It’s tough to be inspired by the news these days… but if we take a step away from the “other” Washington, the picture couldn’t be rosier in the Apple State.

King County added 59,500 jobs year over year – besting job growth in 2015 by nearly 15%. This is outstanding news when you consider that 2015 was a breakout year for job growth, and local economists predicted that growth to slow.

This means jobs are a panacea for any economic woe, right?

Well, sort of. As commercial real estate investors and developers, we love, love, love job growth. Yet the full implications for our investments is not that simple.

Here are 5 other important factors to weigh as we look toward 2017:

- Excellent Economic Conditions

- Continuing Apartment Developments

- Tough-to-Obtain Loans

- Cheap Cohort Markets

- The Realities of Commuting

Excellent Economic Conditions

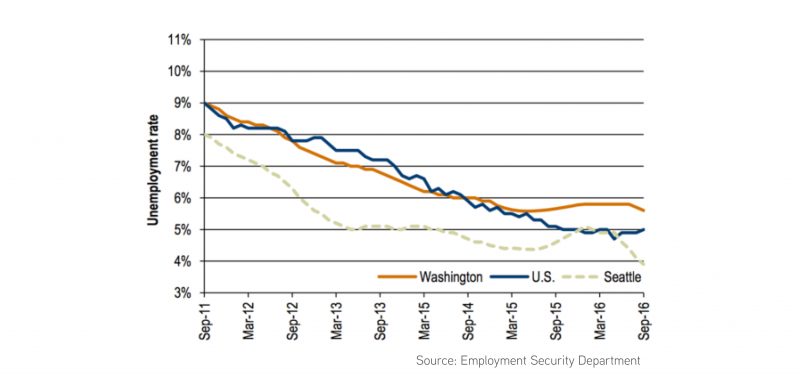

Seattle metro area unemployment fell to a historic low of 3.9% this October, and the aforementioned EDC report revealed that the highest growth sectors in 2016 were Professional and Business Services jobs – READ: high wage earning jobs!

To make a long story short: unprecedented job growth, historically low employment, and growth in high-wage job sectors is good; it’s very, very good.

Continuing Apartment Developments

The economics of commercial real estate development are quite simple. The production of new apartment units requires only demand and capital. Willing developers and land are in abundance. One cannot quibble that land is too expensive when you look at high density-markets like NYC and London.

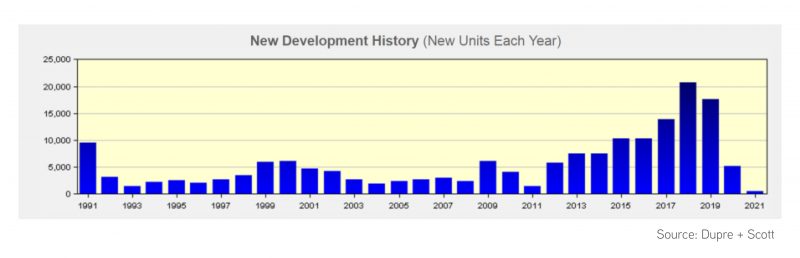

Despite the staggering development of 40,000 units between 2012 to 2016, the next four years may bring another 57,000 units to market. In total – and if built – this 9 year run would add 45% more units to inventory levels in 2011.

To put these numbers in context, from 1985 to 1992 the market added approximately 80,000 units. The region had a far smaller population, fewer jobs, and a greater percentage of home ownership.

Tough-to-Obtain Loans

Cars have governors to prevent the engine from overrunning components not equipped to maintain speeds achievable by said engine. Should an electronic governor on an engine fail, a tire could blow-out at high speeds, resulting in catastrophe.

The same ideas apply to real estate bubbles. When capital “outruns” demand – catastrophe can and does occur. Most financial collapses in the last 800 years were associated with and directly caused by unfettered access to capital – or in the case of the Great Recession, financial instruments capable of emulating capital.

The new parlance of our time is High Volatility Commercial Real Estate (HVCRE). Regulating bodies are placing a governor on banks who loan against “high volatility” collateral – and in many cases that collateral is commercial real estate.

The impact is a moderation of the speed at which capital is deployed. This “governor” helps moderate the actual development and delivery of the aforementioned 57,000 units proposed in the region and helps prevent our metaphorical “tire from blowing out.”

Cheap Cohort Markets

People and jobs are moving to our region in droves. Apartment prices are up and affordability is down – but what does this mean for the apartment industry?

In October, Seattle once more made Zumper’s list of the highest median rent prices. Does this mean that Seattle is SO VERY EXPENSIVE? Yes, and no.

It means if you moved from Biloxi, MS you might find Seattle unaffordable. But if you moved from San Francisco, your rent could be 47% less! The same deal applies to people moving from all our other cohort markets.

The Reality of Commuting

Based on the above graphic, one could decide to keep pumping out Class A glass towers – and some will. But not everyone in Seattle is a software engineer (ok, I might be wrong about that!).

Seattle will still have the fastest rising rents in the nation next year. Yet, when Zillow cited markets with the strongest rent growth potential, they didn’t name Seattle or the other usual suspects. Instead they listed these as the markets with the best rent growth potential:

- Burien – 5% rent growth

- Shoreline – 4% rent growth

- Renton – 7% rent growth

None of these locations are immediately adjacent to the region’s major employment centers, but they are all proximate to job centers. Not everyone can live next-door to work, but many can live nearby.

Identifying highly desirable locations to live – those close to work, well-amenitized and affordable — is key to a cogent apartment investment strategy, especially as regional urban markets continue to price-out renters.

Looking at the 5 factors addressed above, one can easily arrive at two conclusions: (1) there is a tremendous amount of opportunity in our apartment market, and (2) uncovering and capitalizing on that opportunity requires intense expertise and analysis. We are here to help!