For apartment owners, investors and developers it is easy to feel confident about our market. Record rent growth, historically low vacancy rates and a development pipeline that can’t be absorbed fast enough. Yet here is a great and currently apt adage in the real estate world “Cycles are long, but memories are short”.

I’m privileged to work within a cohort of clients that are realist (ok, not all of them!) and continue to analyze the market for weakness, signs of market shifts and danger on the horizon. Doing so begs the question of what inning are we truly in and will this be a 9-inning cycle or are we likely to see some extra game-time.

Truly, no one knows the answer, but that does not stop me from asking the question of my most experienced clients, analyzing the market and arriving at my own conclusions of where we are in the cycle. This update is far too short to cover all of the possible topics nor delve into any one of them in great detail, yet the following are somewhat instructive and might allow you to drive your own conclusions.

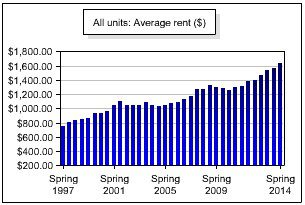

Rent Growth

We have seen quite a few years of sustained rent growth, starting in mid-2011 and it continues to grow, yet admittedly as a bit slower clip than we experienced in the last 4 quarters. If you are interested in rent growth in a particular neighborhood or during a particular span of time, please contact me and I am happy to pull that information together.

Source: Dupre + Scott, Spring 2014 Survey

Occupancy

The Seattle region’s occupancy levels are fantastic and despite continued development, occupancy remains high in the Seattle market. As an overall market in Seattle, we are steadily at 96% occupied, having dipped below that mark during several of the previous quarters.

Source: Dupre + Scott, Spring 2014 Survey

To perpetuate the sports analogy, baseball is a competitive sport, so its only appropriate to see how we are doing against the competition, and I would say fairly-darn well. For a sleepy little market tucked nearly in the Great Pacific Northwest, we seem to keep making national news and posting well in national rankings.

If you held out for the actual answer to the question I posed at the outset, my answer is 6th. It’s a fun question to ask. Next time you are pontificating and prognosticating among colleagues, ask the question and try to figure out what analysis provides the most insight – and if you need data to support it, give me a call.