For the last four years, the apartment development pipeline has captured headlines and dominated the commercial real estate conversation in Seattle. More recently, the PSBJ Article stating that Amazon.com’s CRE empire could grow to 10M SF by 2019 and accommodate up to 71,500 jobs became the Holiday Party topic de jour. (Note: My arithmetic shows that the realistic employment number falls closer to 50,000 jobs.)

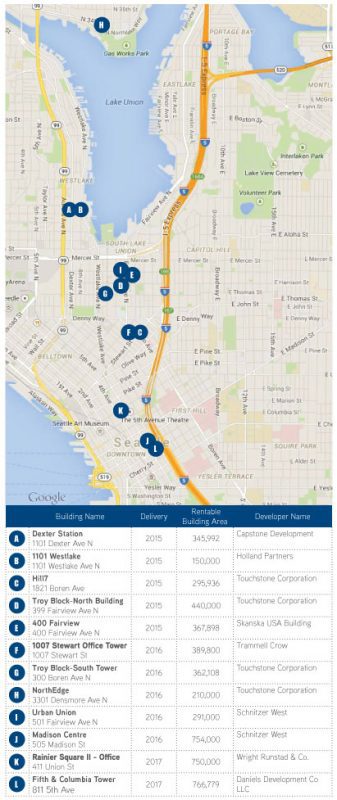

Yet, in the last 24 months office developers have announced plans for speculative office developments in downtown Seattle totaling over 10M square feet. Somewhat quietly, and behind the veil of headlines of nearly 50,000 apartments planned in Seattle, office developers have broken ground (or are soon to) on over 5M square feet of speculative office development in downtown Seattle – we are talking actual shovels in the ground. (See the interactive map below.)

Development and delivery of speculative office space in downtown Seattle is bound to have myriad impacts on Seattle’s overall commercial real estate and economic environment, yet most poignantly it will impact apartment development and deliveries in two key fashions – both worth a quick study.

More Office Space Equates to More Renters

With nearly 12,000 apartment deliveries planned Y-O-Y for 2015 – 2017, there is undoubtedly pronounced concern over how the Seattle market with absorb such a large quantum of apartment units in a short period of time. Not since the early 1990s did our market see such a voluminous pipeline of new apartment product – and by all accounts, that cycle did not end well.

Pundits and prognosticators find reason in conclusions on both sides of the supply-demand equation. Yet, whether the market can sustain our nation-leading rent growth and low vacancy figures while absorbing five digit apartment deliveries for the next three years remains a valid question. Regardless of which position you take, in our new ‘urban’ world, more office space equates directly to more renters.

At this time, no office developer is certain they will hit proforma rents – yet they will fill the space one way or another. And the corollary, whether gross rents hit +$40 SF or not, more bodies will fill office space downtown – and demand for close-in, urban apartment units will increase concomitantly. And in a time where nearly 90% of King County apartment development pipeline is near downtown Seattle, this is a very good phenomenon for apartment developers and owners.

Office Construction Increases Project Costs for All Construction

Just as a rising tide lifts all boats, an increase in construction activity will increase costs for all developers – including apartment developers. As the construction industry emerged from the doldrums of the financial downturn in 2010/11, all vendors began to raise their prices. And accordingly, developers, mostly apartment developers, competed for resources – architects, engineers, general contractors, subcontractors and materials. As a result, supply/demand metrics once again began to favor the construction industry.

Until recently, apartment developers competed against one another for these resources. With over 5M square feet of speculative office development under-way (this is excluding self-performed projects, built-to-suits, pre-leased buildings public projects and the “other” 5M square feet of proposed projects), construction resources are becoming all the scarcer. The impact of this scarcity on the dynamics of apartment investment is not totally known.

Some apartment developers argue that impediments to development (e.g., increased costs) will separate the metaphorical wheat from the chaff and decrease competition – thereby increasing the potential for greater returns. Others argue that increased costs will make development less profitable, yet know that in economic environments such as Seattle developers will justify development with lower return expectations.

For the cautious forecaster, it is too soon to tell what ramifications increased construction costs will have on apartment development and investment. Yet, rest assured that this asset class will not evade changing market conditions and staying cognizant of the changes is the clearest path to greater success.

In the end, development of speculative office space in downtown Seattle is likely to accrue to the net benefit of apartment owners. However, the prescient developer and investor will pay close attention to both macro and micro factors in how development of speculative office space will impact their investments and investment decisions.

As we maintain a holistic approach to advising clients on their apartment investment strategies, we find this type of analysis beyond interesting – it is essential to our practice and your success. To learn more about our approach to helping our clients outperform the market, please contact us to discuss the Seattle apartment investment market and your individual investments.