The only rule about real estate investing that you need to know in 2016 is one that you already know: the past is prologue. Sage and ominous as it may sound, it is time to take stock of history.

Seldom does a week pass when I am not asked “where are we in the real estate cycle?” It is both an appropriate question and a ridiculous one. Appropriate as we should always test our investment theses against the past and ridiculous as any response is somewhat binary in nature (any answer suggesting it is either a “good” time or “bad” time to invest in real estate).

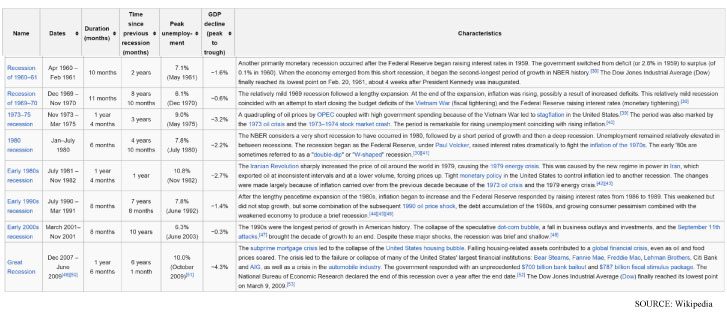

A quick review of the past 55 years of economic cycles is revealing of patterns that cannot be ignored and illustrative of factors to which we should obligate ourselves to pay great attention – especially in 2016. The punchline: if you like selling into market peaks, 2016 is a great time to sell. However, if you are a long-term holder or a developer, more analysis is necessary.

Buy on the “Zeros” and Sell on the “Fives” (or at least not too close to the Zeros)

The real estate business if replete with great axioms and one of my favorites is to “Buy on the Zeros”. Essentially, buy when the market is low. Over the course of the last six decades nearly every economic downturn occurred decennially on a zero year: 1960, 1970, 1980, 1990, 2000 & 2007*.

*The Great Recession technically began at the end of 2007, yet most in the Pacific Northwest truly began to feel the economic decline in 2009.

Click table for link

Another phenomenon that is born out of this patter is 10 year cycles. Are market cycles always 10 years? Absolutely not, yet measuring periods of national economic expansions has historically arrived at an estimation of a period of 5.5 years per expansion. Upturns and downturns in cycles last any number of years, yet the last 55 years is pretty good evidence of 10 year cycles.

Does that mean we are going into a downturn in 2020? Not so fast. Primarily, we don’t know. Secondarily, The Great Recession which began in 2007, decennially celebrated in 2017, is an ongoing downturn with much different fundamentals than previous downturns.

An important (and historically differentiated) aspect of the last downturn in the Pacific Northwest is that our market was “Last-In” and “First-Out”. Conventionally, Puget Sound is last into a recession and last out of a recession. In The Great Recession we bucked that trend (thanks Amazon, Boeing, Microsoft, Zillow, et al.).

What about the “Fives”? Real estate investors that sold assets in 2005 did very well, as did those that sold in 1995 and 1985. Arguably 2007 and 1997 were better years to sell, yet if you had waited until 1986/87 to sell you might have got crushed by the implications of the Tax Reform Act of 1986. My point, show up early for this party as timing markets is a perilous practice.

What Do the Fundamentals Say?

The fundamentals of our market continue to show health and opportunity for continued growth. If you look at conventional measures, the Seattle/Puget Sound market exhibits economics that inspire and support continued investment.

- Job Growth: Continues to Rise

- Wage Growth: Better than Most of the Nation

- In-migration: Continues to Rise

- Apartment & Office Absorption: Posting Healthy Metrics Y-0-Y

The health of our market was likely best summarized by Matthew Gardner yesterday (12/10/2015): …[W]hen you have more people moving in and have income and employment growth like we have, I’m not seeing any big cause that is predictable that will push us over the edge”.

Although Mr. Gardner was primarily speaking about the single family market, he has vast experience analyzing regional market fundamentals in Puget Sound.

In the coming years we will undoubtedly experience some turbulence. Early in the cycle (2011/2012) it was hard to go wrong. As we progress further from the “zero” years, margins for profit and allowance for error compress, requiring more precision. Will we have a truly “bad” year in the next several years, I truly doubt it – we are a supremely strong market. However, now it is time to make expert decisions on where and how best to invest.

How to Proceed in 2016

There are certainly areas of the apartment investment market that are either overheated or will predictably become overheated in the next 12 – 24 months. The key is understanding the market to a level of granularity to know the difference and plan investment decisions (both selling and buying) accordingly.

One of my favorite quotes as of late is attributable to William Hamilton, an investment adviser in Tennessee. William stated that “[t]he market does not trade upon what everybody knows, but upon what those with the best information can foresee”.

In 2016, use both past, present and future to inform your investment decisions and align yourself with the most informed advisers in the marketplace – namely, us!

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment theses for optimum results into the future. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of dedicated experts, specializes in assisting apartment owners in maximizing returns. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan