An article was recently posted to NREI Online describing the new phenomenon of surban markets, which is their fancy term for suburban markets that are proximate to urban markets. The article argues that Millennials are pushing into these outer-ring suburbs seeking more affordable rent, yet they still want an urban lifestyle.

While I think they should have left the term surban on the cutting room floor, the phenomenon is real, and it’s not limited to 20-somethings.

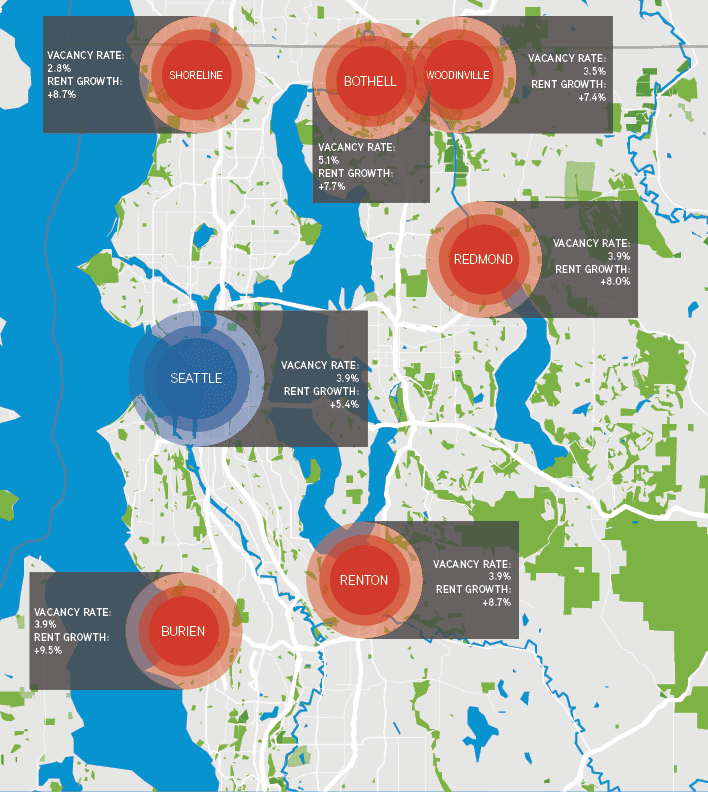

According to our 2017 Seattle Apartment Market Study, apartment dynamics (e.g., rent growth, stable vacancy and high sales prices) in urban-suburban markets surrounding Seattle reported record numbers in 2016, and they’re poised to grow even more.

Seattleites Want Urban Lifestyles, Without the Price Tag

High rents in Seattle’s urban core are pushing residents into nearby submarkets where they can still find urban amenities without paying $2,000+ for a one bedroom apartment.

Yet Seattleites still want to live near lifestyle centers that offer more than a grocery store or a Target. They want to walk their dogs in a local park, try new restaurants, grab a latte, or catch a movie – all within 10 minutes of their front door.

The urbanized development of Seattle’s outer ring is creating a hub and spoke model in the Puget Sound region – much like that of other dense, urban submarkets of San Francisco and Boston. Residents can live in Woodinville or Burien and still feel connected to Seattle’s urban core. The mass transit between these nodes is coming (slowly), but renters are leading the way.

Rent growth in Seattle’s suburban markets outpaced growth in the urban core over the last three years, yet despite sustained rent growth in these markets, vacancy rates remain low. Rent increased an impressive 10.6% year-over-year in the South King region, yet vacancy rates dropped in Renton, Auburn, and Kent.

Cities Developing Urban Centers of their Own

One look at retail development in these cities confirms the theory. Renton recently updated their downtown revitalization strategy, with key updates including the expansion of Piazza Park and further review of the streetscape design standards. Trendy new restaurants and breweries are opening in Renton’s downtown, catering to urban-oriented residents.

Woodinville has suddenly become the spot du jour for whisky tastings, microbreweries, and artisanal gastropubs. It’s no coincidence that vacancy rates dropped by 1.14%, and rental rate growth in the area topped 8.0%!

Renters Will Go Far… but Not That Far

Renters crave more affordable options, but rent and vacancy metrics show that they’re only willing to travel so far. The North Snohomish region has the lowest five-year rental rate growth (36.9%), and the vacancy rate stands at 4.22%, versus 3.82% in North King County or even 3.76% in South Snohomish.

The desire for proximity leads to markets like Shoreline, Mountlake Terrace, and Tukwila having some of the lowest vacancy rates in the region while still seeing rental rate appreciation.

Where Rent Growth Leads, Construction Follows

If rent per square foot remains relatively low, investors are more likely to buy existing apartments in these high-demand areas rather than build new developments.

The South King and East King markets illustrate both sides of this spectrum: development is sluggish in South King for the next five years, where average rent is $1,233 per unit. In the East King region – which has been an established suburb for longer, and where rent exceeds $1,700 per unit – there are more than 9,900 units set to deliver in the same time frame.

As rent increases in the outer-ring suburbs, watch the cranes follow – I predict we’ll see much more development planned in urban-esque regions of South King and North King regions as we enter the next market cycle and distinct neighborhoods will emerge where Seattleites can get their urban fix.

But why is this important to understand?

He Who is Right Earliest Makes the Most Money

Predicting movements in markets is the only surefire way to outperform – making investors the most return. Yet, making predictions is tough; however, not impossible.

In our February 2016 post, Where are Rents About the Rise the Most in the Seattle Region, we predicted “[r]ental-rate growth in secondary and tertiary markets adjacent to markets that previously had high rates of growth are poised for out-performance.”

Way back in February 2015, we posted a piece on How Urban-Suburban Apartment Investment Changes the Game. Over two years ago we noticed the formation of new, investment-grade suburban markets with urban characteristics.

Our conclusion?

“Investment in “urban-suburban” styled apartments offer an elegant and hedge-able investment strategy – and possibly one with the most long-term risk-adjusted returns.”

You don’t have to be right about much. Just be right about the future.

When markets feel fully priced , real estate market cycles mature, and markets become more efficient, margins thin out. And thereby, erosion in a proforma return has exponential impact on total returns.

Understanding market characteristics and movements as early as possible is critically important. Study the data and work with the most capable professionals! And give us a call!