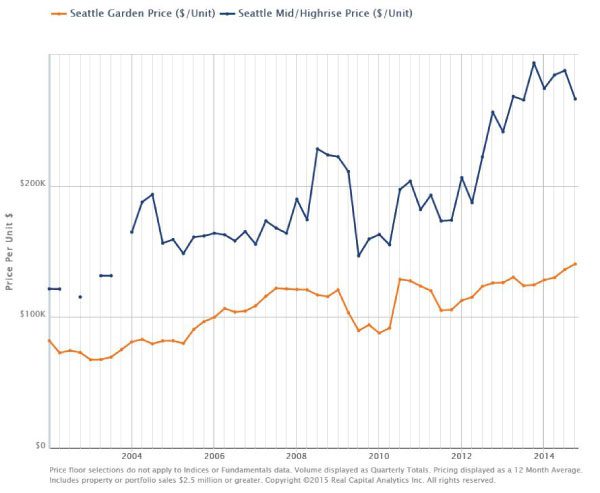

It is a good week to discuss peaks. On Monday, the NASDAQ hit 5000 for the third time in its history and just 2.4% shy of its all-time high during the Dot-Com bubble. Although not making national news with quite the same splash, apartment values remain in rarified air having exceeded their 2007 peak back in 2014 and are on a continual rise in 2015.

The following graph validates the rise in both mid-rise/high-rise and garden court apartment values in Seattle over the last 10 years.

A few weeks back, in my post Factors Driving Up Seattle Apartment Values Persist in 2015, the focus remained on spreads between cap rate and the 10-Year Treasury – making a case for the continuation of strong pricing in 2015. These factors remain relevant and are joined by a few other macro factors that will keep pricing high in 2015 – but maybe not too far beyond.

In this post, I will cover:

- Factors Influencing Levered Apartment Investors

- Factors Influencing Unlevered Apartment Investors

- Impact of Alternative Investments

- How Apartment Values may Change

Buyers of Apartments – Levered & Unlevered Buyers

The apartment investment community can be generally divided into two camps: levered buyers (those utilizing debt) and unlevered buyers (cash buyers, e.g., certain life/pension funds and REITs). In both camps buying appetite has increased in 2015, as will the willingness to pay more for the same asset this year than they would have in 2014.

Levered Buyers

Debt is a fickle beast. With positive leverage and a risking market, debt is your friend, a trusted partner whose steady hand helps boost returns. In a falling market (remember 2009 and harsh deleveraging?) – not so much. The hallmark of a good ‘debt investment market’ is positive leverage and we’ve been in that environment for some time.

Levered buyers did well in 2014 and their reward for cash well-placed is well, more cash to invest. In this case, cap rate spreads over treasuries will continue to buoy demand. Yet in Seattle, demand is further supported by intrinsically solid local economic fundamentals believed safer and more sustainable than other markets that were perceived as higher yielding markets in 2014 – such as the twin cities of Texas (Dallas and Houston), Phoenix and Las Vegas.

So far in 2015 the Seattle market has felt this demand with nary the available inventory to meet it.

Unlevered Buyers

The case for unlevered buyers is similarly based on the case of cheaper cost-of-capital, yet for different reasons. REIT performance, especially residential REITs, was storied in 2014. Across the sector, residential REITs posted nearly 40% gains in 2014. As a result, shares are trading around 15% greater than Net Asset Value and therefore REITs can achieve the same returns as other buyers while still paying a higher price.

Although some analysts believe that REITs May be Running Too Hot, some Analysts See Solid Returns for REITs in 2015. In either event, so long as investors like the asset class, REITs will have the cash to make strong investments in apartments in 2015 – and they are hot for Seattle.

Other cash buyers are similarly situated. On the hunt for return, they too have found value – and possibly more importantly, safety – in owning property backed assets. Returns produced by residential holdings remain a focal point and don’t carry with them concerns born out of holding certain alternative investments.

The Impact of Alternative Investments

If not apartments, then what? Investors have myriad choices when it comes to placing investment dollars in interest earning and/or appreciating assets. Although apartments are not the only game in town, in the current environment perceived risk in other real property asset classes and certain other investment vehicles has continually pushed a historically disproportionate share of investment dollars into apartments.

The following are a few categories of alternative investments with risk profiles perceived as higher than those found in apartments – leading to less investor demand.

“Other” Commercial Real Estate—Outside of core markets and assets, investment in commercial office space and retail has not kept pace with apartments. There are of course exceptions to the rule, yet non-core cap rates in office and retail far exceed those of apartments in secondary and tertiary markets. However, like apartment investment, industrial property investments remain a darling-child of the industry.

Bond Market—Nearly since the Federal Reserve began quantitative easing and zero-bound rates, bond investors have been wary of rising interest rates. A bond bubble in 2013 caused further long-term bond investor angst. Until the market gains a grasp on Federal monetary policy, bond investment will come with a certain unease. By many accounts, the Interest Rate Forecast for 2015 – 2016 shows a relative certainty of rising rates in 2015 (although opinions vary) – continuing a wariness of the bond market.

Oil/Gas Driven Markets—This more recent phenomenon transcends the overall oil/gas investment market and has broader implications on the job market. Low pricing is causing concern in the commercial real estate markets in Texas, pushing concerned apartment investors to more stable job markets. To date, in markets with oil/gas exposure cap rates are up and values are down.

Europe/Emerging Markets—Exposure to these markets are in many people’s portfolio, especially pension funds, 401k investments and funds held by private wealth managers. As these groups perceive more risk in foreign markets (coupled with poor performance in 2014), they are re-allocating funds to more certain asset classes, especially domestic real estate, including residential holdings (either directly or in the form of holdings in REITs).

How Apartment Values May Change

The only constant is change and we’ve been in a bull apartment investment market in Seattle for over 4 years. In an industry with 7 – 10 year cycles, it’s anyone’s guess when the good times will end. Seattle certainly has the wind at its back, yet a few changes are inescapable.

First, the Seattle region is set to experience the delivery of approximately 30,000 – 36,000 apartment units in the next three years – and even more on a five year horizon. To gain an understanding of exactly where and when these apartments are coming, download my 2015 Seattle Apartment Market Study. In understanding the impact of these new deliveries, it is best to take a granular approach of where, when and what. Specifically, where are these new buildings located, when are they expected to hit the market and what is the product type, e.g., high-rise, podium or garden court?

Next, interest rates will rise. With a rise in interest rates, we will see changes in investor demand and these changes will not have the same implications across all apartment and investor types. As discussed above, levered buyers invest based on varied fundamental from unlevered buyers and vice versa. Again, the savvy investor will take a granular approach to understanding how rising interest rates will impact the apartment market.

If you would like to discuss any of these fundamentals in the context of your investment goals and holdings, please give me a call. The remainder of 2015 will be exciting with a plethora of opportunities for the informed apartment investor.