Headlines are sexy: Seattle made headlines when rents hit +$2.00/square foot years ago, and in 2012 when Goodman Real Estate’s The Post hit +$3.00/square foot, headlines were made yet again. Yet efficiency apartments (sub-500 square foot floor plans) are hitting +$4.00/square foot to excess of $5.00/square foot rents, and many investors remain circumspect.

Why?

For starters, our industry is incredibly self-referential. As innovative as some claim to be, investors are awarded capital by equity partners and lenders alike when they follow tried-and-true practices. The same investors still seek “outsized” investment results while they follow the same path.

Human nature is interesting, especially the contrast between the animal spirits of the most prescient investor versus the oft less profitable of the herd.

A New Product

Efficiency units by their current nomenclature (micro apartments, congregate apartments, SEDU, EDU) are new to our market. However the concept of efficient, urban dwellings has strong historical roots.

Efficiency units meet a hugely underserved market segment in Seattle that is growing as fast as the highly publicized FAANG segment (Facebook / Amazon / Apple / Netflix / Google employees– what we think of when we say “millennial renter”).

If you are making under $60,000/year (and that is still a LOT of people in Seattle) few developers are building safe, modern housing that fits your budget. Your alternatives are usually old, inefficient buildings that require numerous roommates and often lack modern fixturing, acceptable thermal rating or safety. Your other choice is to move!

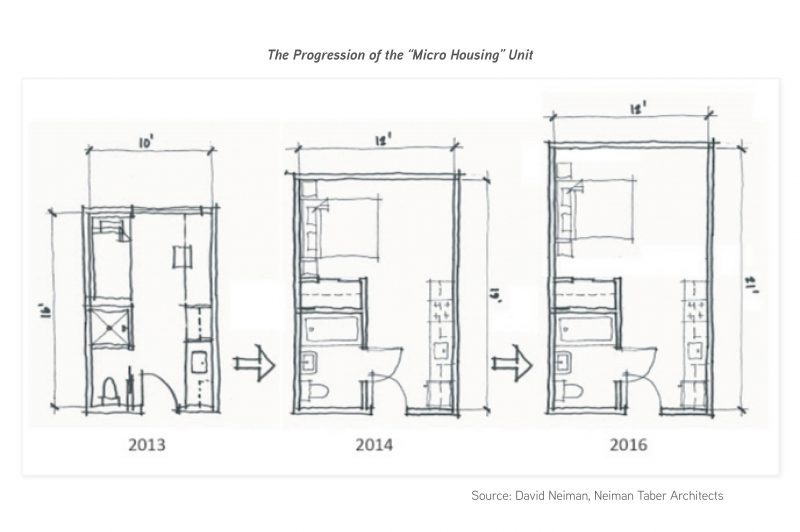

This article is too short to cover all “efficiency” product types, and they change quickly. The development of new “micro housing” is basically eliminated by changes to the code. This means owners of existing micro apartment essentially have a monopoly – and that certainly preserves pricing power.

Yet plenty of room (no pun intended) remains for innovation and investment. For example, underwriting these new unit types demands a new metric for economic and investment measurement.

A New Metric

Staid measures of value are too passé for the rapidly emerging world of “efficiency” units. We simply lack the sales data to reliably focus on capitalization rates, price-per-unit (PPU) and price-per-net rentable square foot (NRSF).

The true value of an investment is the amount of stable and predictable income it provides – now and into the future.

Enter – NOI/NRSF.

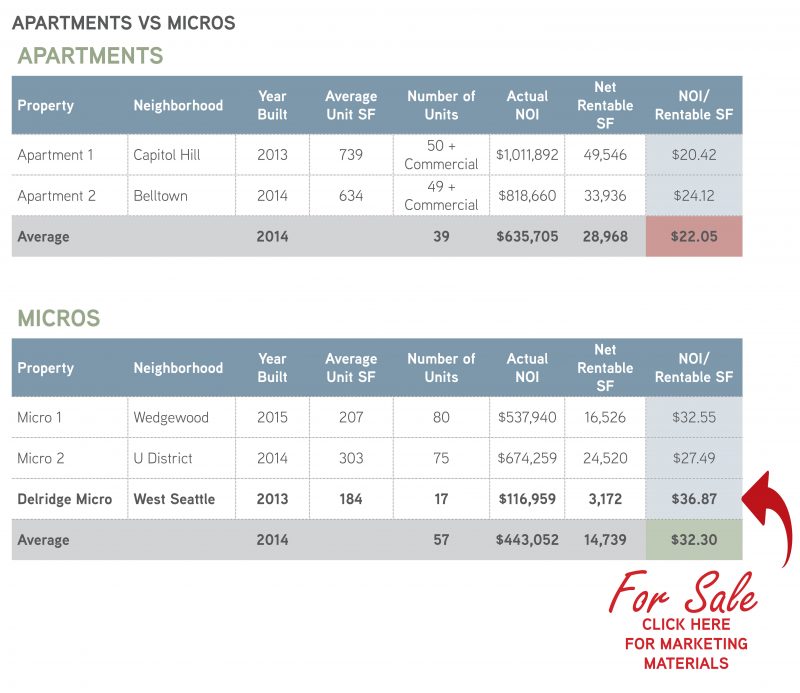

We hunted for a metric that truly defines the value of small, efficient units which are scarcer in the market. Accordingly, we measure the income each building produced relative to each income producing square foot.

Here are the results:

Micro apartments offer 30+% more return for each square foot of investment. This profit covers any perceived escalation in vacancy and operational cost. This comparison only shows micros, yet the same analysis applies to all efficiency units.

It is early innings for this product segment, so now is the time to take advantage of arbitrage opportunities while they still exist.

Seattle’s urban market dynamics are maturating quickly. Analysis of other dense urban markets proves that the phenomenon of rising prices and declining affordability are here to stay. Set aside preconceived notions steeped in the past, and hop on board with a fresh look at a new world of profitable investment fundamentals!