments and geographies. Dubbed Emerging Trends in Real Estate, it offers a cornucopia of information and analysis on the commercial real estate market.

You can download the full 107-page report here: 2018 EMERGING TRENDS IN REAL ESTATE

The copious number of awards Seattle continues to chalk-up in 2017 is thoroughly impressive. Yet, a nod for the #1 spot in ULI’s 2018 Emerging Trends in Real Estate is both a tremendous win, as well as support for all that we love about the Seattle commercial real estate market.

It is certainly interesting to note that only two “major markets” crested the Top 10 – Los Angles (#7) and Boston (#10). Industry professionals have a decided preference for demand-drive (versus supply constrained) primary markets and as of late, secondary markets. Seattle bridges this gap and beat out competition – both big and small!

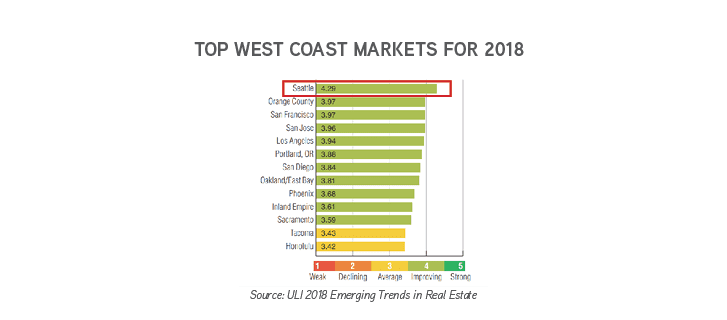

Adjusting focus to just West Coast markets, Seattle simply crushes the competition – earning top honors, but also doing so by nearly a 10% margin over all other markets. Considering the focus we continually hear on San Francisco/Silicon Valley, Portland and Los Angeles, Seattle’s dominance stands as even more exceptional.

Why Seattle?

Here is a summary (directly from ULI’s 2018 Emerging Trends Report) of why Seattle is so favored for investment in 2018 and beyond:

Local property/Market outlook

- Positive outlook for all property sectors in Seattle, with the strongest outlook for investment and development in Industrial and single-family housing

- Local economic outlook, strong investor demand and an abundance of capital available for real estate investment and development

Demographics and livability

- Population growth in Seattle is twice the national rate and the market is expected to gain nearly 29,000 new residents a year over the next five years, with the population aged 15 – 34 rising by a total of 17.3% during that same period

- Seattle has a young, educated population (17% with graduate or professional degrees and 37% with associates or bachelor’s degrees)

- Top ranking for outdoor activities, with 93% of residents with walkable access to a city park

- Seattle is rated as a top 5 culinary market

- Top rated microbrew market with 1 brewery per 19,000 residents

Cost

- High productivity market with cost of doing business of 103%

- 5-year disposable income growth is projected to be good

- Home prices are at 123% of previous peak

- Affordability index at 106.2, rent as a % of household income 20.8%

Technology readiness

- Twice the U.S. percentage (12%) of employees in STEM occupations, with 4.5% of the workforce employed in computer programming related occupations

- 6.63 patents awarded per 1,000 residents

Connectivity

- 94% of households have a computer and 88% have access to high speed internet

- Top destination for international visitors

- 4.5% of total employment in Foreign Owned Entities

Ease of doing business

- 10.2% of firms have been in business less than 3 years and employ 2.6% of total employment

Source: ULI 2018 Emerging Trends: https://www.pwc.com/us/en/asset-management/real-estate/emerging-trends-in-real-estate.html

Where to Invest

Such a terrific outlook for Seattle in 2018 is welcome news. Yet, what is the savvy investor to do in consideration of this information? We’ve always leaned towards analysis that is more granular than broad. A dissection of asset class within the apartment sphere is warranted.

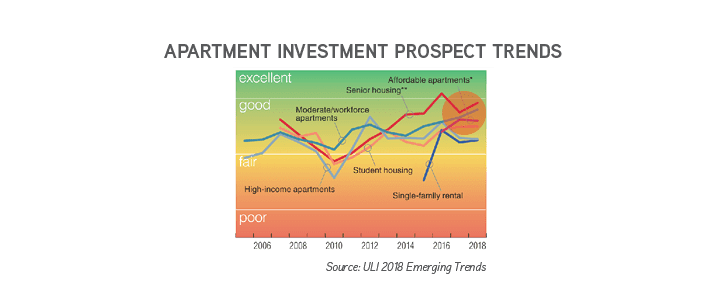

This heat-map graph gives guidance as to perception of outlook by type of apartment use.

It’s interesting to note that the segments of multifamily housing with the most favorable outlook are as follows:

- Senior Housing

- Moderate [cost] / Workforce Apartments

- Affordable Apartments

For our avid readers, this bodes well for Efficiency Housing in Seattle! Take a look at our 2017 Efficiency Unit Report.

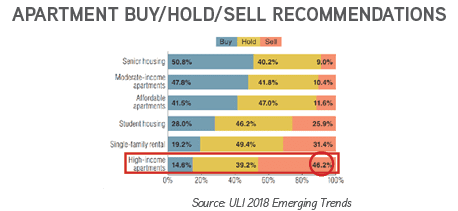

For those transaction-oriented, respondents to ULI’s report showed a demonstrable “sell” preference for high-income apartments.

A single blog post can’t do justice to a comprehensive 107-page report, yet we are able to elucidate headline trends and give direction for deeper analysis. We study the Seattle / Puget Sound market extensively and specialize in providing clients the best possible advisory and transactional services.

Give us a call to Turn Our Expertise into Your Profit!