Two distinct phenomena are currently occurring in Seattle in the context of apartment renters. First, job growth is occurring at a dizzying pace – in 2015 we are again on track to create +50,000 jobs y-o-y – and new employment is significantly of the renter-age cohort. Second, more people (READ: renters) are desirous of living a work-live-play lifestyle more proximate to core-located job centers – generally described as urban locations.

It is 2015 and no one should be shocked by the assertion that Seattle is urbanizing, especially with respect to Millennials. Yet, our approach to understanding urban rentership – and likely more importantly, what exact locations and for how long these renters stay in one location– is an extremely important facet of urban preference to understand.

This post discusses the distinction between “1st Move Locations” – where renters just landing in Seattle (or native residents moving to urban areas the first time) tend to locate; and “2nd Move Locations” – where they end up after settling into an urban lifestyle. Finally, we will discuss why this is important and how a better understanding the temporal-base renter predilections can lead to market-leading investment returns.

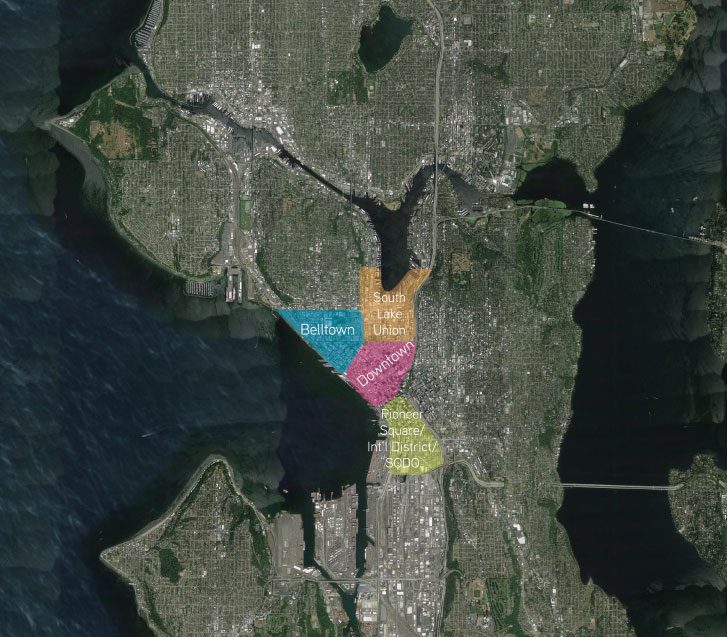

To provide context, let us first take a look at generalized boundaries for Seattle’s urban neighborhoods.

1st Move Locations

1st Move Locations are where new denizens land. You just took a job at Amazon.com and you have to move to Seattle from Boston (or Mumbai or Dubai). You graduated from college back East and were lured to Seattle by a tech start-up. Just as relevant, you’re from Spokane or Ellensburg and found a high(er) paying job in Seattle. Note: most all examples are based on an economic driver.

Where do these renters cluster? Well-advertised locations – which generally correlates to newer buildings. Locations with easy and quantifiable commutes to work. Locations that seem fun and exciting. Locations that to an outsider seem, well… understandable, or at least quantifiable with the tools they possess (a web browser, a telephone and possibly a corporate recruiter).

Accordingly, many of these renters cluster near the core of our city. Here is an example of some typical neighborhoods for 1st Move renters:

2nd Move Locations

The 2nd Move Location choice is an interesting one. Call it urban maturation – what this decision is primarily driven by is an understanding of the City, its neighborhoods and “fit”. What fits best for your lifestyle, spending time with your group of friends, and how best to access recreation you enjoy. Notice I don’t mention work. Young renters do not want to be next to work – they want to be proximate to work.

Renters, at least those with high means – aka good paying jobs – want lifestyle and identity. They pick neighborhoods with activities, character and scale that match their individual identity. Commute to work is just a box to check to ensure commute time is not a pain-point in their overall lifestyle. What is the first predictor of a 1st Mover’s choice in 2nd Move Location – where they meet their friends for brunch on Saturday-morning. After many Uber rides to brunch the eventual question gets asked – “why don’t I just live here?” Can you imagine a Millennial getting to work on Monday morning and asking why don’t they just move across the street from work?

Where are the best 2nd Move Locations? Here are some examples:

Why Does this Analysis Matter?

Understanding renters on a granular scale is key to keeping apartment buildings full and keeping them full at the highest possible rental rates. The most important considerations are how long 1st Move Locations last and what happens to these locations when the spigot of new residents throttles back to a drip? Finally, what are the “best” 2nd Move Locations.

In any analysis on return of an income stream – it doesn’t matter if you are analyzing bond yields or apartment NOI – investors want durability and predictably. Understanding 1st Move Locations and 2nd Move Locations is key to this analysis and vastly important to making profitable investment decisions.

Please give me a call to discuss how 1st Move Location, 2nd Move Location may impact your urban portfolio and future investment decisions. You might be surprised by applicable correlations between Seattle and other more established urban centers in Los Angeles, San Francisco, New York, Boston and beyond.