The last 10 years of the Puget Sound apartment market was a whirlwind: a massive market run-up (2012 – 2019) crashed into the COVID-19 shut-down (2020); then a rebirth and market rally (2021-2022) lead to a historical run-up in treasuries, and commensurably capital costs and declining sales values and volume (2022-2023).

Where is the market today?

Most don’t know.

But we do.

I am writing this update on my family’s summer vacation, sitting in a hipster coffee shop in Minneapolis’ trendy North Loop neighborhood, reflecting on the last 7 months of 2023, and busier than I’ve been in months.

We’ve been busy, very busy.

Our Team closed the sale of 23 apartment transactions so far in 2023.

By comparison, in Puget Sound only 86 apartment sales closed during the first half of 2023, compared to 163 sales during the same period in 2022 – a market stall of nearly 50%.

Puget Sound Apartment Sales Volume Falls off a Cliff

Source: Simon Anderson Multifamily Team Research

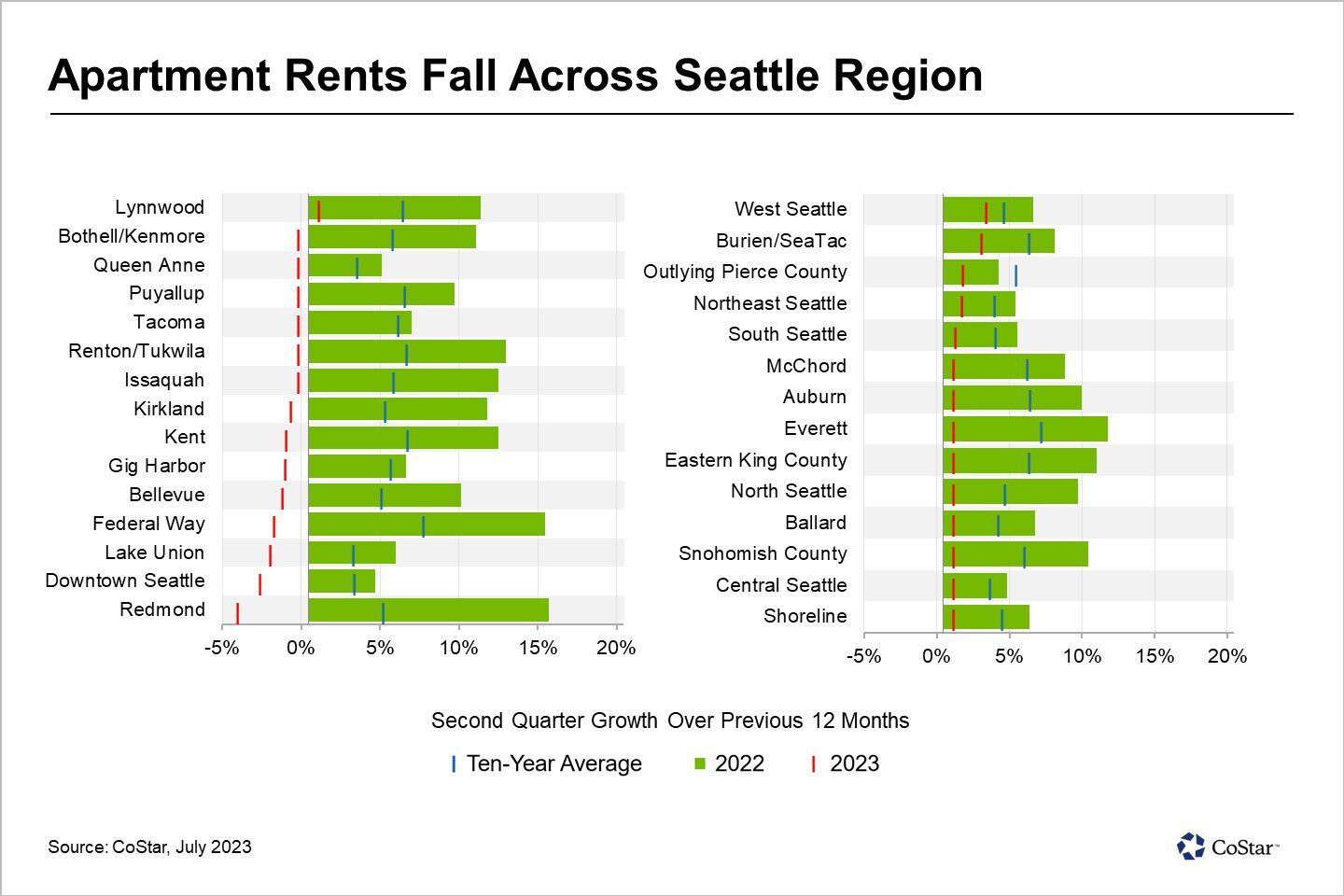

Theme 1: Rental Rates didn’t Sizzle this Summer

Every Fall/Winter in the Puget Sound, investors wait for Spring showers to jumpstart rental rates, and assuredly by May/June rental rates hit the typical summertime high.

In Summer 2023, that is just not the case. Demand for apartments across the region (and the entire state, for that matter) are generally flat – up a tick in some markets, struggling to grow in others.

Investors, and economic prognosticators, seem to believe that flat rental rate growth in 2023 is a predictor of the future. This same lament was present in 2010, post-GFC. However, the ensuing 10 years produced a 50% increase in rental rates throughout the region.

We are seeing grass shoots of economic vibrancy – office occupancy, downtown foot traffic, increased commute times – that will assuredly lead to the next wave of rental rate growth sooner than anyone is predicting.

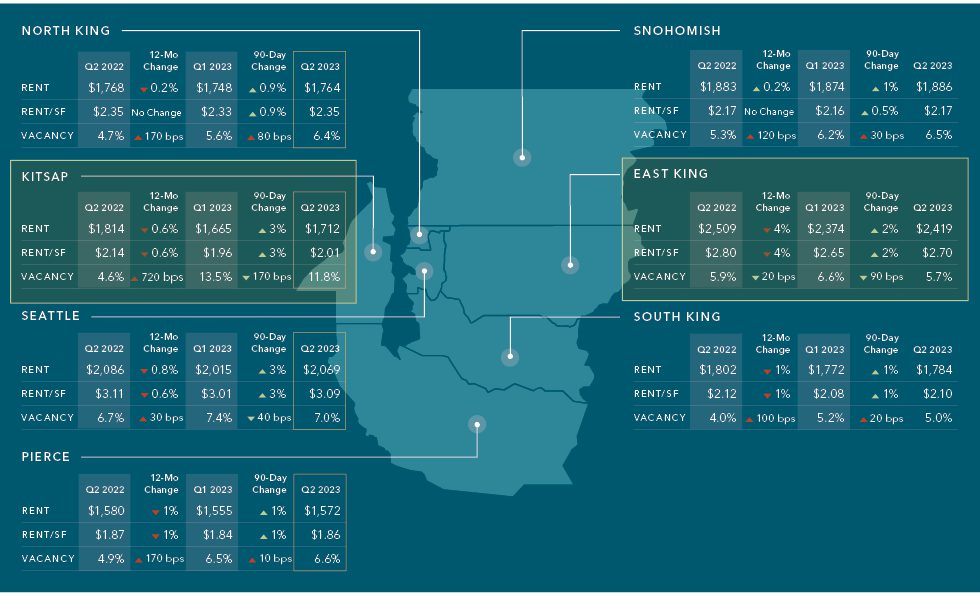

Theme 2: Vacancy Rose in Some Markets, yet Fell in Others

In a year of tepid rental rate growth, it’s important to look at the other side of the coin – vacancy. Generally, when rental rates are slow to grow, it’s a balancing act keeping apartment buildings full.

In many markets across Puget Sound, vacancy rates grew quarter-over-quarter – but not in all cases. In both East King and Kitsap Counties – markets with substantial apartment development pipelines – vacancy rates fell over the last 90-days as demand began to catch up with supply.

Puget Sound – Rental Rates versus Vacancy

Source: Simon Anderson Multifamily Team Research

Be sure to check out each market in our latest research report to see how each market performed during the last quarter, but also over the last several years.

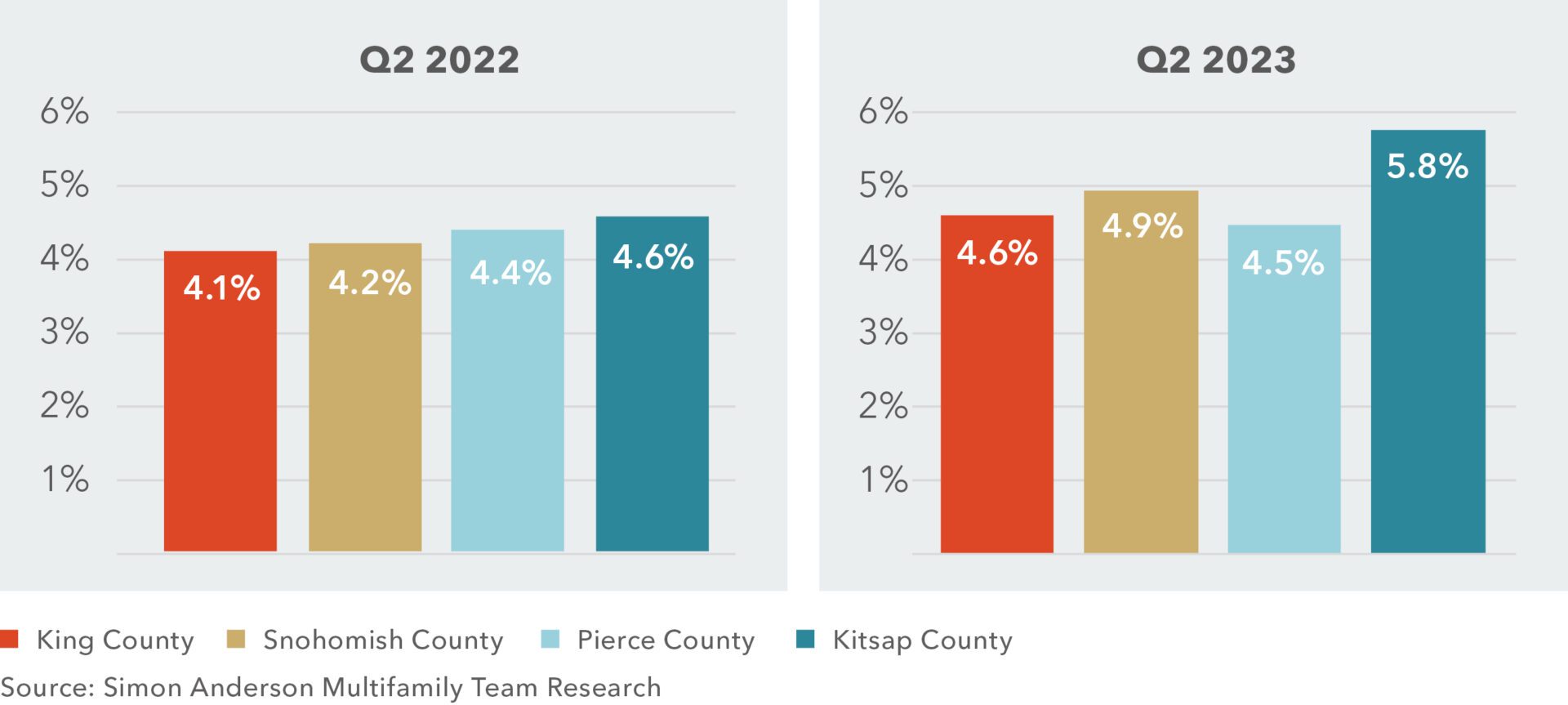

Theme 3: Capitalization Rates Expand 100+ Basis Points

It takes no further examination than looking at capitalization rates changes over the last 12 months to demonstrate why transaction volume slowed to a halt.

Comparing capitalization rates year-over-year shows 50 bps to 110 bps in capitalization rate expansion.

Puget Sound Cap Rates – Q2 2022 versus Q2 2023

Source: Simon Anderson Multifamily Team Research

As of mid-2023, apartment buyers are hunting down opportunities in the 5+ cap range given the cost of debt, concerns over near-term economic growth/rental rate growth, and expectation from investors.

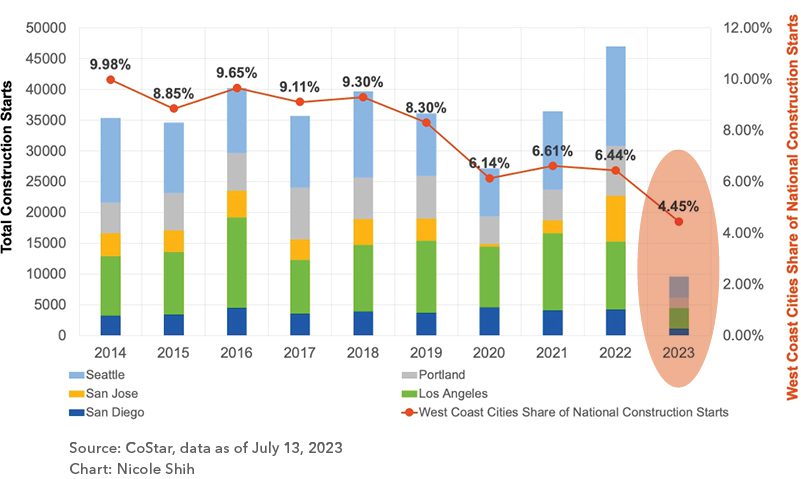

Theme 4: New Construction Cranes are Slow to Rise

We reported in our 2023 Apartment Development Pipeline Report over 140,000 apartment units are in the development pipeline for the region, with nearly 40,000 currently under construction. This is a massive pipeline – the largest ever. However, as new apartment buildings are delivered, few new projects are breaking ground.

The drop-off in actual construction starts (shovels in ground) versus developers having a permit and being able to start construction is as high as 70% — meaning that for every 10 developers that could start construction, only about 3 are actually moving forward.

West Coast Construction Starts Slump

Ask anyone who watches this development pipeline closely and they’ll predict slowing rental rate growth in the region due to concerns of oversupply. However, the facts they fail to discuss are: (1) the locations of much of this development are very concentrated; (2) most all of this new development is for luxury units, which will not impact 80%+ of existing inventory; and (3) most all of these units will deliver before 2025, leaving Puget Sound in its continued housing shortage.

Theme 5: Wait and See

The final theme we are seeing is Wait and See.

Employers are waiting and seeing what will happen as they pivot to a 3-day in the office strategy.

Renters are waiting and seeing before they move from suburban locations back to the urban core.

The Federal Reserve has slowed rate hike to wait and see what will happen with inflation.

And finally, sellers and buyers are waiting to see if the market will change before they commit to a sale or a purchase.

Our sense is that nothing monumental will seem to occur in the apartment market for the next 6-9 months.

However, behind the scenes, renters will have begun to move back to the urban core, apartment developments will deliver without new developments breaking ground behind them, and employers will implement plans to get everyone back to the office at least 4 days a week.

All this will lead to rent growth and sales value growth quicker than any investor or developer can react to time the market!

About Dylan Simon:

I specialize in the sale of apartment buildings and apartment development land across Puget Sound and Washington State. Our Team of 10 apartment investment sales professionals is dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.

CLICK HERE to contact a member of our team and to learn how we can help you Turn Our Expertise into Your Profit ©