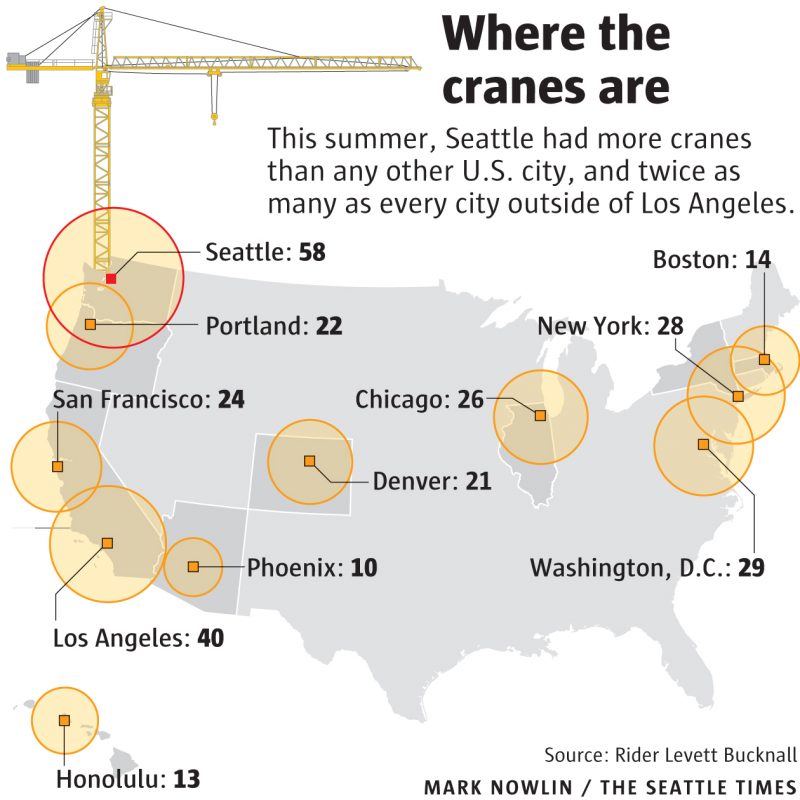

Real estate aficionados and laypeople alike love to discuss how many cranes dot our skyline. Way back in 2016 – like 4 months ago – we topped the nation at 58 cranes. Well, we still top the nation, now at a mind-numbing 62 cranes! These cranes are located all over the region, from Lynnwood to Kent, and well beyond.

What does crane spotting and “crane density” tell us about apartment inventory growth? Quite a lot!

Follow the Cranes

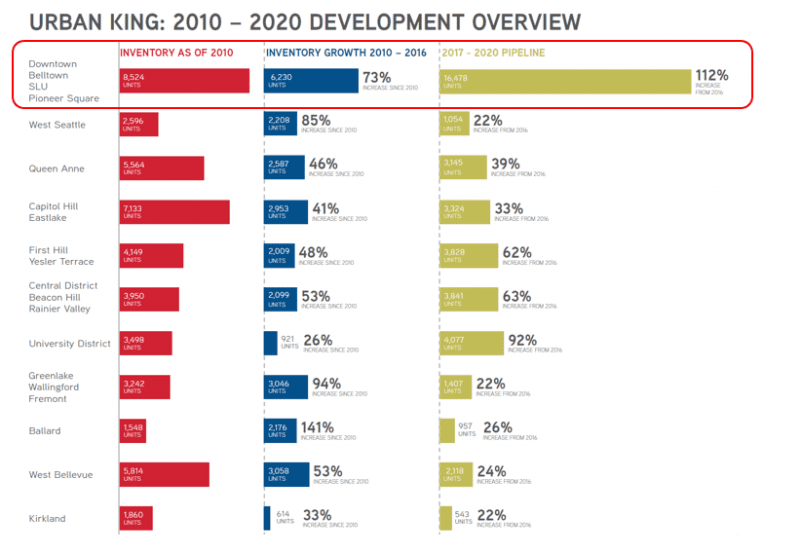

The density of new development is one of the most remarkable features of the current development cycle in Seattle’s urban areas. The inventory of apartments in Ballard will likely double from 2010 to 2020. First Hill may see 1.5x inventory growth in that same period.

Yet Seattle’s downtown submarkets – Downtown, Belltown and South Lake Union – will experience the greatest amount of future inventory growth. In fact, the development is occurring at such a pace that new micro-markets are forming!

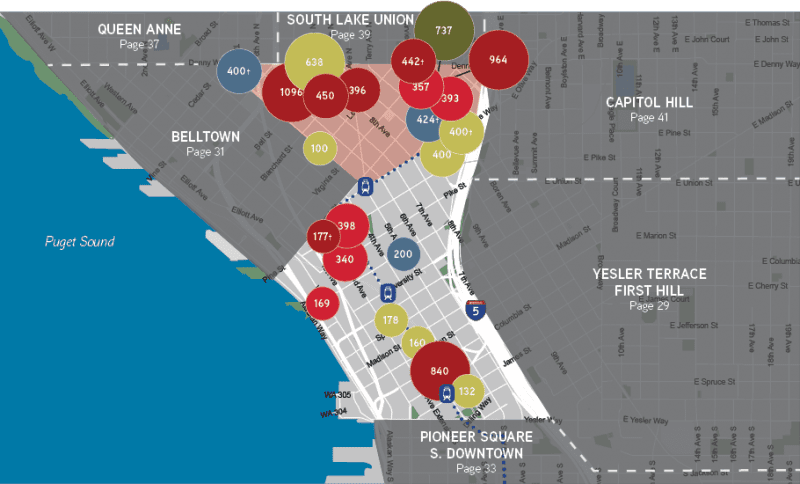

Where is Seattle’s Midtown?

Most major cities have a midtown. Some more defined, like in New York City, and some are less so, like San Francisco. Seattle has a downtown already, and many are already embracing Lower Queen Anne’s newish Uptown moniker. Its high time for Seattle to embrace its Midtown!

Downtown & Midtown Development Pipeline

Local Seattleites may cry heresy as we paint-roll over the colloquial name “Denny Triangle,” yet I still submit Midtown as a jazzy name for this area. And developers can’t argue that its foundation is literally being poured right now!

Between Midtown and Downtown, nearly 10,000 apartment units are currently under construction or planned – with nearly 75% of that total in Midtown. It’s tough to argue that this newly forming micro-market don’t deserve a refreshed name!

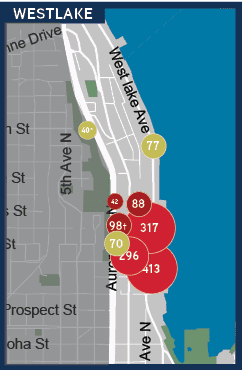

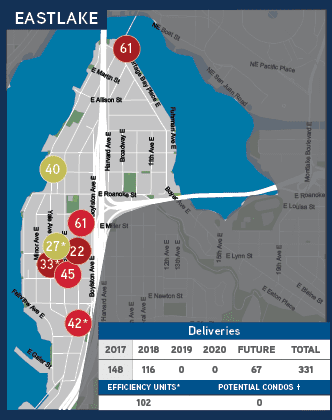

Beyond both Midtown and Downtown, the vibrancy of South Lake Union continues to spill north of the once sleepy lakeside industrial zone. Westlake is earning its stripes as a micro-market of its own, as is its cross-lake brethren Eastlake.

Although Seattle’s downtown submarkets may rocket from 8,500 units to over 30,000 units in ten years’ time, these markets aren’t the only game in town:

University District on the Rise

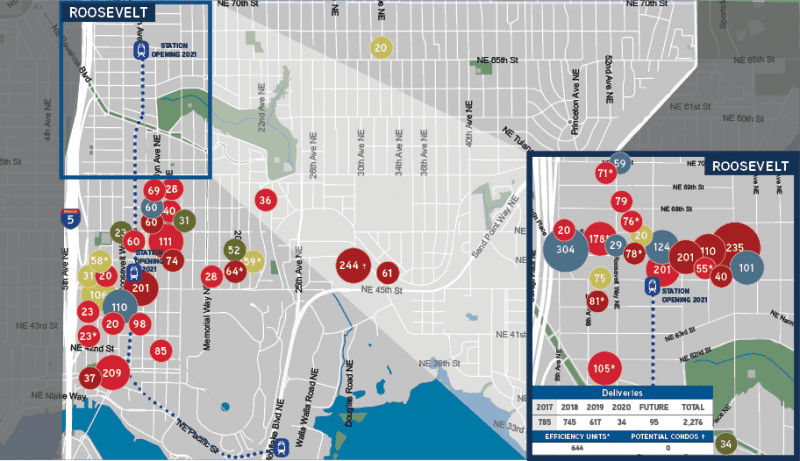

Not long ago, Seattle’s University District was primarily known for student housing and The Ave, sorely in need of TLC. Today’s University District boasts a new light rail station (and one more on the way), the imminence of an upzone, and a rapidly growing consortium of students, professors, and venture capitalists ready to create or discover the tech scene’s next unicorn!

Apartment developers took note and are looking to double the inventory of market rate apartments in the next several years:

At the same time, the Roosevelt neighborhood is emerging as a micro-market in its own right. With connectivity via light rail to the North and South, great retail and retention of Seattle neighborhood appeal, Roosevelt will soon be measured as its own market.

All Neighborhoods are Changing

So far this market cycle, Seattle’s urban neighborhoods have absorbed nearly 30,000 units, with 55,000 more potentially on the way. Our 2017 Seattle Apartment Market Study provides a granular analysis of each neighborhood. Make sure to download it, and give us a call to discuss how to best position your assets and your investment dollars in 2017!