Hello, and welcome to our team’s inaugural post about the 5-50 unit market in Urban King County. Although it is important to understand the big picture and market fundamentals, we are focused on digging into the issues that really matter to private owners of smaller units as well. I will discuss everything from rent and vacancy trends to how to keep great tenants happy.

I decided the best way to kick off this topic is with the release of our latest 5-50 unit market study, which can be downloaded here. After careful analysis of every major market in Seattle – from West Seattle to Wallingford – here are the 3 biggest trends I see developing in the 5-50 unit multifamily market in 2017:

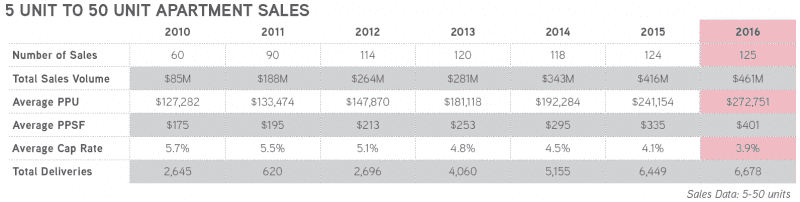

- Newer 5-50 unit apartment sales in 2016 drove the average price per square foot to $401, a 20% growth over 2015 averages.

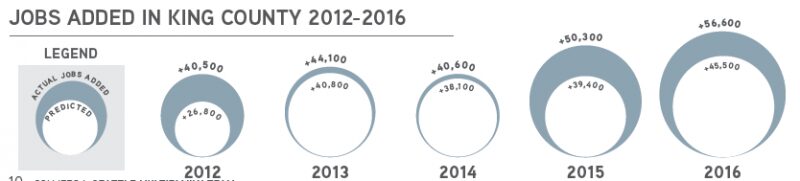

- Jobs have outpaced predictions for the last 5 years, and we have added a whopping 26% more jobs than expected in the last two years.

- Don’t listen to the news, the rents on your 5-50 unit buildings are still rising!

1. Newer, midsize buildings driving sales growth

In 2016, sales prices for 5-50 unit buildings increased 20 percent, despite cap rates only compressing 0.2%. This jump in average price per square foot – from $335 to $401 – was driven by the sales of newer, midsize buildings.

In the past 20 years, most developers weren’t building boutique apartment buildings. You’ll find few 20-50 unit buildings in the market from the past two decades.

The midsize (20-50 unit) buildings that have been built, however, are selling for astounding prices. 80 Main (45 units) in Pioneer Square sold for $691/SF and $446,000/unit. Yardhouse (35 units) on Capitol Hill sold for $766/unit and $398,500/unit.

2016 taught us that owners can get institutional pricing – $400K+/unit and $600+/SF – for buildings smaller than 50 units.

2. Jobs are Outpacing All Predictions

It makes sense that economic forecasters are cautious, but Seattle’s job growth has outstripped local predictions for the past five years. Seattle was expected to gain 45,500 jobs in 2016, and instead we added 56,600.

The Puget Sound Economic Forecaster predicts Seattle will add only 26,300 jobs in 2017, less than half the jobs added in 2016. My prediction? We’ll pass their prediction with flying colors.

After speaking with active recruiters at Facebook, Zillow and Amazon, one thing is very clear. These huge tech employers and their competitors intend to grow faster than they did last year. The question is not if they are hiring, it is will they be able to find enough qualified people to hire?

The silver lining here is that it is a solvable problem. High school programs across King County have been implementing new STEM and tech programs, and UW’s Computer Science program has been growing exponentially over the past several years.

3. Rent is Still Rising

Recent articles have cooed that rental rates are hitting a plateau, and that’s probably true for the high-end competitive set that offers $1,945/month. But if you own a building between 5-50 units, don’t expect to see rents taper; you’re going to be fine. Average rents in 5-50 unit buildings surged last year to $1,408, which is still a 38% discount to your larger competitors.

Even when newer buildings offer concessions – nice amenities, six free weeks, etc., – the average cost is still out of reach for the average renter. This rent discrepancy keeps demand high for older, smaller buildings.

The tailwinds for boutique apartments are still strong as the much higher priced new supply competes for breath at the top!

We look forward to an excellent 2017 with you, please reach out to us with any questions you may have!