Despite the current slowdown in the global economy, rental rates in the Puget Sound held firm during the past 3 months, averaging $1,900/month. However, the regional vacancy rate spiked 200 bps, demonstrating a mix of winter seasonality, and slowing absorption of the nearly 11,000 apartment units delivered in the past 12 months.

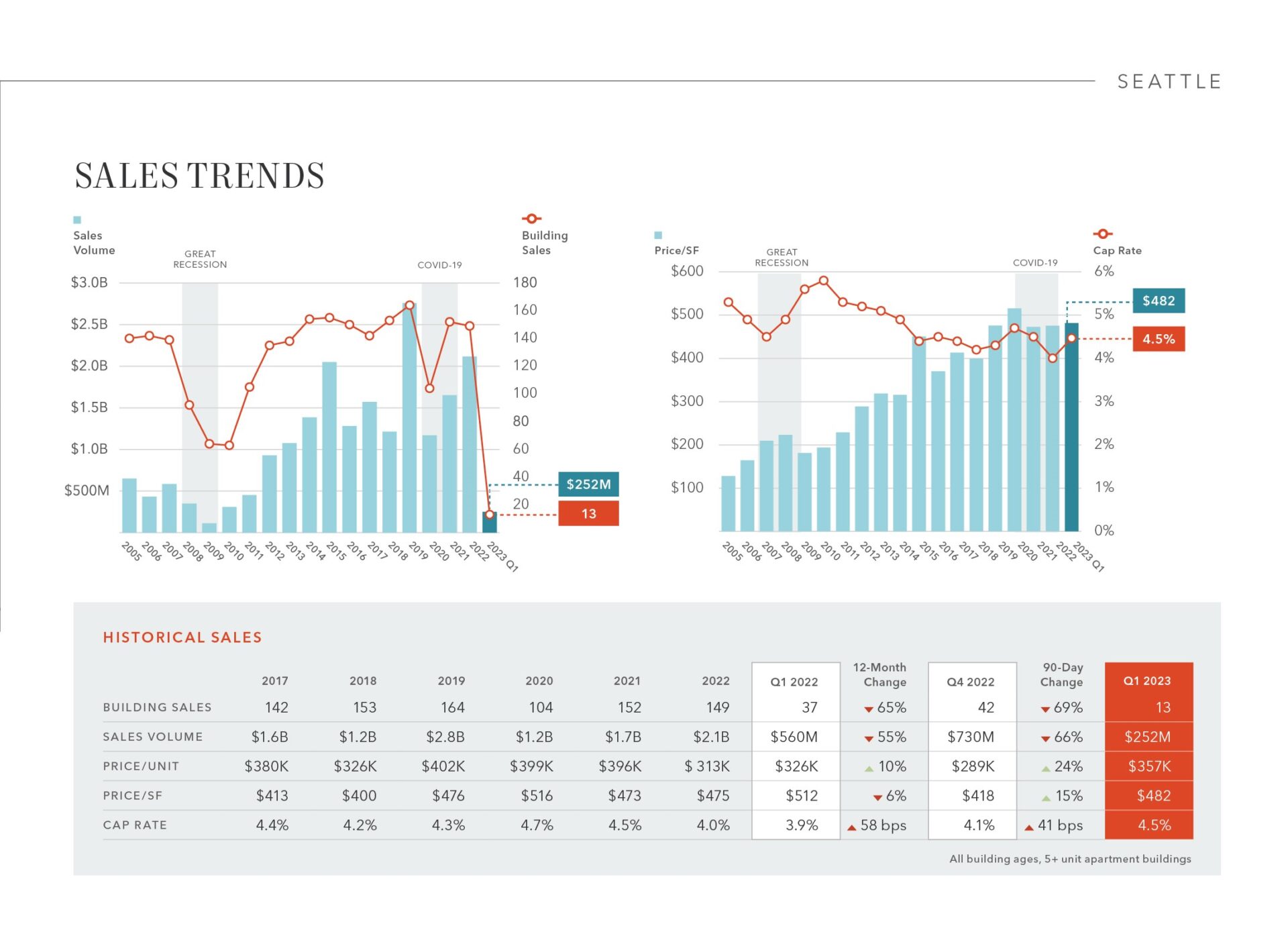

Apartment sales volume is down 50% year-over-year, with smaller sales (sub-$5 million) truly leading the market. Apartment sales activity above the $5 million price point slid 75% compared to Q1 2022.

Due to a dearth in sales volume, opining on a true market cap rate is challenging. Data from Q1 2023 sales suggests a market cap rate in the range of 4.5%, yet investor sentiment is closer to 5.0%.

Through our research across the region, three trends emerged:

- Not all urban markets are performing the same

- Pent-up investment demand will cause the bow to break in certain markets

- Old trends are emerging in some new markets

Not All Urban Markets are Performing the Same

Despite relatively flat rent growth across the region during the last 12 months, looking back the last 4 years demonstrates massive differences in rental rate growth across all markets. Suburban markets were the clear winners, posting cumulative rent growth from 2019 to 2023 in a range of 12.5% (Kitsap) to 22.5% (Snohomish).

Urban markets did not have such positive results across the board.

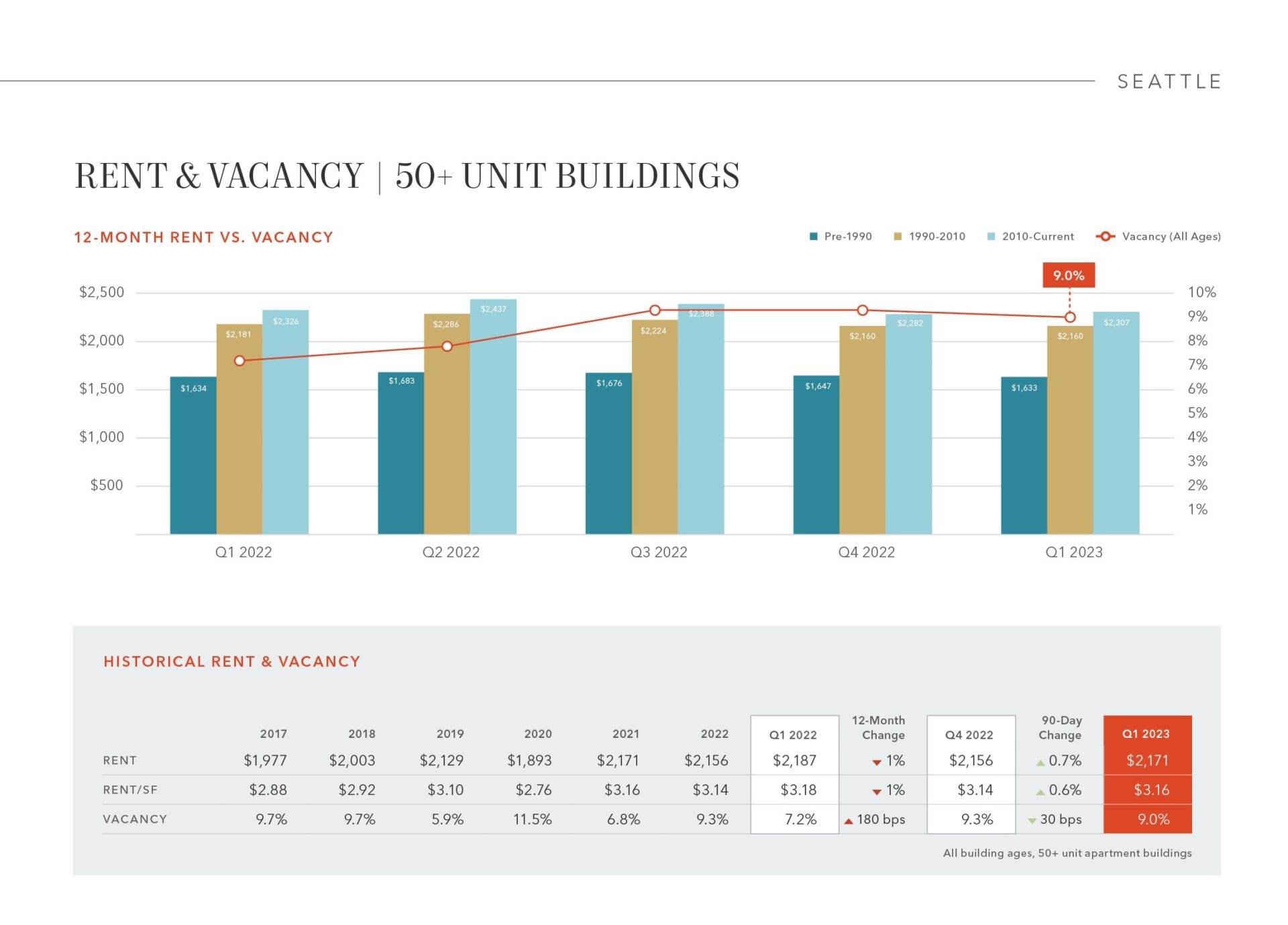

Looking at apartment buildings 50+ units in Seattle, cumulative rent growth from 2019 to 2023 was just a tick under 2.0%

Source: Simon | Anderson Multifamily Team Research

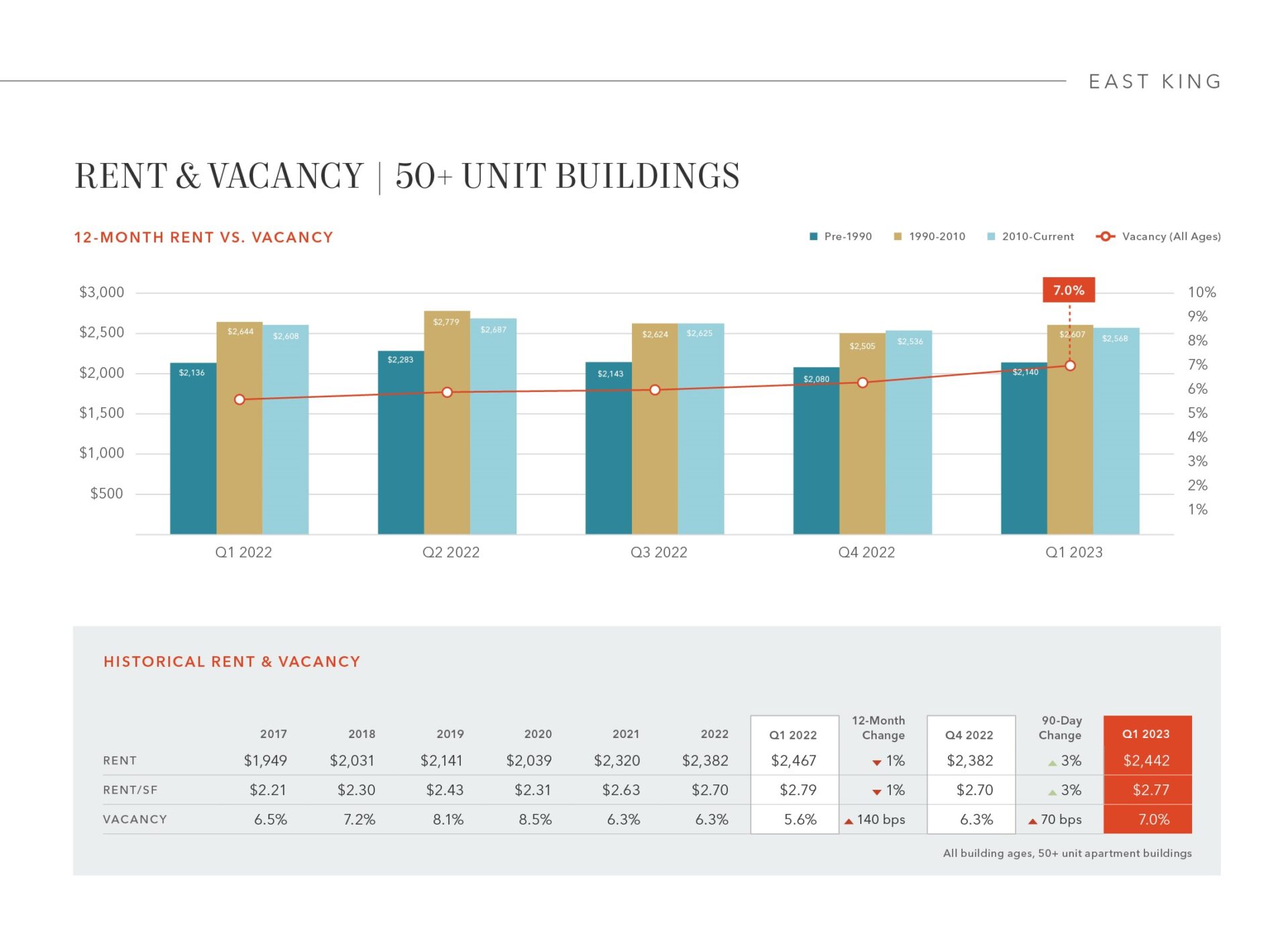

Turning towards the region’s Eastside, cumulative rent growth from 2019 to 2023 topped 14%.

Source: Simon | Anderson Multifamily Team Research

Although not besting purely suburban markets, the rapidly urbanizing Eastside clearly demonstrated its resilience the past several years.

Pent-up Investment Demand will cause the Bow to Break in Certain Markets

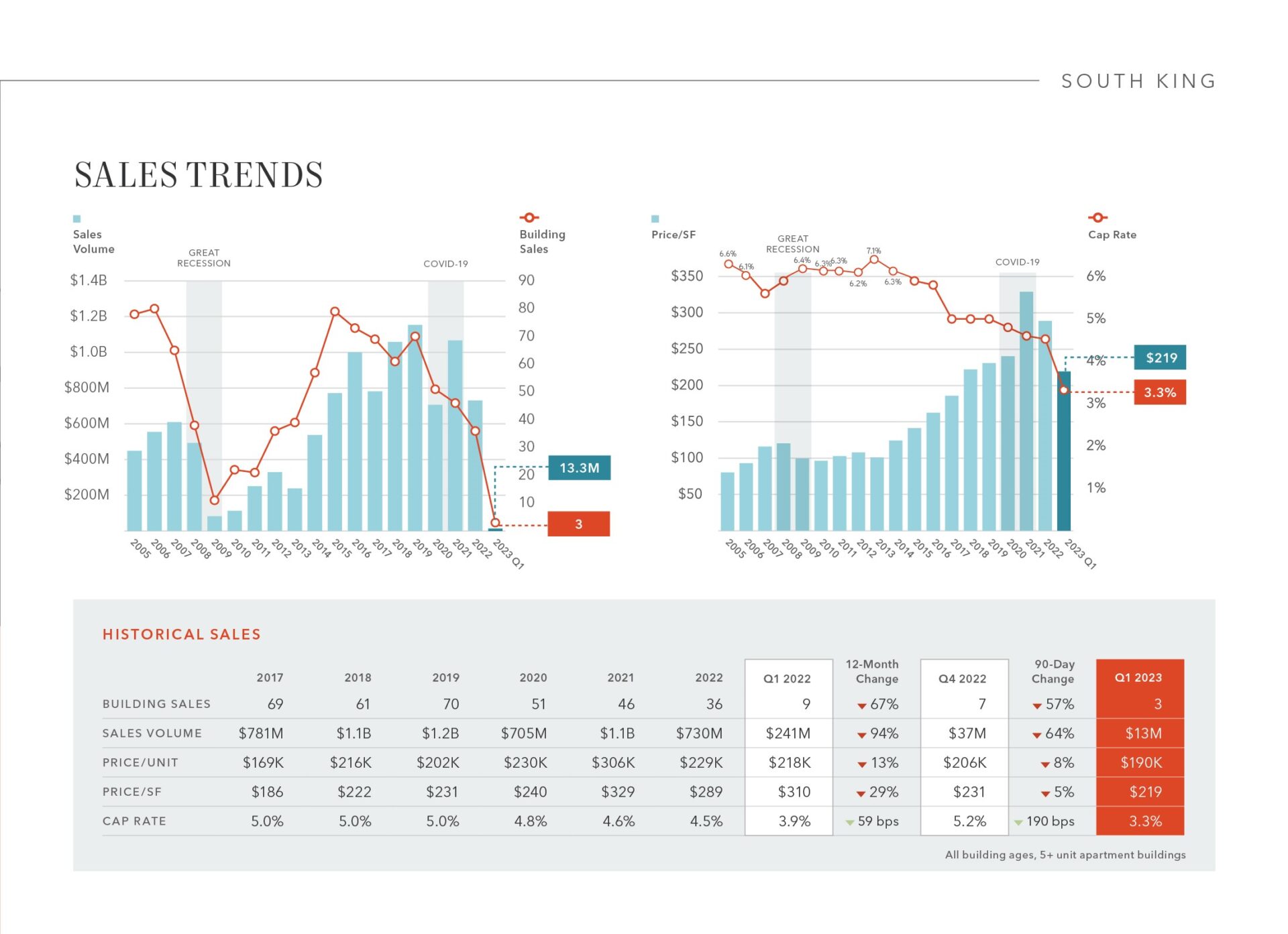

Inarguably, one of the most heavily traded suburban investment markets in the entire Puget Sound is South King. From 2017 to 2021, South King averaged 50 apartment sales every year.

In Q1 2023, only 3 sales closed, totaling only $13.3M.

Source: Simon | Anderson Multifamily Team Research

Snohomish County is the clear runner-up in slowed sales volume. With an average of 75 apartment sales every year from 2017 to 2021, Snohomish experienced only 13 apartment sales in Q1 2023, a reduction in sales volume of 83%.

Seattle is the clear winner by volume of transaction decline. This market experienced nearly 150 apartment sales every year from 2017 to 2021. The 13 sales in Q1 2023 was the slowest investment sales start in 10 years, making a 90% slide in sales volume.

Source: Simon | Anderson Multifamily Team Research

The bow will break in the next 6 to 9 months and when it does, expect these markets to gain steam the fastest.

Old Trends are Emerging in Some New Markets

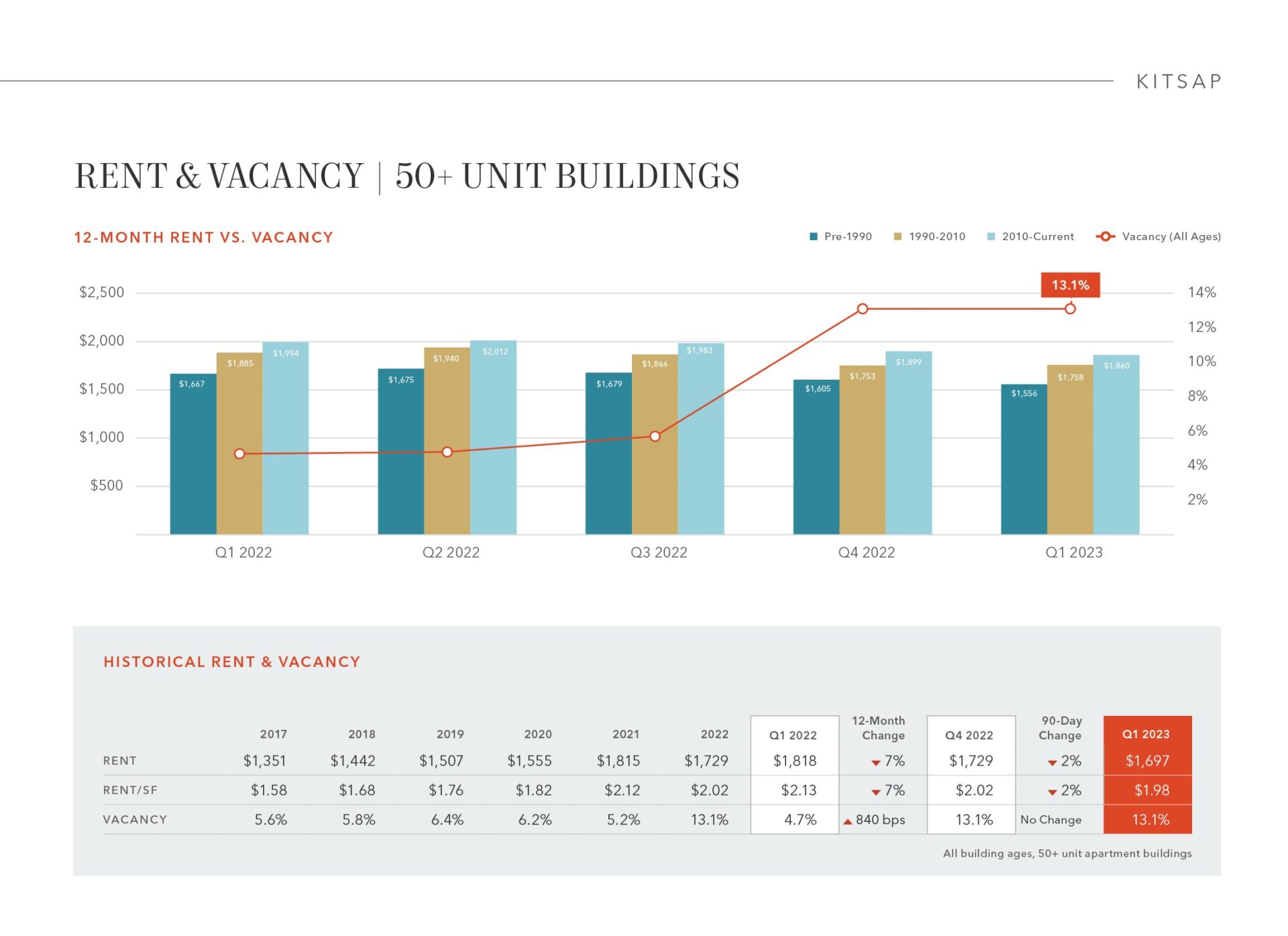

The bullet-train of urban renewal and rental rate growth that came to define the “new” Kitsap County during the last several years nearly came to a screeching halt during the past 6-months.

The delivery of new apartment units coincided [im]perfectly with military deployments – the kind that haunted the “old” Kitsap County – to conspire in a 13% vacancy rate (some owners reporting much higher, on the order of magnitude of 25%).

Source: Simon | Anderson Multifamily Team Research

Is Kitsap off the map for continued growth and resilience?

Certainly not!

Kitsap – and all that it has to offer – will regain is trajectory of continued growth soon enough, yet the reminder of its dependence on military housing will remain a bit closer to mind (for now).

What Does Q1 Tell us About the Balance of 2023

The first quarter clearly ended in a whisper, not a shout. Apartment operators are patiently waiting on the impact of a return-to-work mandate from many of the region’s largest employers.

Rents are holding, but will they outpace increases in supply and operational costs that are eroding NOI?

Its likely that the market will creep along in the current stasis, not getting worse, nor materially better until we see the other side of continuous rate hikes. Many are calling for another 6-9 months of muted demand, meaning that the back-9 of 2023 will be played defensively.

Similarly, prognosticators of a market bottom in the investment sales market are calling for “price discovery” in Q4/Q1 2024 – too far out in the horizon to come into focus.

As a seller, now is a good time to test the market. There is little-to-know offerings on the market, and fewer reflective of today’s pricing.

As a buyer, remain sidelined at your peril.

Once the market gains steam – and it invariably will – pricing will move faster than you can react!

About Dylan Simon:

I specialize in the sale of apartment buildings and apartment development across Puget Sound and Washington State. Our Team of 10 apartment investment sales professionals is dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.

CLICK HERE to contact a member of our team and to learn how we can help you Turn Our Expertise into Your Profit ©