The fall season of commercial real estate events, seminars and symposiums is drawing to a close and yet again the resounding topic of interest for all such get-togethers is the age-old question of where we are in the real estate cycle. Although this is a topic of great interest and import, implication of cyclical positioning may fall less on econometric fundamentals and more on emotion.

Tailwinds

Real estate investors are apt to discuss the market in the term of headwinds and tailwinds, and do so in a binary sense. However, turning to aeronautical implication of “winds” there is no such uniform analysis. As a pilot, headwinds are immensely beneficial when taking off and landing. Headwinds provide lift for takeoff and help close the gap between airspeed and land speed on approach, making both events all the more safe and controllable. However, once in flight pilots vastly prefer tailwinds to increase speed and efficiency.

Contrarily, why would a real estate investor ever want headwinds? Never, I would argue. Yet understanding which way the winds are blowing is of paramount importance in deciding the what, where and whens of investing.

Let’s examine the current market. If demand is our source of propulsion (propelling the market forward, if you will), low interest rates and a mountain of capital to place act as an accelerant – aka tailwinds.

Tailwinds are very helpful under steady-state conditions, yet on approach to an inflection point in a market cycle they act as a false indicator of demand, resulting in overinvestment which generally leads to a downturn (mean-reversion).

Returning to the analogy of flight, when landing pilots purposely seek headwinds in order to provide resistance to forward motion – ultimately a means of testing reality. If a pilot lands with the wind at their back it would be hard to tell if the plane’s propulsion was driving them forward (fuel/demand) or if the extent of forward motion was caused by the enhancement of wind speed (low interest rates/demand to place capital).

For the real estate investor, false indicators of demand can lead to an asymmetry between position in the demand cycle and position in the “perception” cycle (sentiment).

Investor Sentiment

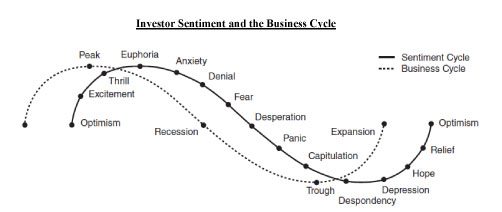

Investor sentiment is the great driver of investment decisions, often driving the market beyond its own fundamentals – at least temporarily. Seth Klarman states the same, yet far more eloquently, “The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” The following is a fantastic graphical representation of the dislocation between investor sentiment and market reality.

Deviation between sentiment and reality is often the dislocation between actual demand and perceived demand. Commercial real estate is a multi-trillion dollar industry, so why are their deviations? Haven’t we figured it out by now?.

First, unlike nascent technological innovations in alternative industries that have pioneered and produced predictive analytics, real estate investment isn’t based on that much science. Secondarily, the temporal distance between investment decision and result (for example, purchasing land to delivering a new building) is quite far – and market forces are apt to change in the interim. Finally, sentiment often drives the decision to invest versus not invest.

Much like the discussion of headwinds versus tailwinds upon landing, when it comes to commercial real estate investment, the preference depends on the viewpoint of the person asking the question. If you have a lot of capital to place we are in the 7th inning of a double-header. If you have decided to sit-tight, you likely believe we are rapidly approaching the bottom of the ninth.

Chewing Tobacco

As prevalent as chewing tobacco is to baseball, so are baseball “inning” analogies to the duration of commercial real estate cycles. A great solution to the age-old conundrum to timing cycles is to invest in demand.

Real estate cycles produce highs and lows, yet measuring and following demand is a much greater hedge against a downturn than any cyclical analysis. I argue that demand is headwind/tailwind agnostic. Although the first graphic above depicts demand as a tailwind, it is more appropriately likened to the fuel within the plane. Sometimes demand is dampened by headwinds, other times the perception of it is accelerated by tailwinds.

Understanding demand metrics is the hallmark of successful commercial real estate investment. Every thoughtful investment thesis is grounded in demand analysis and part of that thesis is sorting headwind from tailwind and sentiment from reality. As we get close to closing out 2015 and preparing for 2016, it is an excellent time to invest in thoughtful analysis to position your investments and capital for the year to come.

Understanding both future and current market dynamics is critically important in positioning both your assets and your investment thesis for optimum results into the future. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan