When news broke this past Monday that Equity Residential, and its intrepid leader Sam Zell, were exiting a position in $5.4B in suburban-located apartment assets (totaling over 23,000 units), analysts and pundits alike couldn’t opine fast enough on implications and predictions for the future. Is the sky falling in the apartment industry? Is the suburban market dead?

Mr. Zell is credited with predicting the 2008/09 commercial real estate meltdown with his prescient 2007 sale of the Equity Office Properties portfolio to the tune of $39B. Zell is watched and admired for his market timing and bold moves ahead of the crowd. Should those who don’t pay attention worry?

Paying close attention to this move by Zell and EQR speaks to a variety of positions. Foremost, EQR is still bullish on Seattle, retaining most of their assets and continuing to build into this cycle. Second, Starwood’s move into EQR’s positions may prove very profitable as it grows its suburban portfolio. Finally, now is a good time for all investors to take stock of the real estate cycle and where profitable investments can still be made.

Historical Rent Growth: Urban versus Suburban

It seems as through 2015 is the year of the “Urban versus Suburban” analysis when it comes to perceptions and maybe even realities of rent growth. As early in the year as January 2015, MPF Research reported to Property Management Insider “we’re going to examine the suburban apartment markets across the country quite a bit during 2015” In the last few months Axiometrics spoke at length on the subject, proving the thesis of growth in suburban rents.

In a September article aptly titled “Data Differs between Urban Core, Suburbs: Metrics show higher suburban apartment rent growth”, Axiometrics bolstered its argument with five years of data supporting the mounting rent growth in suburban product. In March of this year, Axiometrics wrote “Apartment Revenue Growing Faster in Suburbs: The rate of effective rent growth is falling in urban core submarkets as more properties are built. Growth in the suburbs is stronger”. What market will prove stronger in the coming years?

Specifically looking at Seattle, more analysis is warranted. For the sake of such analysis, I used data provided by Dupre + Scott to analyze a decidedly suburban market – Lynnwood – (and one EQR recently exited) versus Seattle metro, a clearly urban area.

To normalize the data, I analyzed the same type of apartment stock (built between 1980 – 2000) and reviewed recent trends (2010 – 2015). The conclusions prove interesting.

Seattle Metro

Lynnwood

Although this analysis only compares two markets, it is a representative conclusion of the strength of rent growth in a suburban Seattle market.

REIT versus REIT

The decision by EQR to focus on urban markets is not a unique real estate strategy, yet it is not necessarily one broadly adopted amongst its competitive cohort. Recently, Real Estate Weekly took REITs to task posing the question of urban versus suburban. In the article, “Why multifamily REITs like a little bit on the suburban side”, strategies and theses varied, yet most REITs preferred to cover both sides of the asset class.

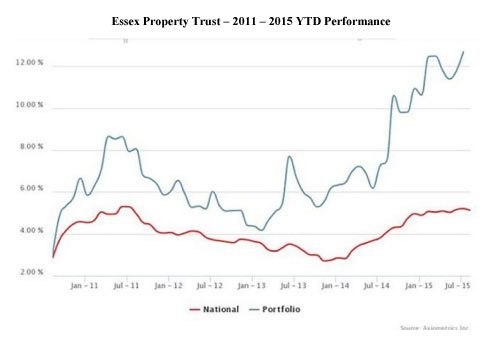

Specifically studying performance, Axiometrics compared Essex Property Trust’s portfolio, which is very broadly focused, against that national market. The performance metrics are clear – and validate Essex’s dual strategy.

Taking a look at AvalonBay, just today news of two developments hit the press – one a downtown, high-rise apartment development and the other a large suburban apartment development in Newcastle, a very NOT urban market. Playing both sides of the field appears popular.

What about Seattle?

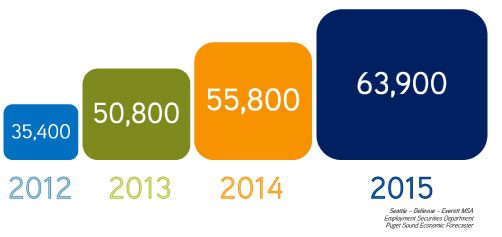

In the apartment sector we are hyper-focused, and appropriately so, on job growth. The story of job growth in the region is nothing short of epic. In a previous post, Rent Growth: Will Seattle continue to lead the nation?, Seattle’s meteoric job growth laid the foundation for the incredible absorption and rent growth experienced in our market over the last 60 months.

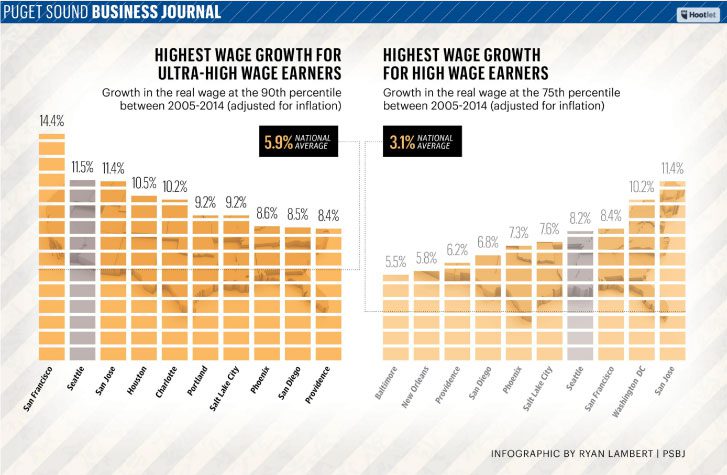

Yet, beyond jobs it is all about wages. Wage growth will assuredly validate both affordability and durability of increasing rental rates – the fundamental hallmark of an increasingly valuable apartment investment.

Turning back to Zell, this is where he certainly has it right and where EQR’s continued ownership and development in urban Seattle proves a long-term investment thesis. Seattle places at the top of the nation for high wages, and recent data proves our high-quartile ranking. Notably, these jobs are located in the urban core.

Interestingly enough, tech workers many not be the only benefactors of high wage growth in Seattle. Last night my favorite LSE-trained economist, Dr. Enrico Moretti spoke at the UW Runstad School Leadership Dinner, where he discussed his economic theories applicable to discussions on regional economic growth.

Before the dinner, the PSBJ interviewed Dr. Moretti to discuss his thesis that tech wage growth increases all wages – even those in Lynnwood. You can read the article or better yet, buy his book on Amazon.com.

What is Your Investment Thesis?

Whether you are a Zell evangelist and follower or not, the question of where to invest is a perennial one, and one that appropriate requires dynamic analysis and adjustment. There is no question that we are well into a very strong real estate cycle, and without question it is supported by fundamentals never experienced in the apartment sector. However, bets made today have thinner margins than those made three years ago. The market has legs – assuredly, just make sure you are following are well conceived strategy.

Understanding both future and current market dynamics is critically important in positioning both your assets and your investment thesis for optimum results into the future. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan