Time flies when you’re having fun, right?

We find ourselves in our third straight month of lockdown, battered and bruised by the push and pull of news headlines, confounded by a stock market that defines resilience (yet maybe defies reality), and up against local policy factors that make operating apartment units more complex than ever.

Given all these factors, how is it really going out there?

Surprisingly well.

Apartment investments remain the darling asset class of commercial real estate. Everyone needs a place to live, especially when ordered by the government to remain in their homes.

In the following analysis, we will revisit data tracking more than 44,000 apartment units in the Puget Sound region for the last five months:

- Rental Rates: asking rental rates ticked up slightly, yet the deeper story is rates on signed leases

- Occupancy: holding strong at 93.4%, far ahead of the early days of the last recession

- Collection Loss: landlords collected less rent in May than in April; however, nearly 93% is still collected

- Renewal Rates: residents are renewing leases 60% of the time, off from a peak of 66% in April

From our analysis of the data we’ve collected, we are finding deeper and more telling trends emerging.

Rental Rates

Over the course of the last several months, we tracked property level operations across King County, covering approximately 280 apartment buildings comprising more than 44,000 units. Our dataset includes buildings as small as 20 units and larger than 300 units, with a wide range of ages and locations throughout urban and suburban King County.

In-place rental rates within our dataset remain mostly flat with a slight uptick – which, under current conditions is an indicator of the strength and resilience of the local apartment market.

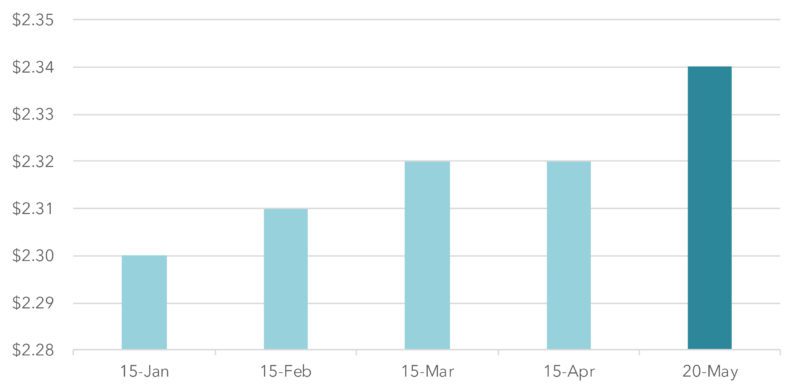

King County Apartment Rental Rates

Average Price per Square Foot

Finding a reliable dataset is nearly impossible – especially when reviewing such short periods of time and facing varying economic conditions. Our local dataset suggests that rental rates increased slightly (1.7%) over the last five months.

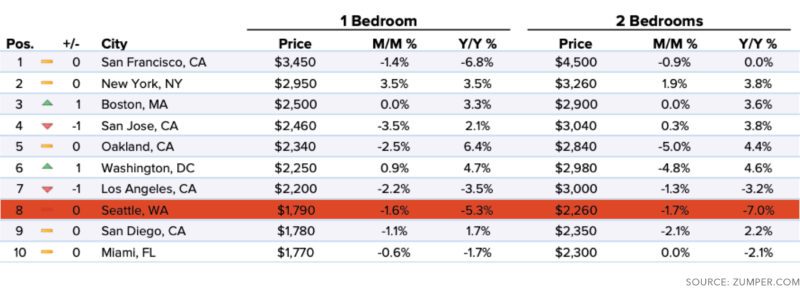

Turning to another group measuring rental rates, Zumper, its data shows month-over-month and year-over-year declines in apartment rental rates for Seattle.

National Apartment Rental Rates

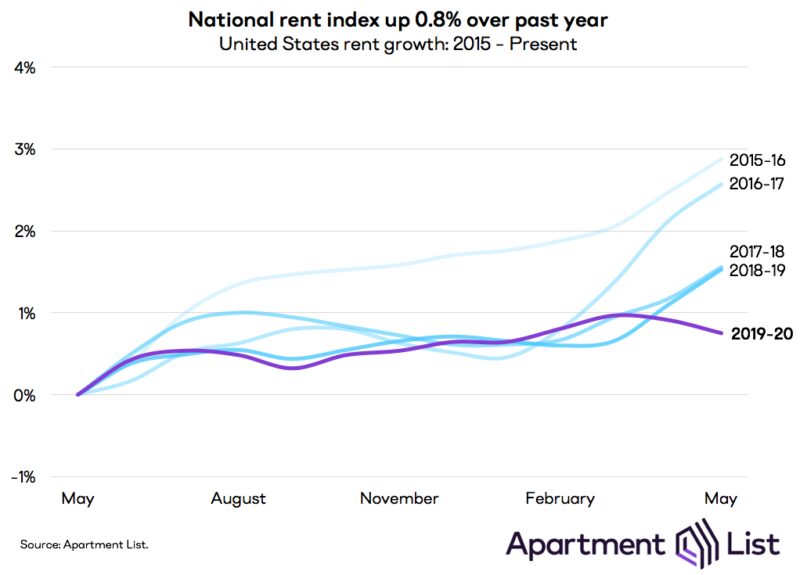

Apartment List also provides a dataset that demonstrates a year-over-year increase in national rental rates, yet a softening amid COVID-19.

The noise in data is very often found in “asking” rental rates (how most surveys are conducted) and effective rental rates (where leases are signed, the harder to access data). Both Zumper and Apartment List show asking rental rates, whereas our local dataset blends new leases with in-place leases – both of which are effective rental rates and more accurate.

Just when we think that we have the tiger by the tail in our analysis, RealPage suggests that newly signed leases are inked below asking rates, which provides further mixed signals on actual, effective apartment rental rates.

Truth is often found in the middle, which would suggest that rental rates in Seattle are experiencing no growth, but also no decline just yet.

PUNCHLINE: Rental rates are not currently experiencing large shifts, but we are not yet out of the woods.

Occupancy

It would stand to reason that if people are not legally permitted to leave their homes – nor legally obligated to pay rent – that occupancy would remain steady. And that it has.

In March we predicted that the early indications of distress in the apartment market would manifest in collection loss (rent due, but not paid) rather than high vacancy and rental rate declines. Such a prediction is bearing in the data.

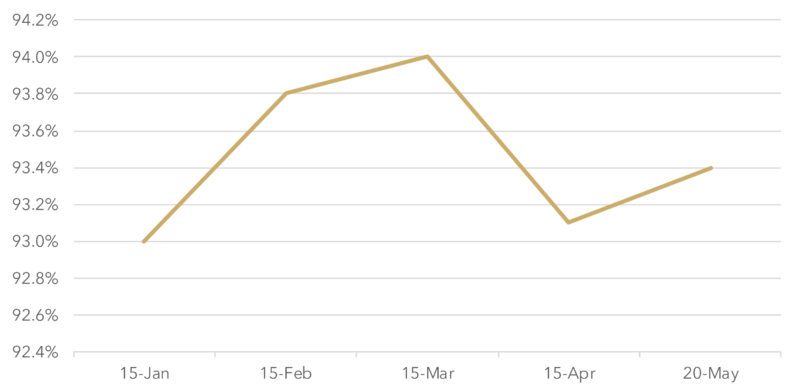

King County Apartment Occupancy Trends

Our further prediction is that the market will experience a slight decline in occupancy near the end of summer as residents who are unable to afford their apartment in the long run make a shift before the very long, cold, dark months of fall and winter in Seattle.

Given strong demand drivers in the region, we expect that regional occupancy will remain strong, but we’ll experience some declines in localized markets with the most competition, e.g., lease-ups of new developments.

PUNCHLINE: Occupancy is not yet an indicator to watch in the near term.

Collection Loss

If there is a predictive metric that all eyes are squarely trained on, it is collection loss. In fact, it was ill-conceived conclusions that upwards of 30% of renters were not paying rent which prompted our deeper analyses of collection loss.

The viability of such conclusions was ill fated: the apartment market simply outperformed all predictions.

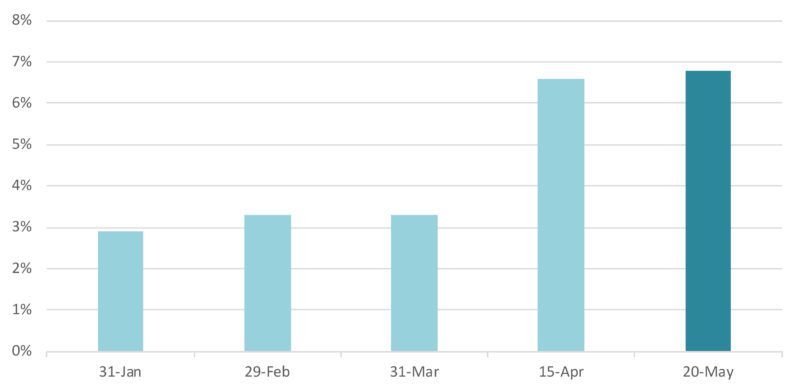

On average, collection loss in our region is 6.8% – meaning landlords are collecting 93.2% of rent payments. Many buildings are collecting 100%, while others are working hard all month long to claw up to 90%.

King County Apartment Collection Loss

Again, our dataset is a subset of the region (a sample size of approximately 20%), so we turn to national data to obtain a broader picture of the market. The National Multifamily Housing Council (NMHC) continues to run a series they call the NMHC Rent Payment Tracker. This tracker covers slightly more units – just over 11 million – yet the data is far from regionally specific.

Three distinct conclusions may be drawn from this data:

- Seattle continues to outperform the nation

- Rent collected post-COVID is not far off from pre-COVID months

- It is best to survey near month’s end*

*For May we adjusted our own data collection from the 15th of each month to the 20th.

One of the most important factors outside of geographic region is when the data is collected, as payments steadily increase each week of the month, which is further supported by RealPage data: Apartment Rent Payments Make Progress by Week Two.

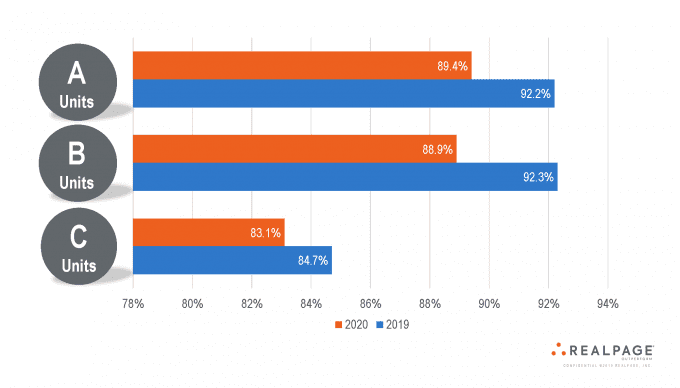

The final element that takes additional study is the difference in rent collection among classes of apartment units, with Class A and Class B apartments far outperforming Class C apartment buildings.

Rent Collection Rate by Apartment Class

2019 – 2020, Year-Over-Year

PUNCHLINE: Collection loss was the biggest bogey in early COVID analysis. Dire prognostications are proving more fiction than fact.

Renewal Rates

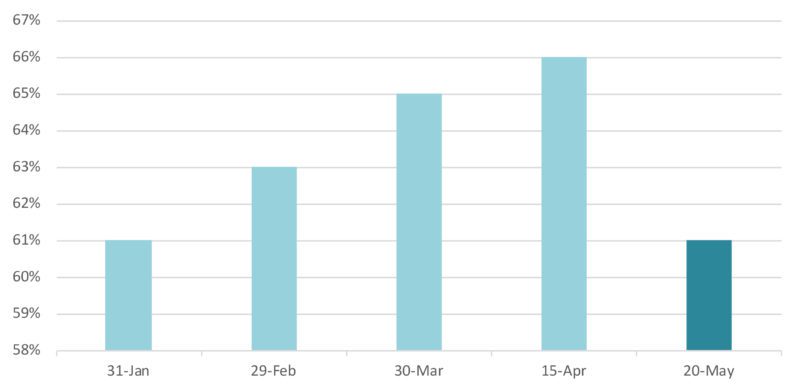

It’s an easy decision to renew your lease when you aren’t allowed to move, nor are required to pay. As such, renewal rates remain high, but no longer as high as they once were.

Our intense data tracking from January through May 2020 demonstrates an arc to renewal rates, first starting where you’d expect in the winter (high at 61%), then predictably increasing at the height of COVID in March-April (66%). Rates have since fallen slightly but are still far above the national average of 53%.

King County Apartment Lease Renewal Rates

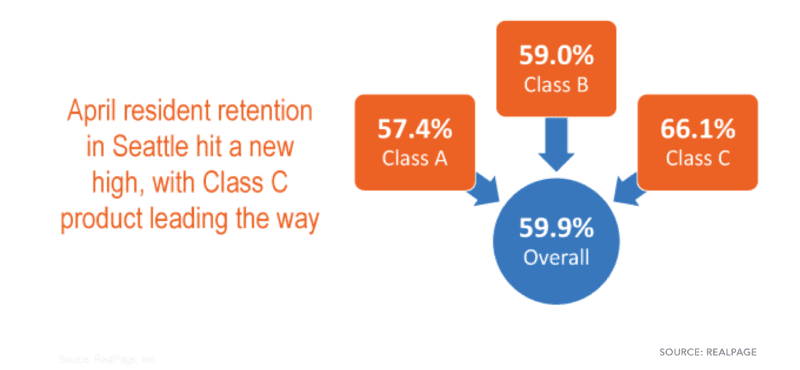

Although resident retention in Seattle hit a 10-year peak in April – prompting a RealPage article on Seattle’s “decade high” renewal rates – in May residents appeared to show less commitment and possibly plans for a move in the months ahead.

Interestingly, RealPage dissects renewal rates by building class, demonstrating the highest degree of renewals in Class C buildings and possibly telegraphing that residents who have the least ability to make a change are seeking to secure housing for the future.

With no ability to raise rental rates nor evict residents, there is little downside to lapsing to a month-to-month lease. Further, with uncertainty of when people will go back to work and with savings possibly declining, non-renewals could signal renters assessing a move.

PUNCHLINE: Falling renewal rates is a key metric to watch. Expect a shuffle in the market come Q3-Q4 that will undoubtedly impact rental rates and occupancy.

Where We’re Focused

We remain busy and are working hard for clients. We continue to put transactions together and are coming to market with new listings in June. Although it’s not quite business as usual, business is bustling and we are finding new pathways to transactions – for both existing apartment buildings and development sites.

Our sights remained focused on our clients, watchful of potential structural issues and warning signs; however, our team is ebullient and excited about the economic vibrancy and viability of the Puget Sound region. Please give us a call to Turn Our Expertise into Your Profit!

Want to keep up with our apartment and land listings, research, and industry updates throughout 2020? Subscribe to our investor newsletter and follow our team page on LinkedIn.