Are we at a peak of apartment pricing? That is a question where no definitive (or at least correct) answer is possible, yet many in the industry opine on the matter nonetheless. The interesting phenomenon is that we often don’t know where the peak ‘was’ until months after it is achieved and in our rearview mirror – making the task of trying to match sales with market timing near impossible without the possibility of leaving some money on the table.

Peak Pricing

This week the sale of Gatsby on Capitol Hill marked what seems like near-peak pricing of $507k/unit and $634 NRSF. Although we have seen higher prices on both a unit and NRSF basis, Gatsby marks new peak pricing for podium construction. In the news this week is also press coverage of Vulcan’s sale of its apartment portfolio. Along with its impending sale of The Martin Apartments, Vulcan is selling out of over 1,000 apartment units in Seattle. The impetus of this sale is undoubtedly driven partially based on some thesis of market timing.

The following table gives a snapshot of apartment sales metrics over the last 12 months in Seattle. To even the most experienced apartment investor, these metrics are nothing short of staggering.

“Condo Lift”

Apartment pricing continues to top the $500/SF range, begging the question of who will build condominiums. In recent years I have coined the term condo “lift” to which I am referring to lift in value a condo developer must receive over the value of apartments. Why is lift necessary? A multitude of reasons.

From a developer/investor perspective, selling a residential building as a condo brings with it several attendant risks. Specifically: (1) it is far easier to have one closing than coordinating 50 or 100 separate closings; (2) deed release requirements in construction loans often require up to 50-70% sales of a building before the lender will release a single deed; and finally, (3) a liability tail of 4 years for statutory claims and 6 years for contract claims poses far more risks than selling an apartment building “where-is/as-is” with little or no liability tail. Note, there are myriad other factors, the aforementioned are just the most salient to this discussion.

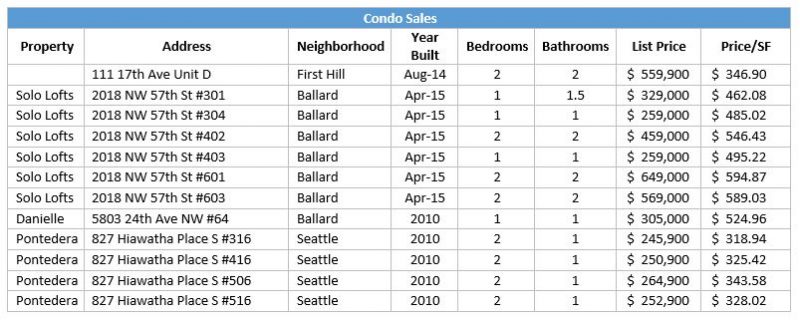

The following table highlights two phenomena. First, there is a complete dearth of available new condos in the Seattle market that are currently available for move-in. Second, in many cases apartment values match or exceed condo values. This table is the result of a search on Redfin for all condos at or near move-in condition in Seattle.

When will the market experience “condo lift”? In the past, a general rule of thumb is that a condo project must have a greater than 20% return than that of an apartment to justify the risks outlined above. The interesting juxtaposition is that home buyer’s desire to buy, and willingness to pay, has almost no definable correlation to investor demand, and willingness to pay top dollar, for apartment buildings.

What is on the Horizon

Inevitably, the dynamics of the supply-demand curve will lead developers to build condos (assuming they can get financing). Additionally, inevitably investor willingness to pay huge premiums for apartment buildings in Seattle will subside – again, impacting developer decision logic on product type they choose to build.

A combination of economic resiliency in the region and the Federal Reserve’s confidence in raising rates will affect change. So long as interest rates remain low, pricing changes will remain subtle, yet if you wait for that change to make a move, rest assured peak pricing will be well behind us and you’ll have to wait to time the next cycle for that perfect exit.