You are tracking 15 apartment sales right now?” I exclaimed. I probed further … “what city?”

“The entire West Coast!”, he said.

I was talking to an apartment investor based in San Francisco, and he was talking about a pipeline of sales activity that normally tops 75+ active listings.

We are in the most anemic time of apartment sales volume since the Great Financial Crisis (GFC).

But unlike the GFC when there was a crisis of capital – we are in a crisis of confidence!

Buyers lack confidence in near-term economic growth, and thereby renter demand. Would-be sellers lack confidence buyers are willing to come to the table at realistic pricing.

As a result, Q1 2023 came and went with nearly zero capital market fanfare.

The following article covers:

- Sales Volume

- Pricing

- Buyers in the Market

We are assuredly in store for far greater excitement in apartment investment markets, right?

Not so fast!

Sales Activity: Volume

According to the Wall Street Journal, nationally, apartment sales volume dropped by 74% in Q1 2023, marking a 14-year low in sales volume.

Our team tracks every apartment sale in Western Washington, and only 15 apartments sales greater than $1M closed in Q1 in all of Puget Sound.

This astoundingly low number is compared to a 5-year average of 57 sales in the first quarter of each year (Q1 2022: 60 sales / Q1 2021: 49 sales / Q1 2020: 43 sales / Q1 2019: 67 sales / Q1 2018: 66 sales). This 75% decrease in regional sales volume corroborates national trends.

Puget Sound Apartment Sales Volume

(Q1 2013 to Q1 2023; Sales $1M to $100M)

Source: Real Capital Analytics

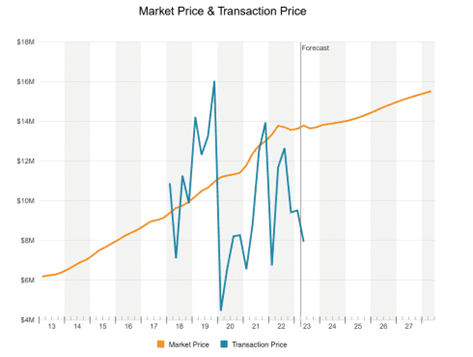

Sales Activity: Pricing

Trying to discern changes in pricing during this last quarter is a much more difficult exercise.

Normalizing sales data for the last 16 quarters is equally challenging!

With the announcement of a massive increase to the real estate excise tax (REET) in Washington State, sales volume – and pricing – accelerated in 2019. The following year, apartment pricing took a sharp dip, then plateau during the first year of COVID (March 2020 – March 2021). Strong renter demand, and extremely low interest rates, resulted in surging apartment values the following year (April 2021 – April 2022). Unfortunately, high values surged into a brick wall of massively accelerating interest rates by Spring 2022.

Accordingly, the last four years of apartment sales data is a yo-yo of ups and downs, and very hard to interpret.

Puget Sound Apartment Sales Values

2018 to Q1 2023 – Actual versus Market Pricing

Source: CoStar

Buyers are calculating purchase prices mathematically, solving for a return – while sellers are looking at historical data to validate both the propriety in selling, and to arrive at a “fair” sales value.

At the end of the day, pricing is likely off absolute peak by 10% to 20% — and where to measure that peak is an additional, murky business.

If you really want to understand what your apartment building is worth today, I suggest you simply call us!

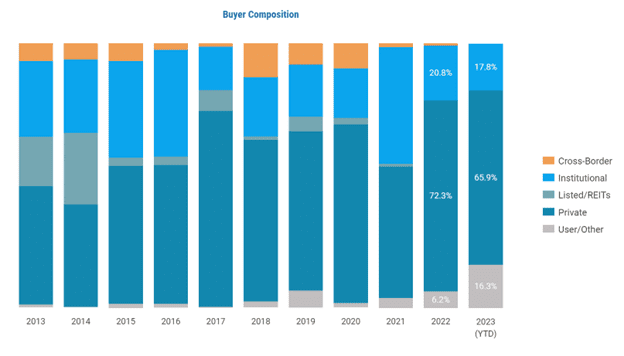

Sales Activity: Buyers

As far as buyers, the predominance of recent sales are occurring between private buyers and sellers. The following graphic demonstrates that in Q1 2023 foreign buyers and REITs were completely out of the market, and institutional buyers are a diminishing share of the buyer pool.

Puget Sound Apartment Sales

2013 to 2023 YTD; Sales $1M to $100M

Source: Real Capital Analytics

Currently, the private client space of apartment transactions is weathering the capital market storm. With each closing we expect to see the bid-ask spread narrow as investors gain confidence in “price discovery”.

I expect we’ll see the leaves change color in the Fall before the same conclusions will be drawn in the space of institutional capital.

Will Sales Surge this Summer?

We have a few more months of uncertainty and unwinding ahead of us, yet I still don’t see enough clarity for a reversal in the sales market.

I expect that we will start to see a greater volume of listings come to market as we enter May and June, yet I expect that it will pale in comparison to previous years.

Additionally, we are hearing in the market that there are very few “real” sellers – meaning all that is listed will not sell. I expect the bid-ask spread will narrow, yet not in the favor of buyers.

It is very likely that the weight (and wait …) of sidelined capital will work to dethaw an otherwise frozen market before sellers adjust pricing much more than the market experienced during the last 6 months.

As a seller, now is a good time to test the market.

As a buyer, remain sidelined at your peril.

Once the market gains steam – and it invariably will – pricing will move faster than you can react!

About Dylan Simon:

I specialize in the sale of apartment buildings and apartment development land across Washington State. With my co-founder, Jerrid Anderson, we operate a team of 11 apartment sales professionals dedicated to helping apartment owners and investors sell and buy apartment buildings and development land from $1 million to over $100 million.

CLICK HERE to contact a member of our team and to learn how we can help you Turn Our Expertise into Your Profit ©