Supply and demand is an immutable correlation in economics, yet staying ahead of the curve remains a challenge in any real estate cycle. In Seattle we are on the precipice of the delivery of the largest quantum of apartment units the region has experienced in the last 30 years. Will demand keep pace?

No study of apartment supply / demand dynamics is complete without reference to jobs – and better said, job creation. I often describe job growth as the panacea to all that may ail a commercial real estate market – and it is no truer when discussing absorption of newly constructed apartment units.

Job growth is often hard to measure (and even more difficult to predict) and no source provides job growth statistics on a level of granularity that justifies development of an apartment building in a particular submarket, yet alone a particular neighborhood or block. Yet, modeling regional job growth against apartment deliveries remains both insightful and instructive.

In order to gain insights into where the Seattle market is likely headed, we measure job creation versus deliveries first over the last decade, specifically 2004 – 2014, keeping a keen eye on vacancy rates. As far as predictions for where the market is headed, we then take a look at planned deliveries, and job creation forecasts, from 2015 – 2020 – rounding out a decade of development (2010 – 2020) that will change the face of Seattle forever.

King County & Seattle from 2004 – 2014

Over the course of the last 10 years the Puget Sound Region has experienced an ascension from the Dot-Com Bust – then leading to the Great Recession, and now the strongest market cycle witnessed in decades. During the latest market cycle, the great majority of both job growth and apartment deliveries have occurred in King County, and specifically in the City of Seattle. For a frame of reference, 90% of all apartment built from 2010 – 2014 landed in urban neighborhoods in and around downtown Seattle.

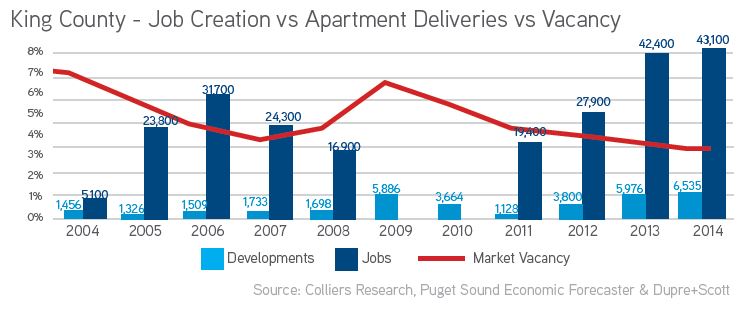

The following graph charts three important and interdependent metrics within King County:

- Delivery of new apartment units in King County

- Job creation in King County

- Prevailing apartment vacancy rates in King County

It is noteworthy that during the last three years the ratio of jobs to delivery of apartment buildings is around 7:1 – while maintaining a declining apartment vacancy rate, currently around 3.5% (a historical low).

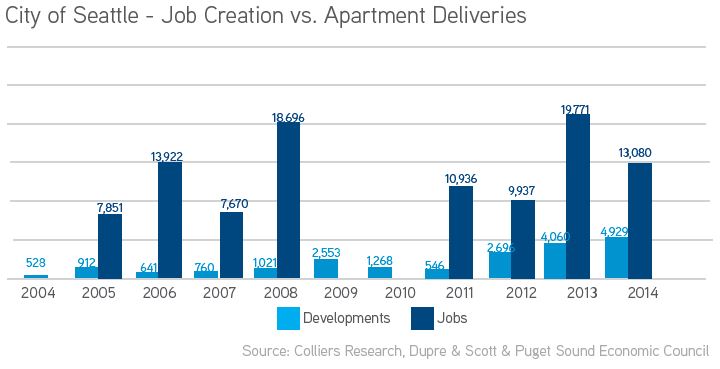

Analyzing the same metrics within the City of Seattle draws emphasis on the growth of apartment development within the city limits. Starting in 2012, development within the city hit a crescendo, nearly topping 5,000 units.

King County Forecasts for 2015 – 2020

Forecasting is a dangerous business, understood by no one better than Casey Stengel. Stengel is famously quoted for admonishing “Never make predictions, especially about the future.” When it comes to the outlook for apartment investment, predictions regarding job growth are necessary to understand the impact of the current development pipeline.

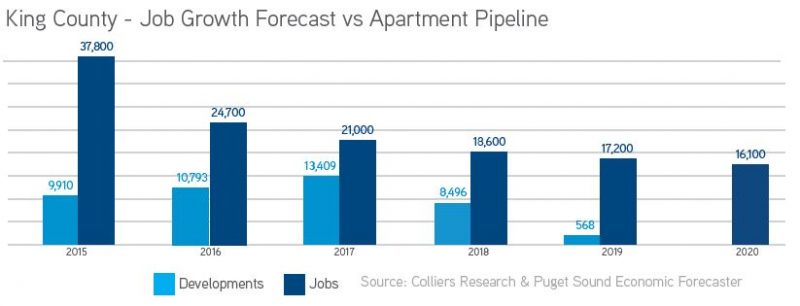

For King County, approximately 10,000 apartments are planned for delivery in each of 2015, 2016 and 2017 (the below chart specifies each year). Each year has an increasing number of deliveries, yet predicted job growth is waning.

Analyzing this table may cause concern. Unlike the previous several years of 7:1 job to apartment delivery ratio, the next few years looks as though ratios are sinking from 4:1 to as low as 1.6:1. It is important to take these ratios seriously, yet counterbalance concern with a few realities:

- Job growth is already besting predictions, with 2015 on track to produce over 50,000 jobs

- Not every apartment planned will be delivered

- Worst case scenario is rising vacancy rates that will temper over time

Looking past 2018, deliveries begin to dwindle as most developers have not planned that far into the future. Historically the region has added approximately 3,500 – 4,000 units each year and that number should be adjusted for overall population growth and demographic shifts. The foregoing graph is a good starting point for understanding how the market may react to impending delivery of over 30,000 apartment units in King County – yet further analysis is both warranted and necessary.

Investing in the Future

Understanding market dynamics and particular data-sets is crucial to making informed investment decisions. At this point in the market cycle it is vastly important to understand certain keys to each apartment investment, especially new developments. Please contact me to discuss your apartment investments and also better understand how to achieve the highest risk-adjusted returns for any new developments, acquisitions or dispositions you are considering.