Collection Loss on 44,000 Seattle Area Apartments

We find ourselves in strange times indeed. How does one treat time in a slowed world?

Netflix’s stock price and the volume of alcohol sales are good metrics of changed daily activity. Trampoline sales are through the roof. Goat-2-Meeting is a real thing should you want to wild-up your Zoom call with a llama, or perchance you favor a namesake goat!

Here at Seattle Multifamily Team [virtual] headquarters, when we find ourselves with a bit of extra time and the question “What is happening in the apartment world?” looms, we have one panacea: go to the data!

We have the data to answer compelling questions related to:

- Rental Rates

- Occupancy Trends

- Collection Loss

- Renewal/Retention Rates

What does the data tell us?

First, news headlines certainly don’t tell the whole story, much less the real story, of how Seattle area apartment buildings are performing.

Second, the apartment market is doing just fine – and certainly significantly better than nearly all other commercial real estate asset classes.

Finally, we are in early innings of how the current pandemic will impact the broader economy, and specifically the Puget Sound Apartment market.

How Did We Get Here?

If you read nearly any article, industry publication, or headline printed prior to March 1, 2020, the story line for apartments was one of resilience. Nearly every author touted “sound fundamentals” as the thesis for any positive, forward-looking prediction.

What a difference 6 to 8 weeks made in our lives.

Lenin is quoted as saying that nothing can happen for decades, and then decades can happen in weeks.

Times have changed, and so has the tenor of market prognostications. Since the pundits believe the market is no longer going up, up…up, headlines must proclaim that the market is headed down, down…DOWN!

But is it? We think not; yet, we better let the data guide us.

To ascertain how the regional apartment market is performing, we set about collecting a control set of data in King County:

We then analyzed the data over the course of the last 3½ months to begin determining emergent trends.

Rental Rates

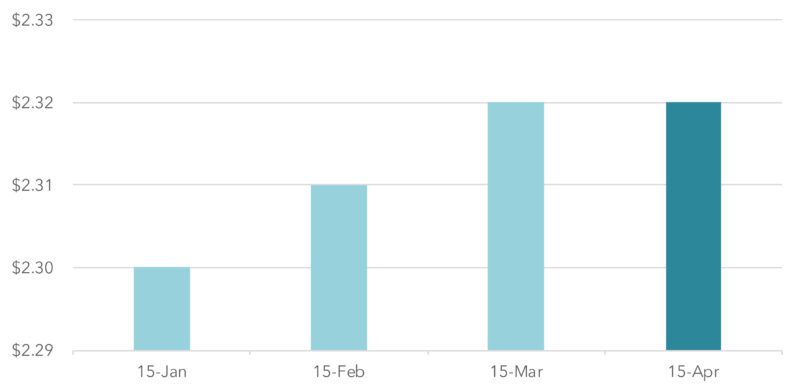

Historically, troubles in economic markets first cascade in the form of declining rental rates. In the case of the current COVID-19 pandemic, the local apartment market is behaving – at least as of now – a bit differently.

Rental rates remain steady.

The surveyed data covers all of King County, with a healthy balance across the spectrum of age, location, building size, and unit size. Rental rates, averaged across 44,000 units, started in January at $2.30 per square foot and as of April 15, 2020, have climbed a nominal 0.3% to $2.32 per square foot.

Is 0.3% rental rate growth in just over 3 months good? Absolutely not. Especially considering the period from January – April usually experiences some of the strongest rental rate growth as Seattle thaws from the cold, dark winter months.

King County Apartment Rental Rates

Average Price per Square Foot

Source: Kidder Mathews Seattle Multifamily Team Research

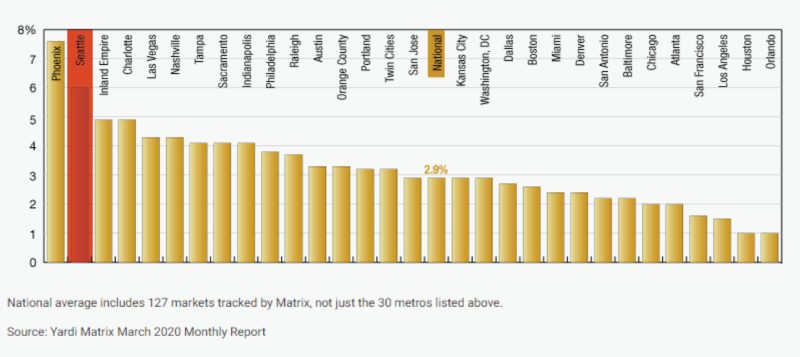

Prior to the COVID-19 pandemic freezing global economic activity, Seattle was set for another banner, nation-leading year of rental rate growth. As of March 2020, Yardi pegged Seattle at 6.0% year-over-year rental rate growth.

This annual growth is second only to Phoenix, and legions beyond San Francisco, which barely reached 1.5% rental rate growth in that same period.

We will watch rental rates closely over the course of the next month to see if, and to what extent, rental rates change.

Occupancy Trends

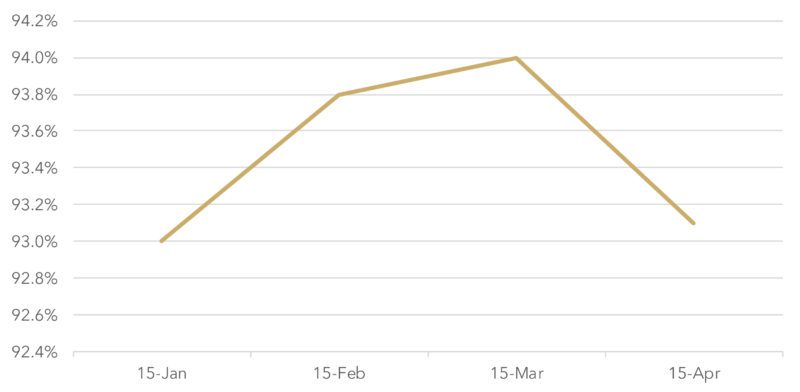

In challenging economic times, occupancy naturally falls. Yet in the current environment, we expect a different near-term result – primarily due to the moratorium on evictions, much less a huge disincentive to go out into the world and seek new housing.

The data is highly reflective of these circumstances. Occupancy in our sample set of apartment units was 93% in January 2020 and as of April 15 had ticked up slightly to 93.1%.

We would expect occupancy rates to improve in spring months, and they did so marginally until April when the market responded to a post Stay Home, Say Healthy environment.

King County Apartment Occupancy Trends

Source: Kidder Mathews Seattle Multifamily Team Research

Changes in the trend line will be monitored month over month and it is our expectation that we’ll see greater vacancy in the market – it’s just a matter of when and by how much.

Collection Loss

The percentage of rent collected – or rather, the percentage of rent not collected – is not the sexiest metric to track, especially in healthy markets. However, in times of economic softening (dare we say the “R” word – recession?), it’s time to dust off the old financial statement to recall “just how bad it got” last go-round.

This time is different – truly different. Until at least June 4 of this year, renters cannot be evicted for non-payment of rent, nor can landlords assess late fees for non-payment.

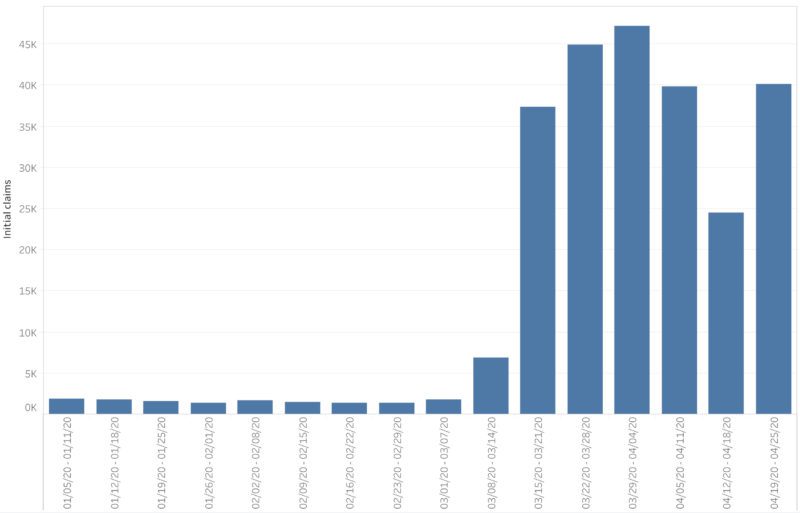

These circumstances, coupled with an unprecedented spike in unemployment, naturally lead to a huge uptick in collection loss.

Initial Unemployment Claims – King County

January 2020 – April 2020

Source: Washington Employment Security Department

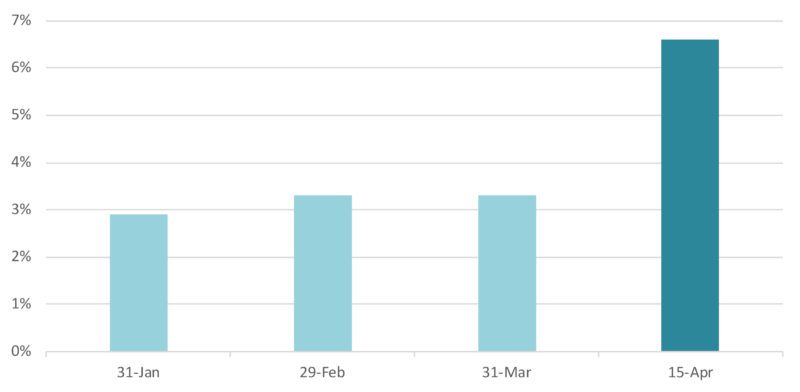

Accordingly, collection loss more than doubled from 2.9% in January to 6.6% as of April 15. To those reading local and national headlines, single-digit collection loss may not seem that bad – and it isn’t.

King County Apartment Collection Loss

Source: Kidder Mathews Seattle Multifamily Team Research

I recently wrote Staying the Course; We’ve Seen this Before combating national headlines of 25% to 30% collection loss, demonstrating that locally it is likely in the 5% to 7% range; this is now validated with data.

It is now May 1 and we are back to a zero-baseline of collected rent. Stay tuned for another update later this month!

Renewal/Retention Rates

Apartment renters don’t always stay put. This is increasingly demonstrated in urban centers where apartments are closer together, unit sizes are smaller, and there’s always the bright, sparkly BBD (bigger, better deal) right around the corner offering new finishes, better amenities, and likely some lease-up concessions.

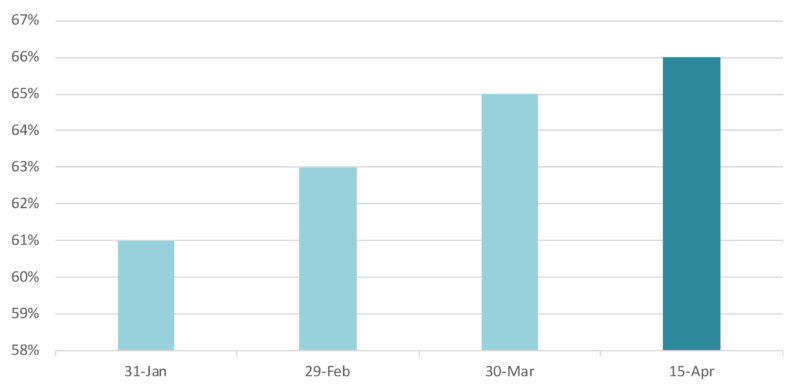

Across the region, it’s fair to peg renewal of leases, otherwise referred to as retention, around 50%. This percentage is sometimes higher, but often lower in urban centers.

In our current environment it’s not surprising that many residents are opting to stay put – or more aptly said, Stay Home, Stay Healthy!

Our data collection started in January 2020 with average retention at 61%. This is higher than normal, but some of that can easily be attributed to seasonality (moving in Seattle’s dreary/rainy January is not for the faint of heart).

Not surprisingly, retention increased nearly 10% to an average of 66% as of April 15 – and likely increased further by end of month.

King County Apartment Retention Rates

Source: Kidder Mathews Seattle Multifamily Team Research

We’ll continue to monitor the data and expect retention to remain high through the Stay Home, Stay Healthy Order – much less the eviction moratorium – and then begin to normalize.

What’s to Come?

Everyone is watching the apartment market – and overall economy – very closely in the coming weeks and months to determine what the future holds. The best way we can stay informed and serve you is to provide accurate real-time data and insights on the market.

We will continue to send monthly updates on trends in actual operations of apartment buildings in our region. Please reach out to us with questions and to discuss your needs when it comes to buying, selling, or financing apartment buildings and development land.

In the News:

- Seattle Area Apartments Sustain Collection Losses – Connect Seattle

- May 1: Rent & Occupancy Trends – The Registry

- Seattle’s Multifamily Market is Outperforming Other CRE Asset Classes – GlobeSt