The Seattle apartment market is on fire… actually, white hot! Rising rents! Low vacancy! And an enormous apartment development pipeline, to boot! The question I am continually asked is if the market will be overbuilt. My response – it depends.

Any rudimentarily detailed analysis of absorption dynamics necessitates more than a binary “yes/no” quip to answer the speculative question of overbuilding. When faced with the question of overdevelopment I default to an analysis of where, when and what. The “where” is easy to spot, as is the “when”. My 2015 Seattle Apartment Market Study details the location of all major apartment projects in Seattle’s development pipeline, as well as anticipated delivery dates.

Yet approaching the question of “what” is both challenging and interesting. An analysis of what can include: construction type, price point, finishes, unit mix, et cetera, et cetera – ad naseum. I am particularly intrigued by the “what” category of construction type, particularly high-rise development.

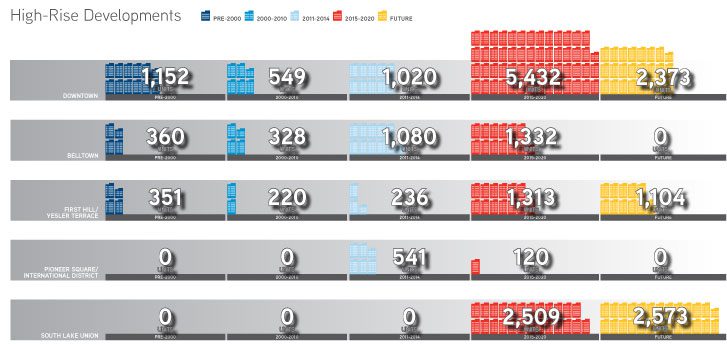

High-rise apartments form a category of their own. Zoning in no more than five neighborhoods allow for high-rise development. Design, labor pools, construction timelines and last-but-not-least, rent levels require a differentiated analysis. Taking a closer looks at the high-rise development pipeline, the analysis proves interesting.

Here are some simple facts and figures:

- Pre-2010 the Seattle market had 9 high-rise apartment buildings comprised of 2,961 units

- From 2011 – 2014 the market added 10 high-rise apartment buildings, adding 2,877 units – 100% inventory growth

- From 2015 – Future Planned projects, the market is set to add 51 high-rise building (yes… you read that right – FIVE-ONE) totaling an additional 16,761 units – a 300% increase in inventory as of 2014 and a near 600% increase over 2010 inventory levels.

First, some qualifiers. This analysis includes all buildings planned over 10 stories in the Seattle market, not every building covered in this analysis is a 40 story tower– yet a lot are. Some of these buildings will be delivered as condominiums – I forecast a low number. And finally, some of these buildings will not get built. That said, my phone rings every week with a new market entrant (developers and equity sources) who is looking at building a very large apartment project in Seattle.

The following provides a detailed analysis of high-rise deliveries versus inventory for each of the five neighborhoods in question. The time periods are specified in each analysis, as are the number of buildings and units added over time.

Downtown Seattle

It is appropriate to pronounce downtown Seattle as the epicenter of apartment high rise development. The time period between 2011 – 2014 nearly doubled downtown’s inventory of high-rise apartment units – and that is just the beginning. Delivery levels get very interesting in 2017 and 2018 with a very large number of projects planned for the future.

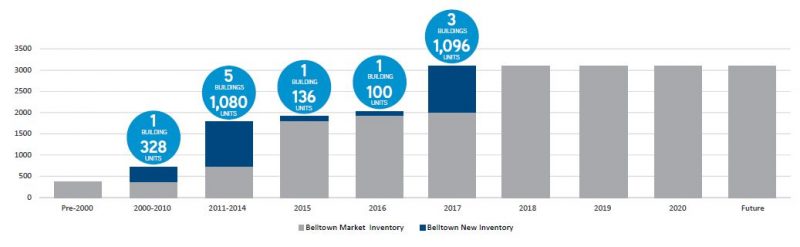

Belltown

Belltown is certainly on the rise. My thesis is that Belltown’s ascendancy as a fantastic neighborhood [again] will surprise many. In the latest real estate cycle, denoted here as 2011 – 2014, inventory of high-rise apartments in Belltown grew by 2.6x. Inventory levels are forecast to grow by 50% in 2017 and then level off for the future. For those who believe in a market that is flanked by Amazon.com’s global headquarters, a James Corner designed waterfront and a growing CBD, Belltown has a lot to offer.

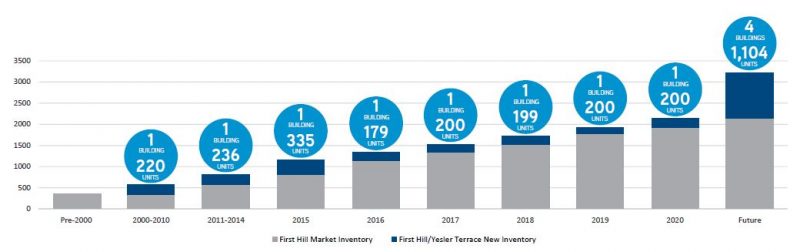

First Hill / Yesler Terrace

If there is ever a market demonstrating “steady” growth of high-rise apartment development, it is First Hill. In each year from 2011 – 2020 new projects are planned for delivery, without any massive onslaught planned at any one time. Yet, inventory levels will see a spike with the addition of Yesler Terrace to the definition of this neighborhood. Some may disagree with this grouping, yet time will be the arbiter of neighborhood boundaries.

Pioneer Square / International District

Rising from no high-rise inventory Pre-2010, Pioneer Square earned a place on the map with the magnificent arrival of The Post, NoLo and Wave, in addition to the arrival of +$3.00 square foot rents in Pioneer Square. Now that Pioneer Square has proved it mettle, it is time for others to take notice. This is not the first time I will say that Pioneer Square and the International District will surprise many in its [re]emergence as Seattle’s best neighborhood.

South Lake Union

It goes without saying that South Lake Union is Seattle’s fastest growing neighborhood. I provided a detailed analysis of the history of South Lake Union’s apartment development in my An Urban Neighborhood is Born article. The following graph illustrates the momentum and fervor at which high-rise development is taking shape in South Lake Union. The growth of high-rise development in South Lake Union will be exciting to watch!

The dedication of an entire article to high-rise apartment development is a testament to the importance of this segment of the apartment asset class. The above analysis only scratches the surface of development versus historical inventory, yet leaves topics of absorption levels, rental rates and vacancy forecasts for another day. Please contact me to discuss your apartment portfolio and how best to achieve the highest level of investment returns.