Investment in any class of asset requires significant understanding of myriad fundamentals shaping the investment environment, especially pricing risk in the form of the daunting tasks of predicting stability and plotting growth expectations.

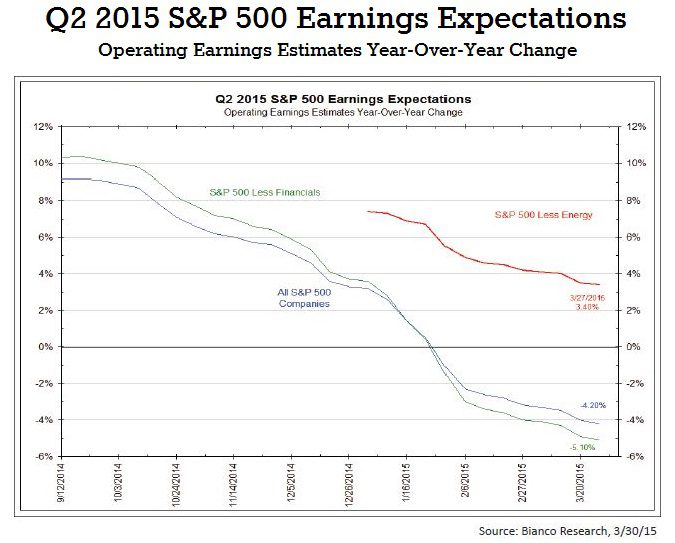

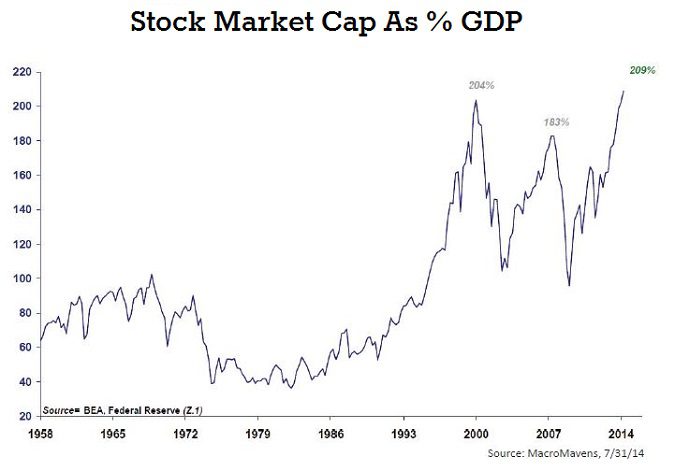

In 2015, attempting to find an acceptable level of risk-adjusted return is formidable, regardless of asset class. Treasuries pose a risk of interest rate appreciation and commensurate bond depreciation in light of resetting rates. Current equity markets seem miss priced in light of historical levels of market capitalization to GDP ratios (see the following two graphs for insights on both points).

Commercial real estate investment professionals speak in the same parlance of risk-adjusted returns and are squarely focused on (1) durability of an asset’s income stream; and (2) predictability of growth. High growth potential markets are often shrouded in risk and “durable” markets generally offer yield levels appropriately matched to lower risk.

Times are unique in Seattle. The city is experiencing a true renaissance across many sectors of the economy and populace. It is for these reasons that investment in commercial real estate assets in the Seattle region – specifically apartment investment—offers investors an uncommon risk profile: low risk with high growth potential.

The following four points offer a glimpse into Seattle’s thriving economy and long-term prospects for sustained economic growth. Investment in any market is not without risk, yet the ability to counterbalance risk with proven and sustainable fundamentals will help any investor sleep better at night.

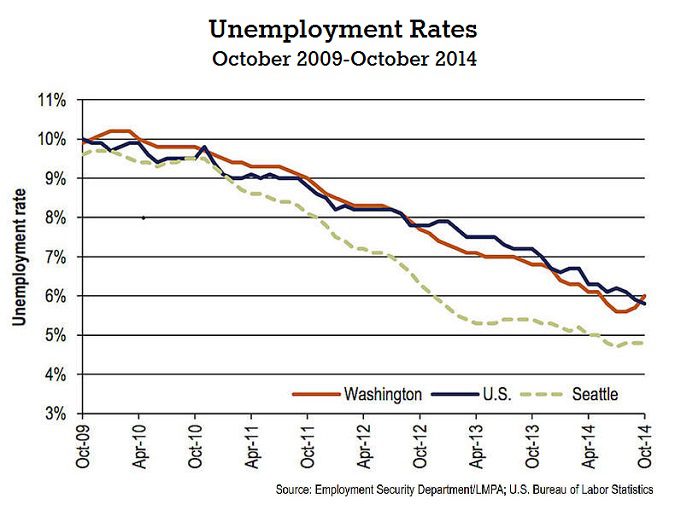

Job Growth & Stability is Nation Topping

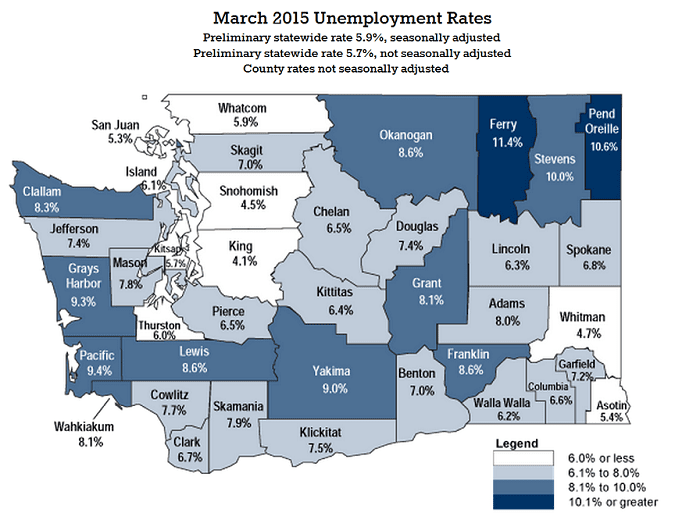

As of today’s news, the United States unemployment rate fell to a low of 5.4%. Although this is fantastic news, Seattle’s unemployment rate fell below this mark over three years ago in Q1 2012.

Currently, Seattle’s unemployment rate is at a braggadocios low of 4.1%. Across the nation it is hard to find another MSA with a blended unemployment rate sub-4.5%, especially one adding the type of high wage earning jobs as those offered in our region.

Our Tech Workers Literally Send People to the Moon

Seattle jobs have literally gone from “aerospace” to “outer space”. Back in the 1970s, concern of Seattle’s status as a Boeing Town was warranted, let alone forever memorialized with the 1971 billboard reading “Will the Last Person Leaving Seattle Turn out the Lights” – symbolizing our dependency on the aerospace industry.

Today, SpaceX is adding nearly 1,000 “outer space” seeking engineering jobs in Redmond to our economy. Blue Origin in Kent is competing to send rockets (and people) into orbit. Kirkland based Systima Technologies Inc. is providing integral technology for the endeavors of SpaceX, Blue Origin and others.

Although in Seattle we spend a lot of timing talking about Amazon.com (appropriately so!), the Seattle region’s job sector is more diverse than ever. Over the last decade the region experienced a critical shift from a company/industry specific job base to an ecosystem job base – much like that of the SF/Bay Area.

In the end, the critical elements are (1) stable jobs; and (2) high paying jobs. A recent Dice.com survey concluded that Seattle’s tech salaries are within 13% of those found in the SF/Bay area ($99k/year versus $113k/year, respectively). Placing the net differential in context, California’s marginal tax rate for these earners is 9.3%, and the state’s highest earners are taxed at 13.3% — wiping out nearly all advantage to California wages.

We are Still Affordable

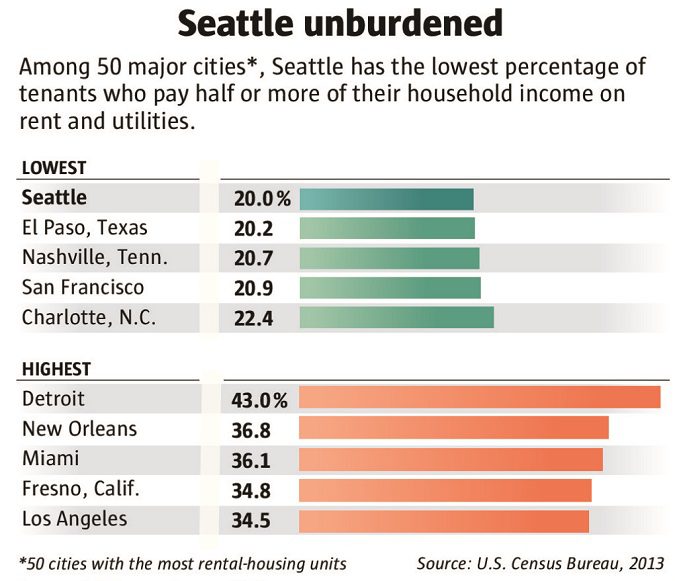

The other side of the coin is affordability. Although we have heard much ado about the housing affordability crisis, the empirical data illustrates that from a comparative rental housing standpoint, Seattle is much more affordable than cohort cities.

In a recent study, Gene Balk reported that Seattle has the lowest percentage of people who spend half their salaries on rent of all the major U.S. cities. (full article HERE)

Rental housing is not the only measure of affordability, yet is a good bellwether of the ability for people to sustain a lifestyle and grow a family in a region. Overall, housing is much more affordable in the Seattle region. In King County, average home prices are sub-$400,000, yet the median home price in San Francisco top $1,000,000.

The ability to earn a good living, provide housing for yourself and family and have a prospect of home ownership all contribute to the attractiveness of our region. The retention and attraction of a citizenry looking to travel such a path ensures long-term stability and growth here in Seattle.

We Have Water!

When commercial real estate investors decide to invest in a market, often decisions are clouded by near-term phenomenon and news-worthy headlines. Yet, for value investors with long-term investment horizons certain fundamentals must come to bear. Water is certainly one such factor.

Issues with water (and riparian rights) have impacted many investment markets, including Los Angeles, Reno, Phoenix, Las Vegas and Atlanta. The issues generally come to light at the top of real estate cycles when densities increase and municipalities plan for the future. We are again at one of those precipices.

Seattle has all of the great attributes of a constricted market. What I often call the “Manhattan Affect”, geographic barriers and entrance barriers lead to scarcity of land and assets, resulting in pricing premiums. Unlike New York and other “Manhattan-esque” markets, Seattle has room for further growth, asset pricing that is not yet obscene… and water to support continued growth.

Please give me a call to discuss your investment goals and how we can develop a strategy to maximize return with your current assets. The study of both macroscopic and granular trends is the key to prescient investment strategies and market-leading returns.