As we approach January 1, we are not just entering a new year but a new decade – and potentially an 11th year of economic expansion.

The Seattle and Puget Sound region is poised for continued stability and growth in the year ahead. Yet, alongside these predictions of sustained healthy local market economic conditions are national and global warning signs of uncertainty.

How do we best navigate an uncertain future investment landscape?

I recently came across a timely quote attributed to Marie Antoinette: “There is nothing new except what has been forgotten.” Otherwise said, past is prologue.

It’s incumbent upon investors to both understand the past – using it to best predict future outcomes – and remain nimble and innovative in thinking to ride the wave of the future.

The following five apartment investment themes for 2020 will aid your navigation of uncertain waters while venturing away from sitting on the shore of stagnation – a surefire way to miss opportunities!

1. Look for the outlier opportunity

The outlier is by definition that which is voted “unpopular” by the pack. And the foolproof way to make the lowest investment return is to do what everyone else is doing. It’s safe, but is it profitable?

As we enter uncertain times, investors flock toward safety, thereby bidding up prices and bidding down cap rates – and, concomitantly, returns. If you are looking to preserve wealth, safety is an erstwhile pursuit. Yet, if you need to make money on your investments, you need to make a bet (sometimes an unpopular bet) and bet correctly.

Outlier opportunities exist all around us. They are the votes considered unpopular and a “bad investment.” That could mean that pricing is too high, the asset is in the wrong location, or it is too old.

Here are some examples of outlier opportunities:

- Sub-5% cap rate Burien deals

- Suburban apartment buildings built before 1980

- Micro/Efficiency housing outside of core locations

For each of these investment strategies, the perceived risk is priced into the deal. If that risk proves less than the pack perceives, you will achieve outsized investment returns.

Voila – the outlier opportunity!

2. Seattle continues to outperform

If you’ve read any of my blog posts, you can tell I am a fan of both data and Seattle – and, even better, data about Seattle! And the data shows that Seattle is set to outperform other cohort markets economically for some time to come.

To that end, Seattle remains a terrific apartment investment market over the long term. If you like the fundamentals of this market, remain a dollar-cost average investor and continue to invest into this market.

We also know that trees don’t grow to the sky, and the party must end (slow?) at some point. Looking at that data, as we oft do, we think that slowing occurred and is in the rear-view mirror. Yet, we can’t ignore economic/political/social headwinds the nation and world over.

The bad news: we will have some “economic event” in the next 24 months that will feel like a recession.

The good news: it won’t last long.

Back in 2015, I penned a newsletter titled Seattle’s NEW Real Estate Cycle. The thesis is that Seattle recently joined the ranks of other core investment markets (e.g., The Sexy Six: New York, Boston, DC, Chicago, Los Angeles, and San Francisco).

Does that mean we are immune from investment/market cycles? Of course not. Yet it may be that periods of economic pain between expansion cycles will shorten.

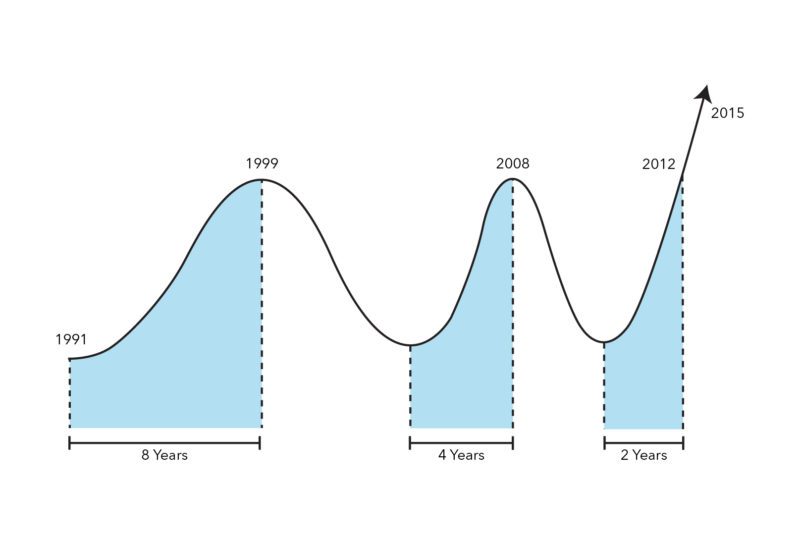

A look at market cycles in San Francisco over the last 30 years is telling.

San Francisco Real Estate Cycle

In each successive real estate cycle, periods of escalation shortened. It is anyone’s guess if this phenomenon will continue – and if it will similarly apply to Seattle. But given that our region is shipping our technical “wares” globally, it is a good sign of a shorter race between expansion cycles.

3. Rates won’t remain low forever

“Interest rates must rise,” everyone proclaimed – and the year was 2012!

But again, they fell. After the fourth round of quantitative easing in January 2013, rates assuredly would rise, and they did – just not for long.

As rates charged precipitously higher during the second half of 2018, we all “knew” that 2019 would be the year of sustained higher interest rates. Yet we were wrong again – to the tune of a 178 BP drop from peak to trough.

When it comes to predicting the movement of interest rates over the course of the last decade, all pundits, experts, and investors alike have been horribly wrong.

Whether 2020 will be different or not is almost beside the point as other macro factors – easing economy, election year (see below), and global political/social unrest – may overwhelm the economy beyond the impact of US monetary policy.

10-Year Treasury Rate: 10 Years of Trends

Source: CNBC

Most real estate loans – and investments, for that matter – are keyed to longer-term horizons (5-year, 7-year, or 10-year terms).

Given uncertainty in overall market conditions, if you can book a low interest rate and set it and forget it, now seems like the right time to do so.

Want to learn more? Give Alex a call!

4. Elections are disruptive

I dare not delve into personal politics, yet regardless of one’s bend toward Donkey v. Elephant, it’s inarguable that the November 2020 election results will leave a nation divided.

History proves that election years tend to remain economically stable – incumbents try not to rock the boat, ensuring status quo conditions leading up to an election; however, once the polls are closed, it’s anyone’s guess as to how markets will react.

Speaking from experience, carrying a multitude of transactions through November 2016, election results were more foe than friend.

Investors abhor uncertainty. If you are considering any transaction in 2020 – a purchase, sale, or refinance – we highly recommend you have it safely and securely in the books before the kids head out to trick or treat.

Will 2021 investment markets prove more favorable than 2020? I highly doubt it. The time it takes to settle markets from an election, regardless of result, demonstrates a risk too great to hypothecate.

5. Stick to your knitting

What if you’re not considering making any great investment moves in 2020, or even 2021 for that matter?

Stay the course and use this time to optimize operations:

- Take care of deferred maintenance

- Upgrade accounting and technology systems

- Refinance into longer-term, cheaper debt

- Sell the non-performing asset in your portfolio

The Seattle and Puget Sound apartment market remains one of the top-performing investment markets in the nation, and despite some localized near-term challenges, the region will remain favorable for years to come.

Do what you do best and operate your apartment building(s). Stick to your knitting!

If you are looking for guidance on any aspect of apartment investing – valuing your building or development land, preparing to sell, acquiring a building or placing financing – give us a call. We are excited to partner with you in 2020 to help you achieve your goals – both short term and long term.

Allow Us to Turn Our Expertise into Your Profit!