The Seattle apartment market remains on its bull run since 2011. If you follow economic headlines you likely see continually good news on nearly all fronts in the Seattle region. Our region’s economic success has a direct correlation to rental housing fundamentals and as a result, it is no surprise that we are experiencing positive trends in both rental and occupancy rates.

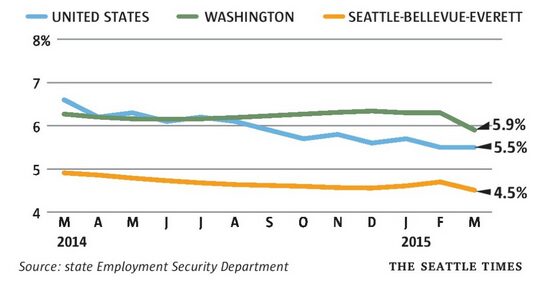

Taking a look at the Unites States versus the Seattle region raises some interesting questions. The Seattle-Bellevue-Everett MSA has had a strong recovery from the Great Recession and continues to outperform Washington State, as well as the nation. From a jobs perspective, unemployment trends tell the story quite clearly. Year-over-year, however, we have seen the nation begin to outperform Washington State.

An analysis of rent and occupancy trends in the Seattle region versus the nation not only highlights the strength of the Seattle market, it shows that the apartment asset class as a whole continues a bull run through Q1 2015.

Rent Growth

There is likely no greater metric showcasing the strength of the apartment market than rent growth. In the Seattle region he have become quite accustomed to year-over-year rent growth trends in the 6% – 8% range for the last several years. Given the delivery of new apartment units to our market (over 8,000 in 2014 alone), it was expected that rent growth my begin to taper.

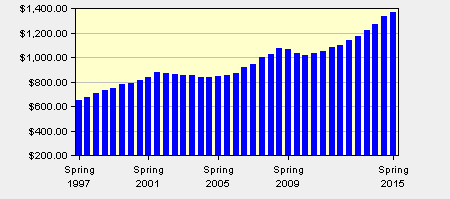

As of March 2015, rent growth figures continue to amaze. As shown below, average rents in King County continue to rise and remarkably Q4 2014 and Q1 2015 show continual growth. Since a market bottom in 2010, average rents have escalated from $1,000/month to nearly $1,400/month – validating nation-topping rent growth for the last 4 years.

King County – Average Rental Rates

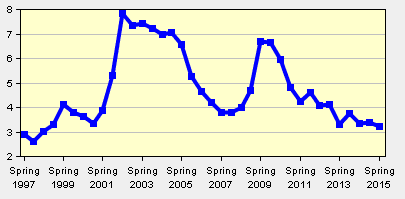

On the national front, rent growth remains robust with a slight tapering in the momentum of growth since December 2014. Overall, the three-year period covered below shows 3% – 5% rent growth in nearly every period measured.

Occupancy Rates

Occupancy rates are the counterbalance to rental rates. In an equalized market, rental rate growth may accrue to the detriment of occupancy rates. In slack markets, both may fall. Yet in a rising tide market, as we have seen of late, occupancy rates have held firm, or even increased, amidst steady rental rate growth and delivery of new apartment supply.

For nearly the last three years, average occupancy rates in King have topped 96% — despite the delivery of over 17,500 new units in that time period and greater than 6% year-over-year rental rate growth. Metrics such as these are deserving of accolades on the order of phenomenal.

King County – Average Rental Rates

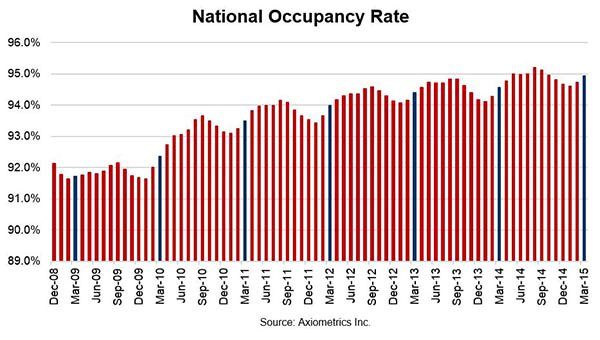

The three year nation occupancy trend has averaged approximately 94.5%, with many period cresting 95%. Although occupancy has recovered from previous cycle lows of sub-92%, the strength of the market can’t quite match King County, yet displays impressive fortitude nonetheless.

How Seattle’s Rent Growth Ranks Nationally

During this last cycle, Seattle as a city and a commercial real estate investment market has risen to the ranks of both national and international attention. Many investors place Seattle in the “Sexy Six” markets across the nation – minting it as a must-invest market for institutional investors.

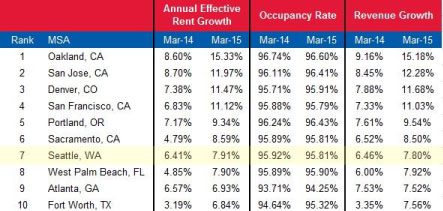

As an apartment investment market, Seattle continues to rank high due to year after year rental rate growth that benchmarks to the best apartment markets in the nation. Interestingly, according to Axiometrics, six of the ten highest rent growth markets are on the West Coast – including SF/Bay Area, Portland and Seattle.

Seattle’s rank nationally highlights its importance as an apartment investment market. To better understand the underpinnings of Seattle’s success to-date and position your assets for success in the future, please give me a call.