As we dive into the first quarter of the year, it is important to take stock of the big picture. Over the course of the last month, pontificators pontificated and predictors predicted. It’s time for the metaphorical rubber to meet the road – to make decisions and take action. It’s time to run our businesses and Make 2017 Great Again! (sorry, I couldn’t resist the reference)

With so much noise in the market – falling rents, historic new apartment starts, rising treasuries, et cetera, et cetera ad nauseum – several key indicators serve as a guiding light to not lose the forest through the trees.

The following are key factors to watch as you navigate the beginning of what will most certainly prove an exciting – and if you play your cards right – profitable 2017!

1. Watch Market Participants

Commercial real estate is an incredibly self-referential industry. Participants watch the actions of other participants then tend to follow. Early in cycles market participants cluster for safety. As market cycles mature, this same instinct guides behavior. Resist such behavior.

In Q1 of 2017, lead the market – don’t follow others.

In maturing cycles margins trim and risk increases. That does not automatically equate to less opportunity; it is just harder to identify the best opportunities. First, do your best to understand where the market is headed (refer to Factors 2 – 4 below). Second, get a firm understanding of the motivations, theses and actions of other market participants.

This week our team is headed to the National Multifamily Housing Council Annual Meeting. Over 3,000 multifamily specialists will attend. This is a great opportunity to get a sense of the “conventional” thinking of market participants in 2017.

If you are attending, we’d love to spend time with you! If you are not attending, rest assured we will return with many insights and strategies for 2017. Let us know if you’d like to meet in February to help frame your strategies for 2017.

2. Follow New Jobs & Wage Growth

I have said it before and I will say it again – job growth is the panacea that cures all that may ail the commercial real estate market. In this market cycle, add wage growth to that formula.

In the Seattle market we are privileged to have both job growth as well as wage growth. For major markets, in 2016 the Seattle region sat atop the list of cities with the highest level of job growth.

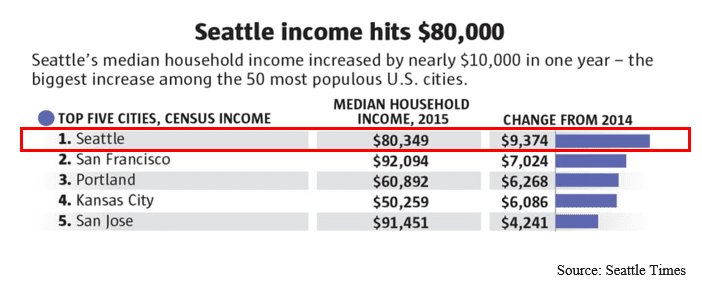

Fueling our market are high-wage jobs in key sectors of wage growth (e.g., STEM, TAMI). Although the following graph shows Seattle following only San Francisco in median income, our year-over-year growth far outpaced SF. As well, adjusting median income for California’s 9.3% state income tax, median income only trails SF by $3,200/year.

Job growth and wage growth are key to understanding how the Seattle apartment market will perform. Myriad factors impact the market – including new apartment starts and rising interest rates – however headline growth in jobs and wages are key factors to watch in our market.

3. Keep Track of Inflation

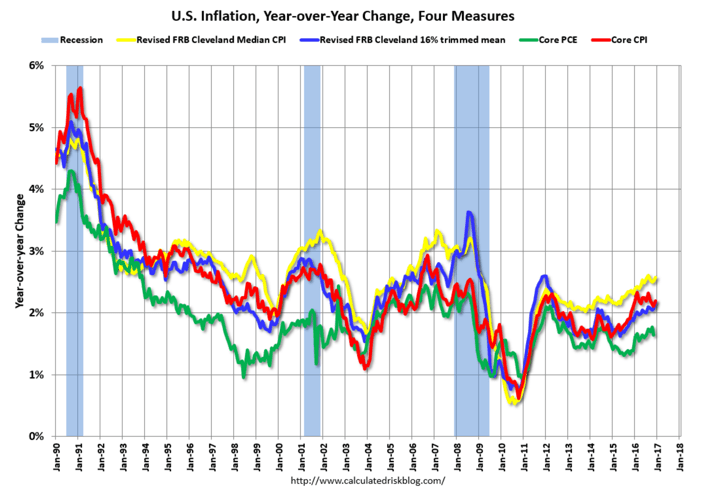

Inflation is likely the number one metric that will drive the Federal Reserve’s fiscal policy in 2017. As the below graph illustrates, the US has not experienced Core CPI growth greater than 3.0% in over 20 years.

Most economist are predicting steady 2.0% inflation growth for 2017. The key is “steady.” Watching measures of inflation will help assess near-term borrowing rates as well as general health of the economy.

4. Study Seasonality & Concessions

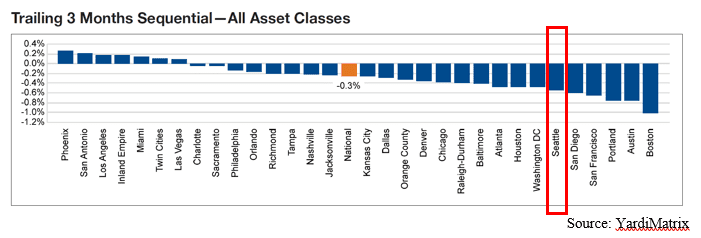

Seasonality is the name of the game in watching rental rates in the Seattle market. In the last several weeks many articles were written discussing declining rents – and I argued that the period of measurement was likely skewed.

Analyzing rental rates in the fourth quarter of 2016 illustrates declines in many major markets. Interestingly, of those markets Seattle is the only market that had outsized rent growth throughout 2016.

This divergence between T-3 rental rate growth versus T-12 rental rate growth shows a true “amplification” of seasonality in the Seattle market.

Accordingly, don’t always believe what you read. As we enter February it is always important to monitor concessions: do they stick around in the spring months or start to burn-off as the market leaves the “dark months” of winter? This is a great measure of the health of the market for the balance of the year.

5. Monitor Delayed Starts

Finally, keep an eye on what new apartment buildings get started. Lender have concern about the future. Subcontractors don’t (at least not yet). This is creating an interesting phenomenon in the market. New projects are getting harder to pencil as construction debt is expensive and construction cost estimates are expensive based on subcontractor bids.

This process of getting a project to pencil is an activity that occurs 20 to 40 months before new units actually hit the rental market. Accordingly, the perception of lenders (risk in the market, lower leverage and more expensive debt) and subcontractors (there will be work forever, so bid high) may lead to less new product, and competition, than expected.

The interplay of these two perceptions will drive the amount of new development starts – which will in turn impact rental rates and vacancy rates (simple supply and demand).

Next month we will have all of our new market studies available, which cover the development pipeline of over 65,000 new apartment units under development or planned. Keep an eye out for those studies to help monitor what will eventually get built or tabled.

Would you like to know more about us? CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your capital for optimum returns. Our apartment investment sales team, comprised of five highly qualified professionals specializes in assisting apartment investors in maximizing returns.

We focus on representing apartment developers and buyers and sellers of apartment buildings from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan