Over the holidays, a flurry of articles from local news sources sent the same message: rent growth is declining! New development is outpacing jobs! The market is slowing! The sky in Seattle is falling!

Guess what? It’s not.

Papers need to get sold and online articles need clicks (how else do you sell advertising, right?). However, markets are complicated, predicting the future is difficult, and headlines that call for steady, calculated market responses are boring.

What is causing such pandemonium? Well, a strong political hangover from November 8th is one response. Yet these headlines are many years in the making.

Let’s examine some likely sources.

- Economic Expansion Cycle: Our current economic expansion cycle is longer than most

- Rent Growth: Rent growth is outstripping wage growth

- Development Pipeline: Deliveries of new apartments are mounting

While panic is a likely response to such headlines, it is important to examine the Seattle apartment market more particularly. Smart investors need to get it “right.” And doing so requires study on a granular level, a consideration of market changes – both cyclical and structural – and reference to macro factors, such as the duration of economic cycles.

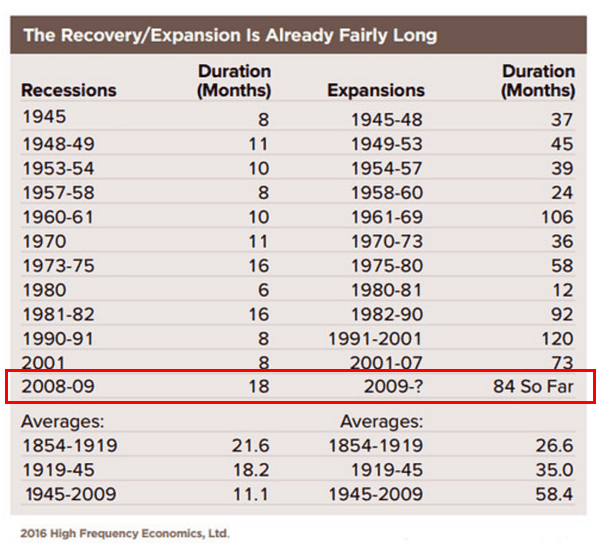

Economic Expansion Cycle

This cycle of economic expansion is getting a bit “long-in-the-tooth”. As a result, the prediction is that economic forces will change and we will have a slow-down.

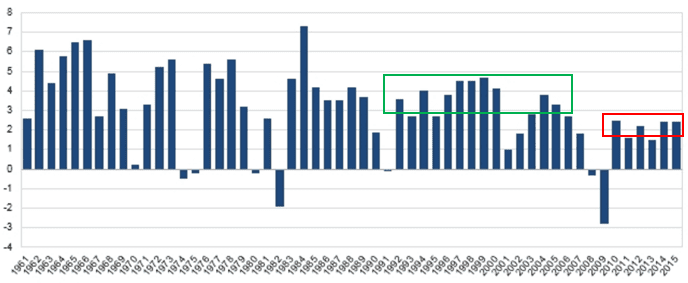

Every economic cycle is different – as is certainly expressed in the above chart. The Great Recession was the longest and deepest down-turn since the Great Depression. As well, the ensuing years of expansion (namely 2010 to present) are the weakest since World War II (we have not broken +3.0% GDP growth since 2003!).

Seattle is certainly counter-cyclical in this regard. In Seattle, employment, wage and production growth re-emerged post-Great Recession as early as 2010, and the market’s been on a tear ever since! However, just because we’ve done well doesn’t mean others have as well.

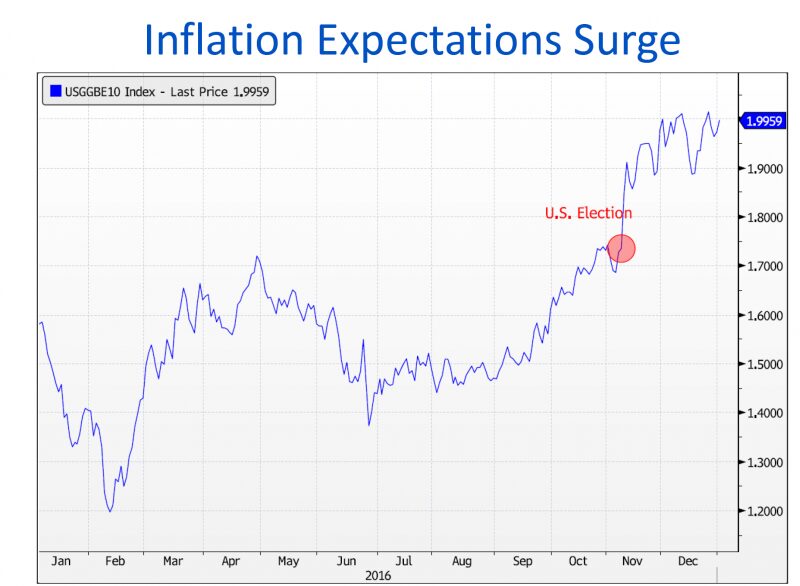

The United States has recovered from previous low-growth periods by spurring inflation – and we are likely on the precipice again of such pro-inflationary forces in order to spur economic growth.

Speculation that the current economic expansion will taper because “it’s time” is simply that, speculation. Cycles will cycle, that is just what they do. Yet in the case of the current expansion, it is likely to continue in many sectors of the economy until a true “economic recovery” is reached.

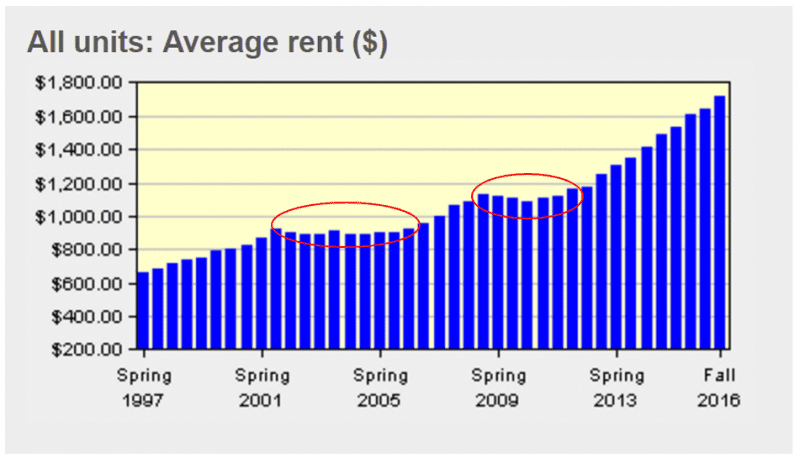

Rent Growth

The next area of concern is rent growth. The Seattle and Tri-County markets experienced tremendous rent growth over the last 5 years. As of late, such growth is moderating. Cue the press!

Without question, trees will not grow to the sky – nor will rents continue forever on a steep upward trajectory. However, concerns in the market require moderation.

First, most of the “measurement” of rent as of late are from Q4 – the WORST season for rent appreciation in Seattle, regardless of economic conditions. Our market suffers from an intense amount of seasonality. In the “dark months” it’s damn hard to rent units, especially at escalating rental rates.

Second, the amount of decline in rental rates is small and restricted to Seattle’s core markets, where there is immense competition with new deliveries. The fact of the matter is that in Seattle’s core, rents don’t fall off very much – even in periods of economic slowing.

Seattle Rent Levels

The above graph covers two economic slow-downs, both Dot-Com in the early 2000s and the Great Recession. Moving through the Great Recession, the peak (Fall 2008) to trough (Spring 2011) experienced a reduction in average rental rates of $42 (-3.7%), whereas the increase from the trough to present increased 58%. Not bad for the longest and deepest recession since the Great Depression!

It is important to consider that rental rates will stabilize for a period of time after massive increases, yet the Seattle market has rarely seen sharp declines in average rental rates.

The key is to prepare for periods of slowing growth (i.e., sell in up-turns with the highest NOI or watch leverage in periods of slow growth). We can help you prepare as markets hit inflection points, this is where expertise and trained-eyes on long-term trends truly pay-off.

Development Pipeline

Seattle’s development pipeline remains the topic de jour for holiday cocktail parties and beyond.

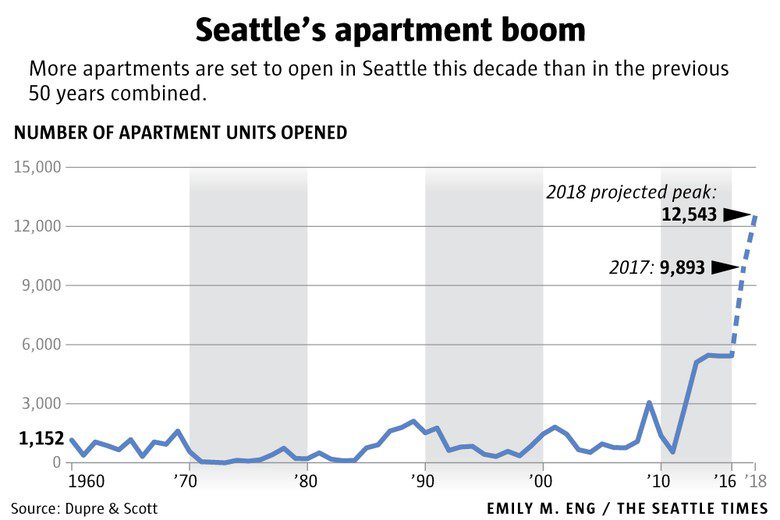

My favorite must be the below graph on the never-before-seen apartment boom!

The data is correct, yet the choice in measurement criteria is the rub. It is very true that developers will deliver nearly 10,000 apartment units in Seattle in 2017. It is also true that ~70% of the state’s jobs and new residents will land in Seattle as well.

Let’s look at a more balanced historical reference.

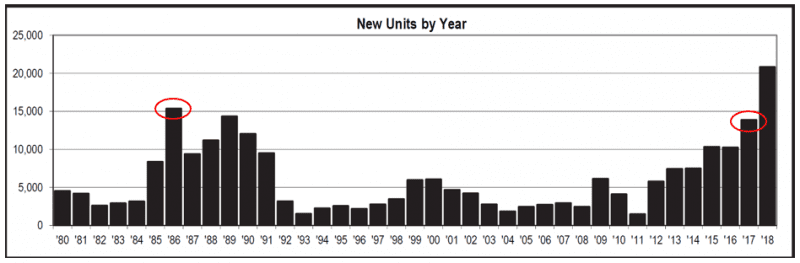

Tri-County Development: 1980 – 2018

Back in the 1980s and 1990s development occurred in the suburbs, because that was where people wanted to move. When Microsoft moved to the Seattle region in 1979, it moved to the suburbs in Bellevue. By contrast, when Amazon moved, they decisively chose an urban location to both attract talent and avail itself of urban dynamics.

Apartment developers are simply providing housing based on consumer demand.

A thesis that the region never experienced a development boom of this magnitude may sell papers, but it’s not accurate. It is true that if development continues at such a frenetic level it will outpace the previous boom, yet that’s also unlikely to happen as construction debt is harder to obtain and development costs are delaying and sidelining many development projects.

Greater study of the development pipeline is necessary: The Tri-County graph shows that in 1986 over 15,000 units were delivered, a mark we have not even reached this cycle – when the region has 1.6 million more residents than 30 years ago.

What We Expect in 2017

As we focus on the months ahead, a greater study of the apartment market is necessary. Whether apartment investors or developers knew it or not, 2012 – 2016 was a far easier time than today to make money in the apartment market.

Competition has markedly increased, margins are slimming and greater analysis is needed to achieve commensurate level of returns from just a year ago.