On October 20th we had the privilege to address over 400 multifamily industry professionals with our Pacific Northwest State of the Apartment Market presentation. This presentation encompassed a 57-slide overview of the region’s apartment fundamentals. It’s just over an hour long, yet packed with insights across all Puget Sound markets.

Click below to access the full video Presentation.

In this video we cover:

- Rent & Vacancy Trends

- Development Pipeline

- Future of Demand

- Sales Trends

- What’s to Come

If you don’t have an hour for the full video, the following summary provides a glimpse into our market data and insights.

Rent & Vacancy Trends

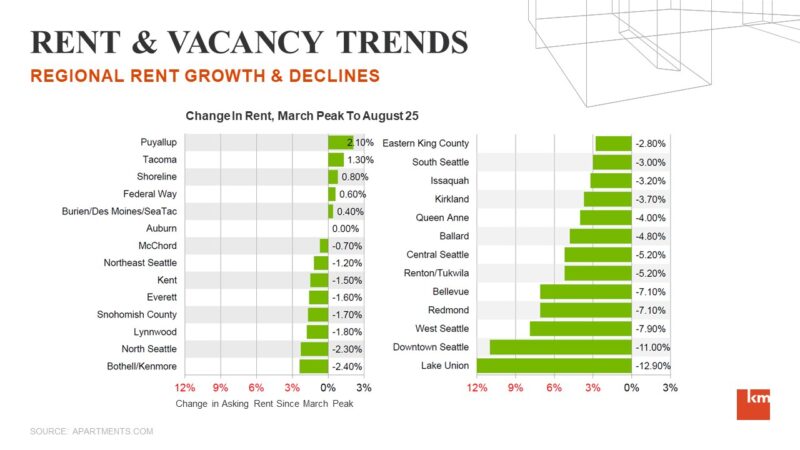

Although there is much talk about where rent levels are falling, there is not much discussion of markets experiencing rental rate increases – and they do exist. The differences between rental rates in the urban markets versus the suburban markets remain stark, and with greater affordability and more space, suburban markets are now outperforming core, urban markets.

Click HERE to access our Q3 Rent & Vacancy Research Report

Rental and vacancy rates don’t tell the full story as concessions and collection loss are playing critical roles in the overall picture of income collected in apartment properties. Our presentation provides a much fuller look at these trends, as well as forecasts on where rent and vacancy levels may be headed – and for how long!

Key takeaways from our presentation include:

- Rent & vacancy rates are changing quickly, and each submarket is behaving differently

- Collections issues are posing challenges to valuations for sales and refinances

- Concessions are creeping into nearly all markets, not just lease-ups

- Income collection is likely volatile for the next 12 – 24 months until broad market stability

Development Pipeline

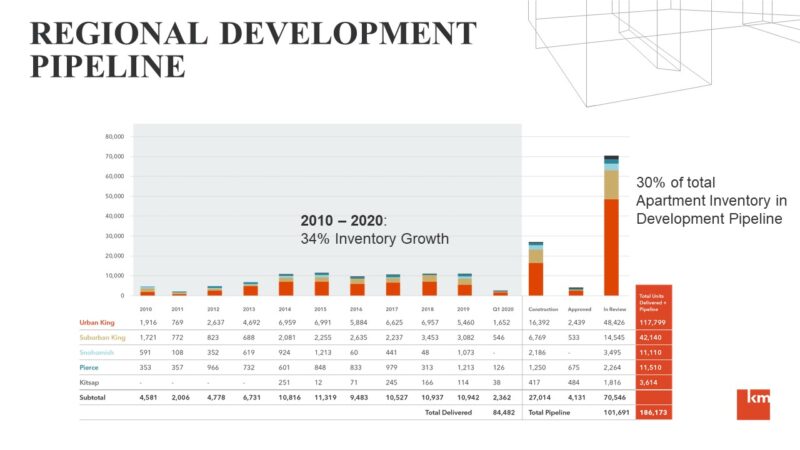

It’s no surprise to anyone familiar with the Puget Sound market that developers have been on a tear this past decade delivering 85,000 new apartment units since 2010. What is less apparent from the smattering of cranes in the sky is that another 100,000 apartment units are in the development pipeline – only 27,000 of which are currently under construction.

Click HERE to access our Apartment Development Pipeline Research Report

With apartment developers in a position to add an additional 100,000 apartment units to the region’s apartment stock over the first half of the decade, it’s important to understand the critical balance of supply to demand.

Key takeaways from our presentation include:

- 8,000 to 10,000 apartment units will be delivered each year for the next 3 years

- Concentration of new deliveries could post near-term absorption challenges

- Development pipeline is slowing while developers wait for rent growth and construction costs abatement

- The pre-COVID-19 trend shifting from urban to suburban development is accelerating

Future of Demand

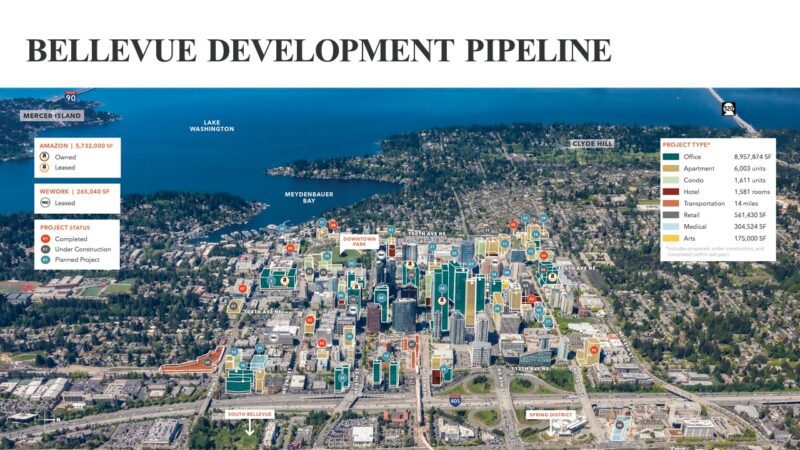

All eyes are on the Eastside as major tech employers venture east and the allure of suburban living finds momentum in the post-COIV-19 era. All Eastside markets seem buoyed by renter and investor demand – yet Downtown Bellevue remains the major benefactor of such trends.

Nearly 10M square feet of Class A office is either under construction, development, or proposal – with Amazon claiming upwards of a 6M square foot footprint.

Proximity to job centers, lifestyle amenities, and the allure of suburban comforts continue to fuel interest across all Eastside markets – if not in spite of COVID-19, possibly inspired by it.

Key takeaways from our presentation include:

- Office demand remains high, leading to increased apartment demand

- Eastside “Hub & Spoke” markets create nodes of suburban office and apartment development

- Increased interest in Eastside signals long-term balancing versus shifting away from Seattle

Sales Trends

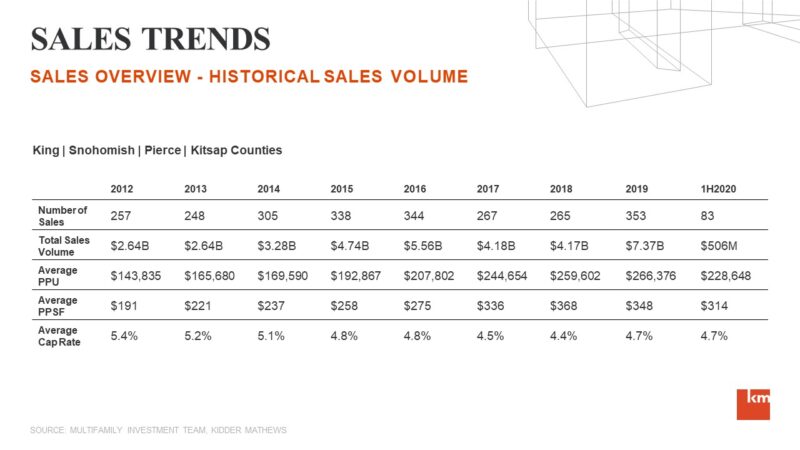

Following the banner sales year of 2019 – with nearly $7.4B in sales – eclipsing the previous record sales year in 2016 by over 30%, 2020 is unsurprisingly a slow year for apartment sales. However, is a surprise that capitalization rates are holding firm and on trend with the previous year’s sales.

Click HERE to access our Mid-Year Apartment Sales Research Report

We expect that apartment sales will remain slow for the remainder of the year; however, the lull in sales won’t last. With low interest rates, capital needing a home, and investors getting more comfortable with the impacts of COVID-19, the current bid-ask spread is already showing signs of narrowing.

Key takeaways from our presentation include:

- Bid-ask spreads slowed the sales market in 2020 by greater than 70% year-over-year

- It’s all about NOI in 2020, cap rates are holding as buyers focus on collected income

- Low interest rates vastly help deals pencil as capital seeks a home

- Sales volume will pick-up coming into 2021

What’s to Come

When analyzing what is to come, it’s important to focus on both the near-term and long-term, without getting too fixated on either as neither will unfold exactly how anyone predicts.

Near-Term key takeaways from our presentation include:

- Balancing rental rates with vacancy and concessions will remain a tough balancing act

- Newly constructed buildings and over-leveraged buildings are the riskiest assets

- Trimming expenses will be challenging with rising operational costs and high tax assessments

- Reversing trends from the previous cycle may or may not be here to stay

Long-Term key takeaways from our presentation include:

- Seattle remains resilient and will be one of the 1st markets in the nation to experience economic vibrancy

- Global health, science, and technology sectors will lead the recovery in the PNW

- Everyone will agree we are recovered by 2024, but the recovery will form by mid-2022

Whether you own an apartment building or development land and want/need to sell, or you are looking to get into the Seattle/Puget Sound market–deals are still getting done.

We can help with a Free Valuation of Your Apartment Building or answering questions about lending for both new acquisitions and refinances (contact Alex Mundy).

Working with a capable, experienced, and active team of sales and lending experts is always important–and such sage guidance was never more necessary than it is today.

Give us a call to Turn Our Expertise into Your Profit!