The late Yogi Berra once famously said “It’s tough to make predictions, especially about the future.” And right he was. I wouldn’t expect that many investors in the equity markets predicted a +10% decline in the equities markets thus far into 2016 – and had they en masse, such shifting sentiment would reasonably trigger a sell-off in late 2015. In the stock market, predictions and concomitant investor buy/sell behavior can drive markets.

Yet, the apartment shifts less on sentiment than on actual fundamentals of supply/demand balance (or relative imbalance). Since the leading edge of the current expansion cycle – call it 2011 – driving factors of rent appreciation formed at the nexus point of (1) growth in high-wage jobs; (2) pent-up demand; and (3) delivery of higher quality rental units.

Over the course of the following three years the Puget Sound market displayed rather predictable and linear growth. Rent levels increased rapidly in core markets of urban Seattle/Bellevue, near high-wage job centers and in lock-step with job growth in FIRE/STEM/TAMI sectors. As the cycle progressed, linear expansion of rental rate growth eventually reached beyond core neighborhoods and submarkets, yet not to the extent it cannibalized rental rate growth from whence it came.

What is in store for the future? The subtle nuance of artfully predicting the future is appropriately reading trends of the past.

2013 – 2014 Rent Growth Trends

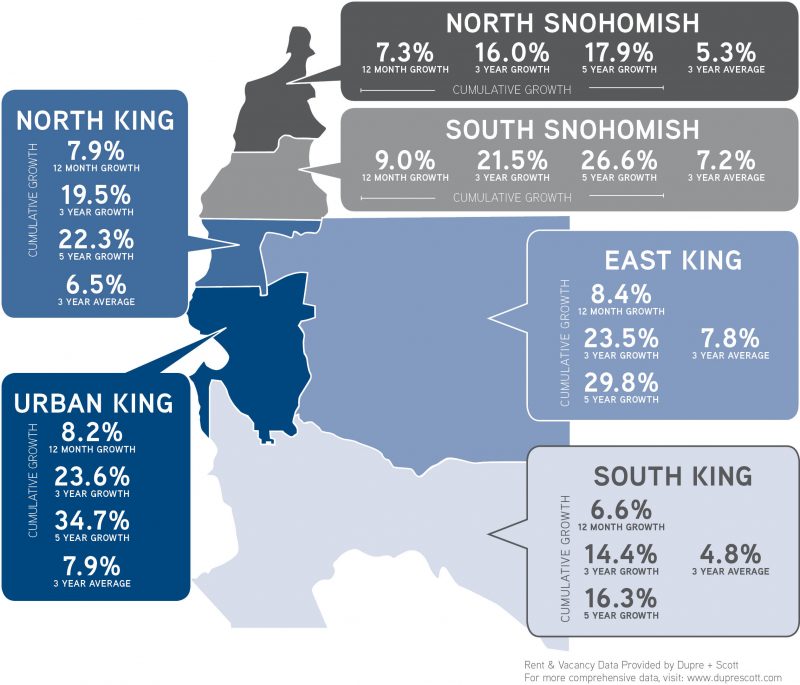

In our 2015 Apartment Market Study we analyzed 12 month, 36 month and 60 month rent trends, both annually and cumulatively. The following graphic summarizes conclusions by macro-market in King and Snohomish County.

The most apparent trend is found in the top performing markets year-over-year:

- South Snohomish

- East King

- Urban King

For each of these markets rent growth is easily explained by way of the delivery of new, higher-cost apartments and growth in high-wage job sectors. Digging deeper into 3 year and 5 year trends, cumulative rent growth between 20% – 40% poignantly exemplifies the strength of these markets as high rental-rate growth markets.

2014 – 2015 Rent Growth Trends

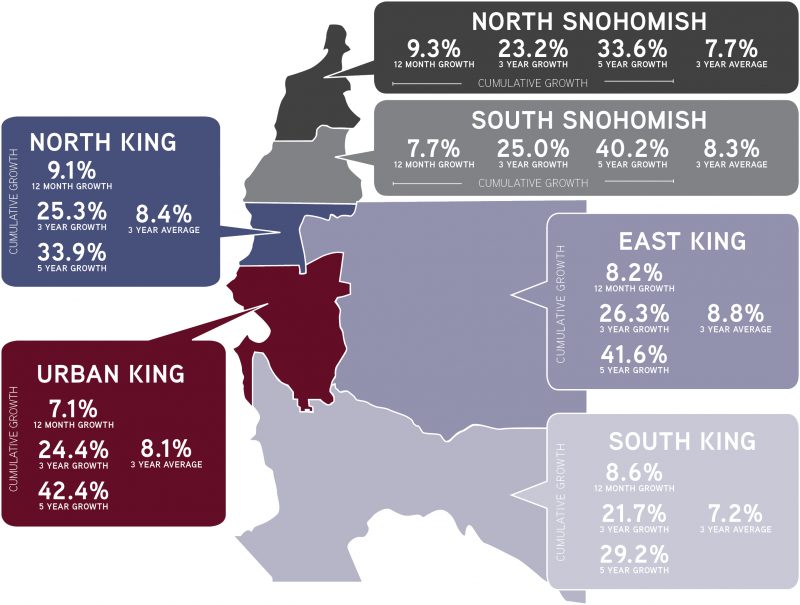

In the last week, we released our 2016 Apartment Market Study, analyzing the same 12 month, 36 month and 60 month rent trends – yet updated to capture the preceding 12 months of market performance.

A comparative analysis produces fascinating results. Of the six markets studied, year-over-year a 100% shift occurred – in 2015 the bottom three markets from 2014 outperformed ALL cohort markets.

2015 Top Performing Markets Year-over-Year:

- North Snohomish

- North King

- South King

In addition to outperforming its cohort markets, North/South King and North Snohomish County are beginning to gain ground on 3 year and 5 year trends. These market movements require significant study to anticipate rental-rate growth into the future.

Conclusions & Take-Aways

Rental-rate growth in secondary and tertiary markets adjacent to markets that previously had high rates of growth are poised for outperformance. Interestingly, these market have received very little new inventory of apartments and are forecast to continue to receive very new inventory. Quick reference to our 2016 Apartment Market Study illustrates the dearth of development in these markets.

Another gust of wind at the backs of suburban markets at lower monthly price-points is minimum wage growth. Higher minimum wages will benefit secondary markets to a far greater extent than urban markets.

Rental rates in the core, although facing headwinds in the form of keeping pace with wages and the addition of new supply, are likely to experience downward pressure – possibly simply slower growth projections. Yet another reason to look to markets with room for growth and precious little new supply competing for dollars and renters.

Keep in mind that certain core markets and properties are positioned for stellar performance based on individual characteristics of projects and strategic locations. Thoughtful analysis must be performed on the micro-level with any investment and hence the importance of expertise on trends in our market – both macro and micro.

Understanding both current and future market dynamics is critically important in positioning both your assets and your investment thesis for optimum returns. Our apartment investment sales team, comprised of four highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing buyers and sellers of apartment assets from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan