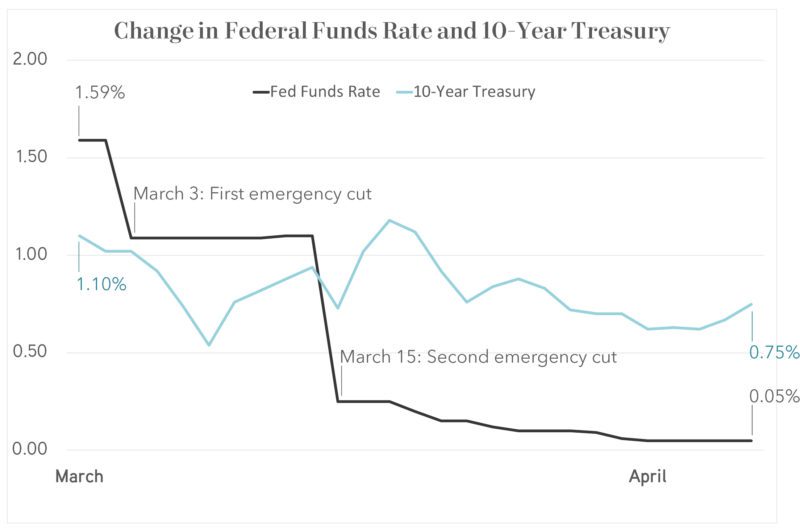

Interest rate benchmarks were incredibly volatile until late March. With no indication that the Fed will increase rates in the near-term or lower rates below zero, the market is settling down.

Changes in interest rates are now driven more by perception of risk. The result is that pricing is very different from lender to lender.

Updates:

- Banks and credit unions continue to tighten their lending criteria and are far less competitive than they were two weeks ago. Most banks are priced in the high-3% to high-4% range on new apartment loans, although a number of major players have exited the market.

- Life insurance companies have lowered rates significantly over course of the last two weeks and are now pricing in the low to mid 3% range. However, they are taking a conservative approach to lending.

- For low leverage refinances over $6 million, Fannie Mae & Freddie Mac are again the most competitive options in the market with great terms and pricing in the low 3% range. Stringent reserve requirements applicable to high leverage loans do not apply to Tier 4 deals (55% LTV or less, and 1.55 DSC or higher).

- CMBS remains out of commission.

Recommendations:

High leverage deals will be very difficult to get done in the near-term. If property performance materially changes during the loan process, expect the loan terms to materially change. Hedge your bets by asking how your lender will respond to a rise in rent delinquencies, and understand how much it will cost you to walk away.

If you are trying to refinance now, there are good deals available for conservative loan requests.

If you need to refinance or obtain purchase financing right now, we can help find the best options amidst the chaos. If you have the time to take a wait-and-see approach, we can work with you in the coming weeks to help identify the right time to move.

Contact: Alex Mundy | 206.747.4725 | alex.mundy@kidder.com