Urban vs. Suburban Cap Rates – Looking at YTD Trends in the Tri-County Markets

Capitalization rates are most frequently used as a measure of investor sentiment and YTD trends in the Seattle/Tri-County markets are telling. An analysis of 2014 YTD sales in both urban and suburban markets within the tri-county region reveal trends that I expect to continue, so long as region job growth continues, domestic inflation remains tepid and FOMC/Yellen guidelines for holding short term interest rates remains consistent.

Headline numbers reveal average capitalization rates as follows: Urban King County at 4.9%, Suburban King and Snohomish Counties at 5.9% and 5.8%, respectively, and Pierce County at 7.2%. It stands to reason that the urban King County market bests its counterparts by a consistent 100 basis points and Pierce County is another 130/140 basis points higher. It is my expectation that if one was to overlay job growth figures, they would follow a consistently inversely proportional relationship between job growth and capitalization rates.

King County

Indisputably, investor demand is most pronounced in King County. Year-to-date, 41 transactions of apartments greater than 50 units have occurred in our tri-county region, 68% of such sales occurred in King County (15% in Snohomish County and 17% in Pierce County). Based on 28 transactions, the average King County capitalization rate is currently 5.3%.

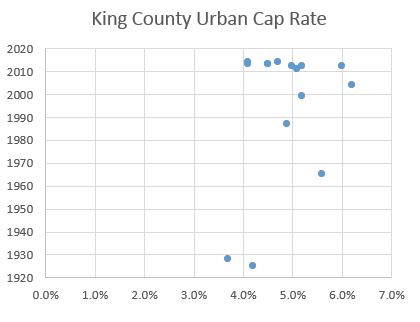

Urban King County

Just over half of King County sales have occurred in urban markets (15 of 28 sales, representing 54% of county-wide sales activity). The average capitalization rate in urban King County is 4.9% and capitalization rates range from a low of 3.7% to a high of 6.2%. Of the 15 sales, 8 fall below a 5.0% cap and for the newest of product; we are generally seeing mid-to-high 4 cap sales.

Source: Dupre + Scott, 50 units and greater

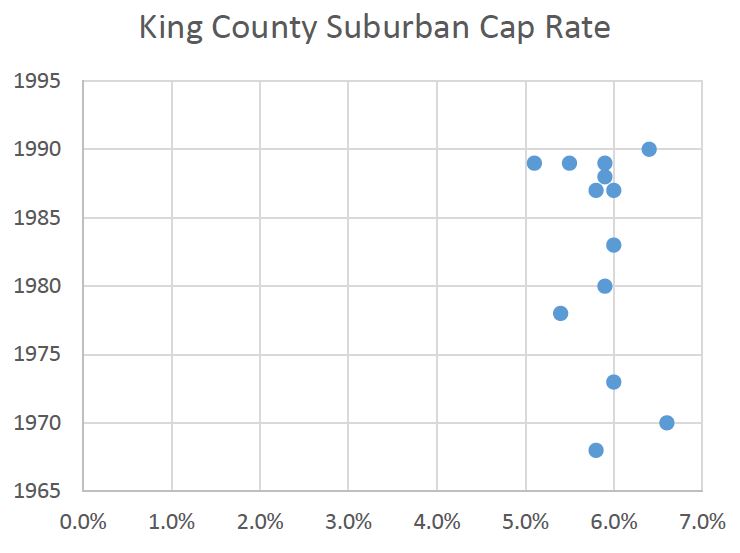

Suburban King County

Sales in King County suburbs have resulted in an average cap rate of 5.9%, with over 8 of 13 sales falling within 10 basis points of this average. There are a few outlier sales (one being Sunset View, which I sold with my partners and I can give you the details) and in general capitalization rates fall within a fairly tight bandwidth.

Source: Dupre + Scott, 50 units and greater

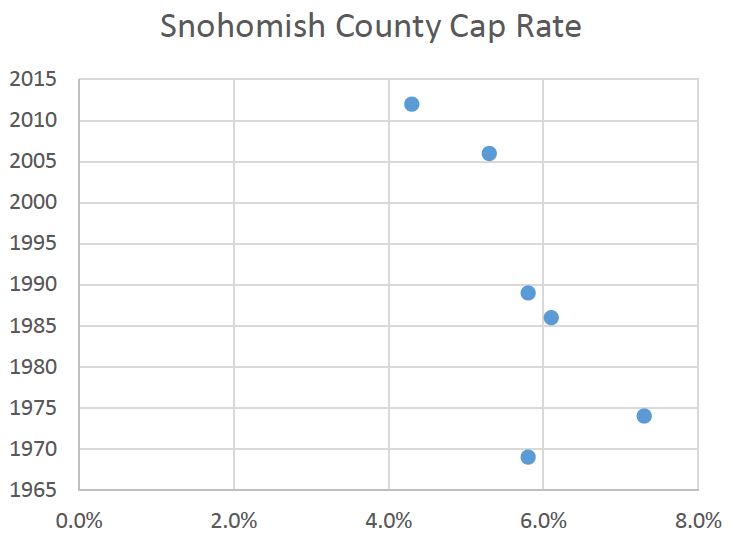

Snohomish County

The average capitalization rate in Snohomish County is 5.8%. Year-to-date, six properties greater than 50 units have sold in Snohomish County and most sales fall near the average capitalization rate. For the outlier sales, namely Bailey Farm and Millington at Merrill Creek, I can provide detailed information of why they transacted a several standard deviations from the mean.

A strong Boeing story, growth out of the core and 10-year historically low vacancy rates all lead to continued investor demand for Snohomish County, and concomitantly, the possibility of lower capitalization rates.

Source: Dupre + Scott, 50 units and greater

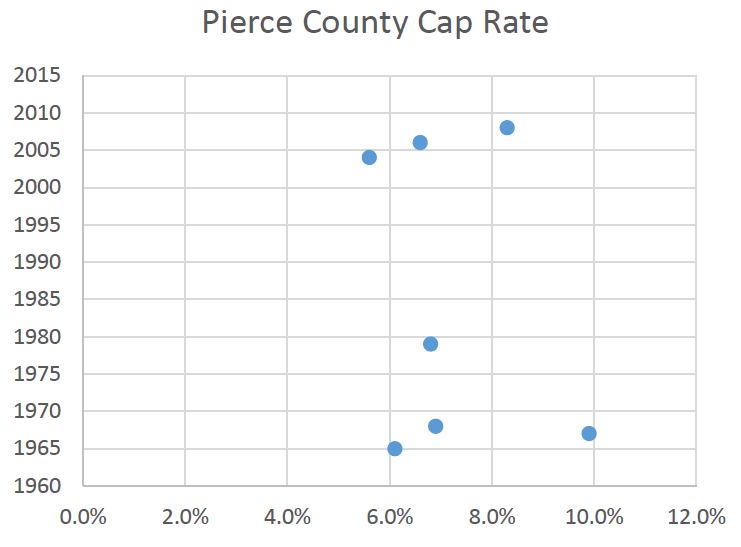

Pierce County

Sales in Pierce County represent 17% of total tri-county YTD sales volume and the average capitalization rate is 7.2%. Removing outlier sales, all but one sale fits within the 6.1% – 6.9% range. Strong overall regional economics and a flight from the core as a result of pricing (on both the rental side and investment side) assist in forecasting continued interest in the Pierce County market. We are likely at the front end of the arc for investment in Pierce County.

Source: Dupre + Scott, 50 units and greater

I predict continued low interest rates and a low inflationary market for months, if not a few years to come, yet these are dangerous predictions to make. If such predictions hold true, capitalization rates will likely remain consistent, if not fall in King and Snohomish County suburban markets as investor demand has a compression effect on capitalization rates. Please contact me for a more granular look at capitalization rates and to discuss likely movements in the near and long term for each market in our region.